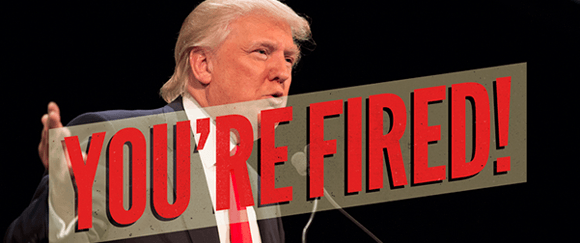

America to Elites: YOU'RE FIRED!

Some hinge has given way, somewhere in the universal order…

The Cubs just won the World Series. Bob Dylan just won a Nobel Prize. And Donald John Trump just won the White House. We try to reduce the thing to words… yet we try in vain.

Trump’s won the purple.

The pundits… the polls… the stock market… the betting market. All got it wrong. Spectacularly, stupendously, gloriously… wrong.

As late as 8:17 last night, PredictWise gave Trump a 7% chance.

But who got it right?

Jim Rickards — the Oracle at Delphi.

First, he called Brexit in June… when all the “experts” heckled him off the stage. Now he’s called last night’s election, when all the same experts laughed him off again.

From Jim’s Twitter feed this morning, digging his thumbs in their eyes: “Anyone listening to mainstream media explain ‘How Trump won,’ after they told you for a year that he couldn’t win is beyond hope of rescue.”

Jim nailed it. Even after Sunday’s green light from the FBI, when all the experts, all the polls, all the markets said Hillary… Jim stood solid on his bedrock.

Monday’s Daily Reckoning title, in 48-point font, bold: “Rickards: Trump Still Wins.”

But Jim’s been whistling the same tune for weeks. Also from Monday:

I first issued a forecast that Trump would win the election before the Oct. 28 announcement by the FBI that the Hillary email investigation was being reopened.

How was Jim able to get Brexit and Trump right when everyone else got it wrong?

Because of the fancy-shmancy analytical tools he uses. He’s applied them to his intelligence work with the CIA and the Pentagon. These days, Jim uses them to forecast events in capital markets. One of his tools is something called Bayes’ theorem.

“This is the same method we used to correctly forecast the outcome of the Brexit vote,” said Jim last week. “Now we’re using it to forecast the likelihood of a stock collapse in the event of a victory by Donald Trump in the U.S. presidential election on Nov. 8.”

Jim warned that markets were pricing in a Hillary win and would “hit an air pocket” when Trump won. He was right.

Dow futures plunged as much as 800 points in overnight trading. The S&P fell 5% overnight. That triggered a trading halt to stop the hemorrhaging.

It’s true, the market made good its losses today. And then some. Seems Trump’s gentlemanly victory speech soothed the savages. That’s our take, anyway. But brother, did it look hairy.

Jim also said gold would go bonkers. Sure enough, gold was up over $50 at one point last night. Rickards Gold Speculator subscribers got an alert this morning advising them to take profits on certain positions. They were able to cash in to the tune of 66%, 81% and 117%.

Here’s what one happy reader wrote: “I bought gold after you explained the exit polls numbers yesterday, I made a nice profit, thank you.”

And as Jim said this morning, gold “will go much higher. Trump’s policy is ‘helicopter money.’” Trump’s no Larry Libertarian. He’s promised a blizzard of infrastructure spending.

The markets seemed to have found their footing in the meantime. But the earth could soon give way…

Yes, Jim warned about the election. But he’s also warning about a looming rate hike when the Fed meets next month:

“If a Trump victory didn’t wreck the stock market,” Jim tweeted this morning, “the Fed will. Rate hike still coming in December.”

Fed funds futures put a December rate hike above 85% before the election. The odds fell below 50% when the market was half out of its mind overnight. But now that the market’s come to its sober senses, odds are back above 80%.

“We think economic conditions and Fed rhetoric both point to going in December,” said Credit Suisse economist Jeremy Schwartz today.

The market tanked 10% in the two months after last year’s rate hike. And Janet Yellen used all her bullets to bring it back. She enters the next fight unarmed.

But Yellen’s a Democrat. And Trump threatened to dump her if elected. Maybe she’d like to leave him a nice little gift on the way out the door? Nothing like a market crash to welcome a new president.

Yellen may be out of ammo. But she could still go out with a bang.

Regards,

Brian Maher

Managing editor, The Daily Reckoning

Ed. Note: Sign up for a FREE subscription to The Daily Reckoning, and you’ll receive regular insights for specific profit opportunities. By taking advantage now, you’re ensuring that you’ll be set up for updates and issues in the future. It’s FREE.

Comments: