Did Oil Just Fool Everyone?

A handful of key assets are on the verge of major moves this week.

Gold is on the cusp of a significant breakout above $2,000 as the US Dollar index drops. Any significant extension above the mythical $2K mark should attract a ton of attention from the mainstream financial media, lighting the fuse for an even bigger momentum move in the metal and the miners.

Bitcoin is also working on its own potential extension above $28K. It’s marked time for more than two weeks after a breakout move off the March lows. Bitcoin is now tightly coiled and could easily top $30K once its next run is underway.

The artificial intelligence bubble is also getting frothy once again. Tech stocks are back as market leaders following a brief hiatus – and the sector’s AI darlings are ripping higher out of choppy consolidation patterns that have trapped these speculative names since February.

No, it’s probably not time to run around screaming about a new bull market. But we’re seeing some structural improvement in the market. The strong stocks are trending. And most breakouts are following through – instead of abruptly reversing like we experienced last year.

These are all exciting developments for stock market bulls. The first quarter ended with a bang, giving market participants a break from the relentless selling that dogged the market in 2022. Despite overwhelmingly bearish sentiment, ongoing inflation and rate hike fears, and a full-blown bank crisis, this year’s strongest names continue to defy the odds.

But the most important market event kicking off the second quarter isn’t happening in the tech sector. It has nothing to do with Bitcoin or crypto. It’s not even about gold’s historic march toward all-time highs.

The most impactful market move right now is actually happening in the oil patch. And it could have huge implications for energy stocks as we kick off the second quarter.

Crude’s Crazy Year

If you made money trading stocks last year, chances are you booked some of those gains in the energy sector.

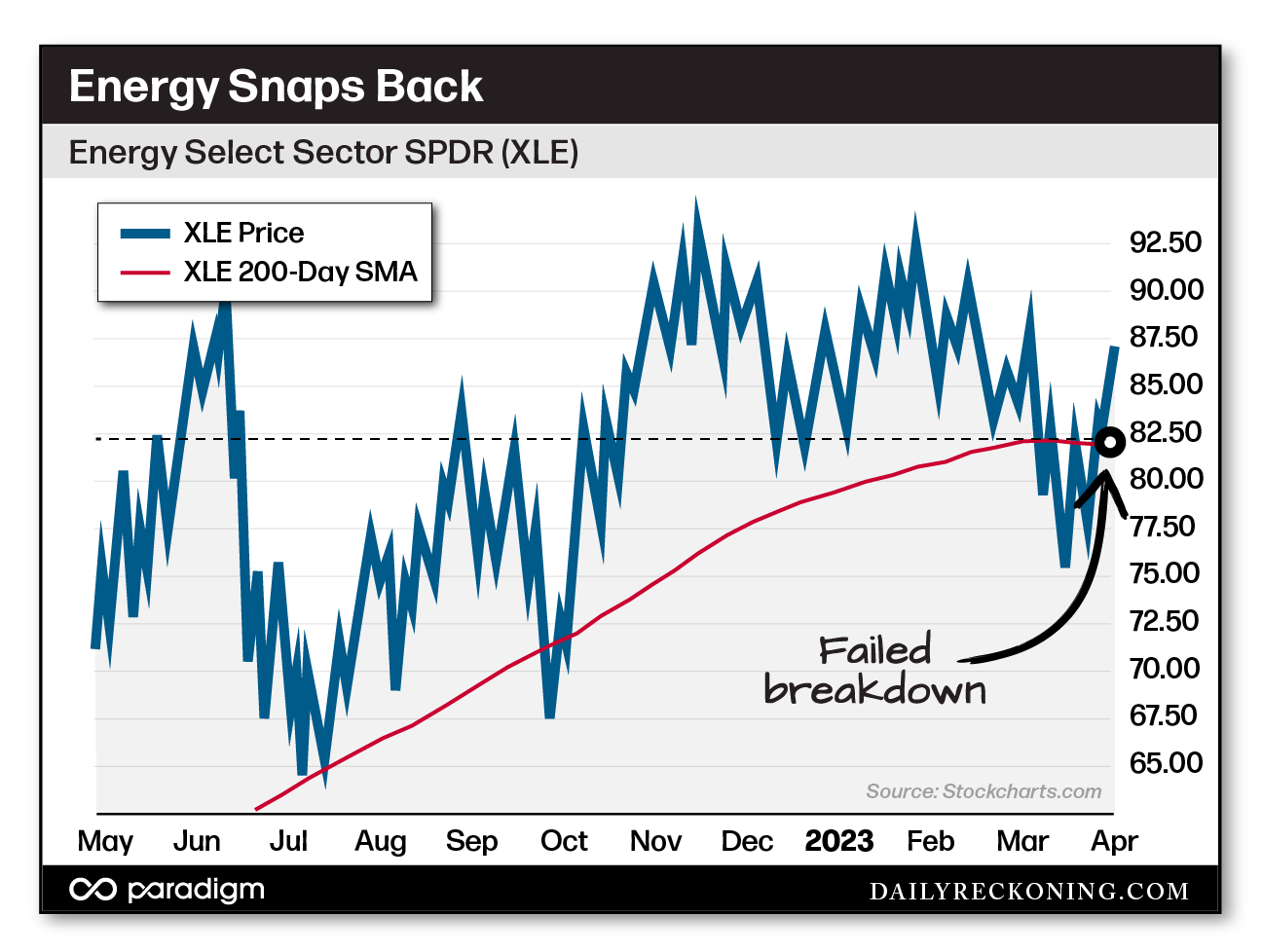

The Energy Select Sector SPDR (XLE) posted a dominant performance during the first half of 2022 as bear market conditions took hold. While growth stocks swooned, XLE gained nearly 70% before topping out in early June when crude spiked to $120 during the early months of the Russia-Ukraine war.

With nowhere else to turn for gains, XLE became one of the most crowded trades on the market. XLE endured a hard reset, dropping 25% from its June highs before bouncing and recovering into the third quarter.

But crude prices couldn’t catch a bid. After topping out in the summer, light crude dropped more than 40% on a steady decline that saw it approach $70 by the end of the year.

While the energy sector still managed to finish at the top of the heap in 2022, it was coming under increasing pressure in March. Crude was losing crucial support levels, falling below $70 for the first time since late 2021. And this time, it was taking energy stocks down with it. As tech snapback trades gained traction in Q1, oil patch plays were flirting with lower prices.

Crude was approaching $65. XLE has dropped nearly 20% in just six weeks and was well below its 200-day moving average. By mid-March, a bigger breakdown was looking inevitable.

But the cartel had something to say about that…

All of a Sudden, Oil Explodes

In case you missed it, OPEC jolted the oil market over the weekend when it announced a surprise million-barrel cut. Saudi Arabia alone is cutting 500,000. I guess they weren’t too happy with prices steadily decreasing over the past ten months…

Geopolitical implications aside, this news was the jolt oil needed to stave off a major breakdown. When the futures market opened Sunday evening, crude immediately jumped more than 6% to retake $80. Light crude is now up an incredible 25% from its March lows.

More importantly, the breakdown is broken.

XLE is now back above its 200-day moving average and the key $82 pivot. The stage is now set for a quick move back to $90 and a challenge of those 2022 highs.

Despite its leadership role last year, XLE’s chart has been a mess for months. Last month’s breakdown looked like the real deal – and I suspect many pro and amateurs alike were leaning bearish on oil and energy stocks.

That’s a recipe for a big move higher. Oil fooled everyone into thinking it was about to fall off a cliff. Now, the energy sector is poised to attack its highs. I think it’s safe to say that more than a few traders will be caught with their pants down if this move extends higher in the weeks ahead.

Let me know your thoughts on this topic (or any other topics you want covered) by emailing me here.

Comments: