The Next Financial Crisis

“A liquidity drought can exacerbate, or even trigger, the next financial crisis,” writes Blackstone Group founder Steve Schwarzman in The Wall Street Journal. “Sellers will offer securities, but there will be no buyers.”

Yesterday, we took note of how the establishment media are acknowledging for the first time in years that another financial crisis is, if not inevitable, at least possible. Progress.

Three weeks ago, we suggested one way that crisis might come about, thanks to an “insider’s insider” in the bond market who told our Jim Rickards that not only is liquidity lacking, it’s “almost nonexistent.” The situation is “worse than you know,” he told Jim — and Jim knows a lot.

The problem is that post-2008 regulations that aimed to make the system less risky are having the opposite effect. Banks are holding onto more assets… so there are fewer buyers and sellers for those assets.

Jim’s friend was focused on the lack of buyers and sellers of Treasuries. And no wonder: There was a “flash crash” in Treasury rates on Oct. 15 last year. Deutsche Bank finds liquidity in the Treasury market is down 70% from its peak in 2006-07.

But if it’s a real “liquidity drought” you’re looking for, it might be in the corporate bond market.

Back to Schwarzman’s Op-Ed and that same Deutsche Bank report: “Deutsche Bank has reported that dealer inventories of corporate bonds are down 90% since 2001, despite outstanding corporate bonds almost doubling.”

That’s just asking for another financial crisis, says Schwarzman: “Prices will drop sharply, causing large losses for investors, pension funds and financial institutions. Additional fire sales will aggravate the decline.”

“The next financial collapse will not come from hedge funds or home mortgages,”Jim Rickards said in this space last January. After all, history repeats, but never exactly.

Instead, “it will come from junk bonds, especially energy-related and emerging-market corporate debt.”

A quick refresher: Total corporate debt issuance for energy exploration between 2009-2014 works out to $5 trillion, and it’s shaky in light of the 2014 oil price collapse. Meanwhile, companies in emerging markets have issued dollar-denominated debt to the tune of $9 trillion, and that’s shaky in light of the dollar’s epic 2014 rally.

“The result,” said Jim, “is a $14 trillion pile of corporate debt that cannot possibly be repaid or rolled over under current economic conditions. If default rates are only 10% — a conservative assumption — this corporate debt fiasco will be six times larger than the subprime losses in 2007.”

We’ll pause a moment to note both oil and the dollar sit today around the same level they did when Jim wrote those words in January.

“Either everybody is short HYG or something is just plain weird here,” reads a note we got from our acquaintance Erik Townsend, a hedge fund manager.

HYG is the big junk bond ETF — chock-full of high-yield, high-risk corporate bonds. For months, Erik has been short selling 12,000 shares in his fund, betting HYG will go down.

Or he was until last Friday. On Thursday, Interactive Brokers informed him his position would be closed out the next day against his wishes. “Why? Because of a loan recall on the shares they borrowed to implement the short, and then their efforts to borrow more shares to back the short failed over three consecutive days.”

Erik figured a phone call would clear things up. After all, he’s not a retail investor. He can call Interactive Brokers’ VIP line for institutional accounts.

“No dice,” he tells us. “They say they are doing everything they possibly can to locate more shares to borrow, but simply cannot source them anywhere.

“Think about that — HYG is an extremely popular ETF. And Interactive Brokers does a HUGE retail business for millions of yield-reaching people who are likely long HYG because they don’t know any better. Yet IB cannot manage to locate 12,000 shares for one of their (preferred) institutional customers no matter how hard they try!

“If they can’t manage to find a single account with an open long in HYG (to borrow to back my short), what else does that imply about liquidity in the junk bond market?”

“What happens when HYG really starts to crash and all the long retails panic and sell all at once, leaving all the shorts naked?” Erik muses.

“Everyone who is short will be forced to cover, but presumably they will seek new positions shorting JNK [another junk-bond ETF] or another instrument in order to maintain their standing position. That doubles the selling pressure. Could be pretty interesting.”

The foregoing is only one way the next crisis might unfold. Jim Rickards has been hard at work in recent months sussing out hundreds of possibilities and finding the common threads.

From there, he’s devised a system of “indications and warnings” — a term he borrowed from his work with the intelligence community — to help you see the flashing warning signs. And he’s developed an investment strategy to guide you through the tumult and come out the other end intact at worst… and even more prosperous at best.

Tomorrow he presents his findings to an audience for the first time. The audience is made up of readers like you who will be gathered at the Four Seasons here in Baltimore. They’ve paid upward of $6,500 for the privilege.

But you don’t have to pay anything like that to listen in. In fact, you can still get the best available deal on recordings and transcripts of tomorrow’s “House of Cards” symposium through midnight tonight.

That’s right. We’re extending the early-mover discount by one day. We’ve gotten an overwhelming response, and we want to give you one last chance.

Nor is that the only reason. “I’ve previewed all of the presentations in detail,” says Peter Coyne, managing editor for all our Rickards services, “and there are details people will want to see — especially from Jim. This isn’t a gloss-over. He has some serious science and math — nothing inaccessible — but he’s bringing out the big guns to prove his thesis.”

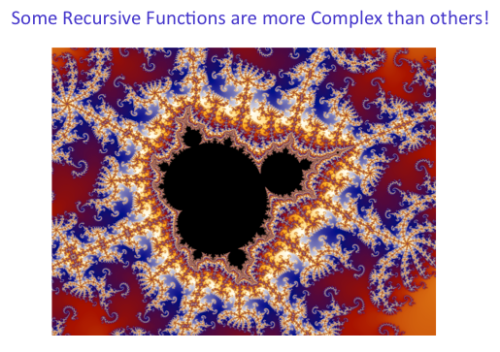

I’ll say. Check out this mind-bender from Jim’s slide deck…

Don’t fret — the transcripts will have all the relevant slides, so you’ll fully grasp the concepts… and how you should act.

Again, we’ve extended the early-mover deadline through midnight tonight. Take advantage now. We won’t extend it again.

Regards,

Dave Gonigam

for The Daily Reckoning

P.S. Be sure to sign up for The Daily Reckoning — a free and entertaining look at the world of finance and politics. The articles you find here on our website are only a snippet of what you receive in The Daily Reckoning email edition. Click here now to sign up for FREE to see what you’re missing.

Comments: