Poor Man’s Gold Can Make You Rich

The silver spot price is above $26 per ounce today. It peaked above $28 on April 19, so it’s pulled back a bit. But that’s no big deal.

Like the rising gold price, which is over $2,300 per ounce, it looks like there’s more yet to come. In other words, precious metals are rapidly repricing.

Right away, this tells me that Wall Street and the City of London have lost control over the price for gold and silver. From all appearances, pricing power has shifted East to India, China and other BRICS nations that now dominate physical purchases.

If you bought gold or silver during the past decade, you must feel pretty good right now. The price is up, and apparently heading higher.

So today, let’s discuss silver and a looming, much larger price jump than what we’ve already seen.

But first, we’ll discuss cocoa! That’s because cocoa (like in chocolate) has recently melted up and exploded.

Could this also happen with silver? Begin with the one-year cocoa chart:

Price chart for Cocoa (screenshot from CNBC)

This chart covers June of last year to the present. It shows over a triple in price for cocoa, with the big move from $4,000 to $10,000 per tonne coming in the past two months.

(By way of comparison, if this kind of price move happened with silver, we’d see the metal at over $80 per ounce; but this gets ahead of the story).

Is this situation with cocoa normal? Do massive price moves occur routinely in the cocoa space? No, and this is kind of weird. Indeed, the current cocoa price has rapidly climbed to a historic high. It’s unprecedented and here’s a chart for the past 25 years to prove it:

Quarter century of cocoa; no big price explosion until now. TradingEconomics.com.

Sure, over the years, cocoa has had ups and downs, but never an upward blowout like we see recently. This is definitely different, so what’s going on?

Econ 101

First, it’s basic economics 101. There’s a cocoa supply issue because of dry weather across equatorial regions of the world where people grow the crop. Per the map below, these areas range from East Asia to West Africa, and to the Caribbean and Central/South America.

The world’s cocoa growth regions, courtesy International Cocoa Organization

There’s no need to delve into meteorology or climate issues. Just think in terms of not enough water or soil moisture to nurture the cocoa trees in key producing nations. Then consider dry conditions and many uncontrolled wildfires. Hence, a much smaller crop.

The long and short is that the world’s overall cocoa crop has fallen this past year. The problem cannot even begin to improve until next year and the next harvest season (with more rain along the way, growers hope).

Meanwhile on the demand side, people across the world love their chocolate. Many people across the world enjoy the taste of chocolate, and it’s no stretch to regard this kind of confection as a poor man’s luxury, hence it enjoys a strong global market.

In addition, market momentum has been a major factor pushing cocoa higher. This speculative component alone can exaggerate price moves.

And just as with gold, the cocoa phenomenon may be a signal that price discovery is moving away from Western hands, towards the East.

To sum up, the recent rise in cocoa price reflects a serious supply shortfall, rising demand, the need for new investment which will require time, and a sense of momentum as people watch the price levitate. All that in the face of a world where the very idea of price discovery is rebooting towards the East, away from traditional Western markets and trading pits.

Now, How About Silver?

Silver isn’t chocolate, but it has long been called “the poor man’s gold.” And silver is both an industrial and monetary metal.

There’s an ancient pedigree to silver as money. It’s deep in the archaeological record. People write books about the history of silver as money (and on that point, I recommend The Story of Silver: How the White Metal Shaped America and the Modern World, William Silber [2019]).

First, let’s look at the silver price over the past 20 years:

Silver price since 2004, courtesy Silverprice.

Note the huge run-up and back down in price, 2011-13; at one point silver was well over $40 per ounce (nearly $50 in 2011). Then, the metal traded in the mid-teens doldrums for a few years, 2014-2020.

And after a jump in 2020 (related to COVID panic buying), silver’s price support was range-bound in the low $20s for the past few years.

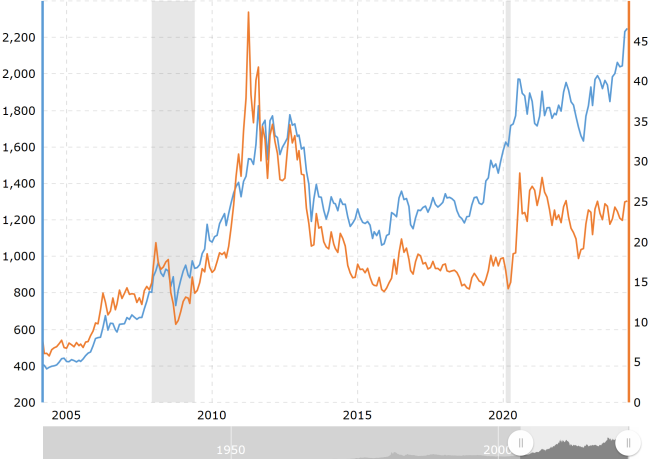

Now, over those same 20 years, let’s also compare the continuous contract price for gold and silver:

Gold (blue)/Silver (brown) prices since April 2004, courtesy Macrotrends.net.

Per the chart, silver and gold tracked closely through 2011-13; they both moved up and down pretty well in tandem. For the past decade, though, since 2014 silver has lagged gold, despite a strong run-up at one point in 2020 (the COVID panic-buy).

For our purposes, silver has traded in a range in the past couple of years, and shows legacy weakness relative to gold, with an expanding gap even now. But can this change? Can silver pull off a “slingshot” effect and deliver strong gains?

Think Like a Cocoa Trader

Think like a cocoa trader for a moment. In terms of demand, silver is popular in ways that are sticky, if not inelastic.

Begin with the monetary angle despite the fact that silver is no longer used in the world’s currencies; it’s absent from U.S. coinage, for example, since a law in 1965 that took silver out of circulation.

But across the world, individuals, businesses, and governments (China and India come to mind) still buy silver, including old coins and definitely raw silver bullion. Silver-stacking is a worldwide phenomenon.

Meanwhile, silver is a crucial industrial metal; a key to every imaginable kind of electronics and absolutely necessary in the fast-growing sector of solar power. All this, and silver has growing uses in fields ranging from water purification to medical products like antiseptic bandages.

Thus, its demand is solid and growing.

As for supply, statistics from the Global Silver Institute show that global silver output from mines is basically flat, if not declining. Countries like Mexico, Peru and China struggle just to maintain production at levels of previous years. Large silver-producing companies like Fresnillo, Newmont, Glencore and more show declining numbers.

Thus, it’s not far-fetched to say that the world may be at “peak silver” just now.

Opportunity

And yes, of course, we have exploration plays for silver out there, and more than a few strong developers. I follow the mining space and I’ve seen and visited many great, promising companies.

But as with cocoa, these silver plays aren’t turnkey operations. All will require time for new silver deposits to see the light of day; time plus immense levels of capital to build mines, mills and related infrastructure.

Oh, and to find and train a new workforce because much of the present labor pool is “legacy,” if you get my drift.

And what about momentum? Well, the price of silver has moved up in recent weeks, but it’s not quite a rocket-ride like cocoa; not yet anyhow.

Then again, people tend not to see tipping points, nor to appreciate how rapidly they can occur. That is, you may awaken one morning, and the price of something (like cocoa or perhaps silver) will be on a tear, and to the casual observer it will make no sense.

Whatever the case, the question to ask yourself is if you are on the silver train right now, before it all begins to move very much? Or will you wait it out a while, until you’re sure the train is rolling? Or will you be the one running down the platform, trying to grab onto something before it all leaves the station?

Get on the Silver Train!

Another point to consider is what has happened with price discovery in metals in general, and precious metals in particular. Gold has definitely moved, by over $300 in just the past four months.

The formerly routine daily sell-down in, say, New York just can’t beat out the global army of bidders who want to move towards some semblance of monetary safety as the U.S. government destroys its currency in an orgy of growing debt and interest payments.

Final takeaway: Silver is moving, and I suspect it will do a slingshot to catch up with gold in terms of relative value, metal for metal. Own physical, of course.

Own paper silver if you want to trade the space (eg: iShares Silver Trust: SLV). And own silver producers like Pan American Silver (PAAS), MAG Silver (MAG), Hecla (HL), or Silvercrest (SILV).

Of course, there are many other smaller plays in the silver exploration, development and mining space, many with great fundamentals and assets, and massive upside.

By every indication, the metal is moving, so you should buy a ticket and get on the train.

Comments: