The “Uncle Indicator” Screams Sell!?

The bears are giving up.

No one’s betting against the raging rally anymore as the mega-cap tech leaders continue to climb to new highs.

The YOLO crew is back to making huge, bullish bets on earnings and loading up on speculative options buys. As stocks continue to squeeze higher, these speculators are cashing in on their wild, out-of-the money calls. Let the good times roll!

Just how frothy is it getting out there?

For starters, the put/call ratio is hitting extreme levels. The folks at Barchart noted that on March 1, the total put/call ratio dropped to its lowest level since late 2021. In other words, no one is paying for downside protection. The stocks only go up mentality is back with a vengeance as speculators flood back into their favorite trade – semiconductors, tech-growth stocks, and crypto.

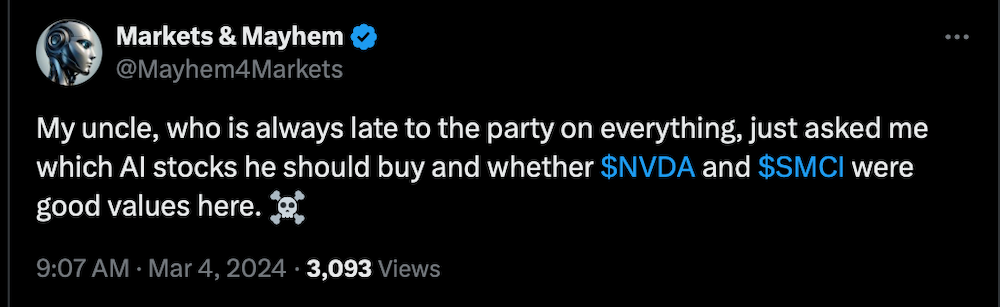

Even worse, I’m hearing stories left and right about everyone’s personal contra-friend calling them up and asking about the latest semiconductor that’s going parabolic…

That’s another uncle indicator flashing bright red. The previous cycle’s biggest bagholders are back to revenge-trade their favorite stocks and alt-coins.

But before you log onto your brokerage account and short every high-flying stock in sight, it’s important I mention that we’re probably not headed for a nasty crash. Sure, some of these ridiculous rallies could use a hard reset. But we’re probably too early in the bull market cycle for a catastrophic plunge. Too many stocks are exhibiting strength, and the list of names making new lows is virtually nonexistent.

Market breadth simply isn’t an issue right now. Typically, fewer and fewer leading stocks will prop up a bull market that’s on its last legs. Today, we’re seeing the exact opposite: more stocks joining the party and rallying along with NVDA and the other high-profile leaders.

Instead of an impending crash due to a top-heavy market, we’re seeing the beginnings of a rotation away from mega-caps into tech laggards and small-cap stocks – a rotation that has become more pronounced over the past week.

Anatomy of a Rotation

It hasn’t been perfect. But after a few false starts, this bull market rotation is materializing.

During these rotation events, the market’s strongest stocks consolidate or retreat as other stocks and sectors begin to outperform and take on new leadership roles. If you learn how to spot and take advantage of these rotations, you’ll find that you can grab onto emerging trends and ride them to fresh highs as they begin to dominate the market.

The next rotation will begin with a much-needed reset of the mega-cap stocks – names like NVIDIA Corp. (NVDA), Microsoft Corp. (MSFT), and Meta Platforms Inc. (META) will stop going up every single day.

Yes, a few of these stocks – most notably Tesla Inc. (TSLA), Apple Inc. (AAPL) and Alphabet Inc. (GOOG) – have already started to fade from their highs. But the other leading mega-caps haven’t lost a step this year. They’ve shrugged off extreme overbought conditions and continue to surge higher.

I’ve been chirping about these soaring market leaders since late last year – watching and waiting for a hard reset that has yet to materialize. And I’m not the only one talking about this top-heavy market. Nearly every major analyst has mentioned the dominant mega-caps as a potential concern going back to early 2023.

But the stock market doesn’t care what anyone thinks. I told you in December that I did not believe the leading mega-caps were going to experience the same level of market domination in 2024. NVDA probably isn’t going to rally another 250%, I noted, adding that the stock probably won’t crash, yet would fall short of its historic 2023 performance.

Yet here we are – just two full months into the year and NVDA has already gained almost 70%.

If you were around in 1999-2000, this mad dash for tech might look familiar. But you don’t even have to look back 25 years to find similar conditions. If you were paying attention during the Covid Bubble in early 2021, you can probably spot the similarities.

Not only would a rotation into different leadership allow these out-of-control shares to chill out for a bit – it would also be incredibly healthy for the market at-large.

Where Does the Hot Money Go Next?

When the streaking semis finally get doused with a bucket of cold water, which stocks could pick up the baton and start running?

You don’t have to blindly guess where the gains will come from – because we’re already seeing key breakouts emerge in some forgotten corners of the market.

Just look at small-caps…

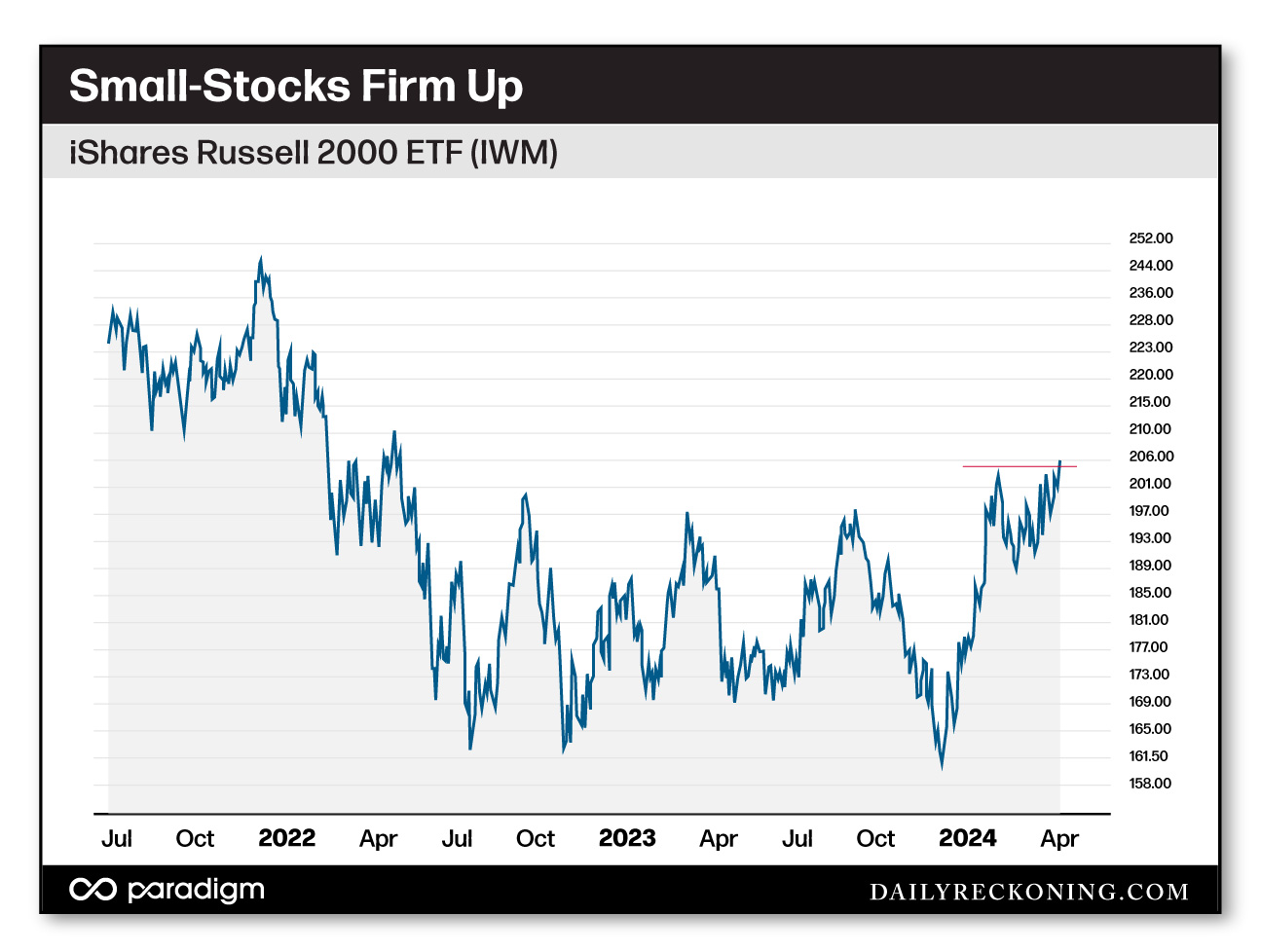

The Russell 2000 has snapped out of its stupor and broken above its December highs following a rocky start to 2024. It’s now green on the year and working on playing catch-up with the major averages:

Keep in mind, the Russell 2000 has grossly underperformed the major averages for nearly two years. The Russell was hit hard by the regional banking crisis in early 2023. It also failed to rally with the major averages into the summer months, leading to a hard reset that lasted from August through October.

Most mega-caps were stable during this period while smaller names took a beating, acting as a safe haven for investors worried about the potential for a bigger drawdown heading into the fourth quarter. When the big move lower failed to materialize and the melt-up rally ignited, the Russell flipped its switch and posted a 20% move off its lows.

Now, IWM has completed a base breakout and is just a few bucks away from new two-year highs, erasing much of its bear market drawdown. If the rotation theme continues to play out, we could see the smaller stocks outpace the big boys – even as the major averages take a break.

Small-caps aren’t the only rotation stocks in play this week.

Gold is breaking out…

Energy is heating up, too…

You don’t have to chase big tech to find great trades in this market. Just keep an eye on the charts and try your best to suppress the FOMO as the semis fly directly into the sun.

Comments: