The Stock Market’s Worst Month

The canine days of August end today.

Here in Annapolis summer’s fever has broken — for the day at least.

The temperature runs to very agreeable settings. Azure skies vault high overhead.

Humidity is scotched and refrigerating gusts steal in from the Chesapeake Bay.

We are in fresh spirits.

Tomorrow the calendar scrolls to September.

Many consider September a dozy month of market peace. October is the evil month they say.

The market’s most catastrophic cataclysms — the Panic of 1907, the Crash of 1929, “Black Monday” 1987 — all came barreling through in October.

October’s reputation is so villainous… so felonious… it has even earned a title:

The “October effect.”

But is it true? Has October truly earned its blackened reputation?

Today we haul the accused into the dock, interrogate its record… and pronounce verdict.

Yet first: How did the stock market conclude this month of August?

A Bad Month

Stocks appear to have lost their courage this month.

The Dow Jones Industrial Average retreated some 900 points.

The S&P 500 withdrew 70 points, the Nasdaq Composite 250 points.

Stocks rediscovered their fighting elan this past week… and made good many of August’s earlier losses.

Barron’s:

So far this month, the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite have fallen 1.6%, 1.3% and 1.9%, respectively.

That’s a significant improvement from their low points earlier this month – in which the Dow and S&P were down 4.1% and 4.8%, which would have been their worst August since 2015, and the Nasdaq was down 7.4%, looking at its worst August since 2001.

Historically, in August, the indexes have averaged gains of 1.1%, 0.7% and 0.4%, based on data through 2022, according to Dow Jones Market Data.

Yet we glance forward — not backward.

To return to our central question: Is October the stock market’s evil month?

History insists the answer is… no.

Wrongfully Convicted

October’s bankrupt reputation likely owes to a sour string of luck.

And its conviction was based heavily upon hearsay and circumstantial evidence.

It has received a very poor legal representation.

Stephen Williamson, former vice president of the Federal Reserve’s St. Louis district court:

Stock market crashes have occurred sufficiently infrequently in history that there is not enough evidence on when they are more likely to occur.

The gentlemen and ladies of Yardeni Research further vindicate October of crimes against stocks.

The average S&P October return is not negative in the least, they inform us.

It is, in fact, a positive 0.4%. It is a slender gain, yes — yet it is a gain.

Meantime, Investopedia informs us that more bear markets ended in October than began in October.

Swoons in 1987, 1990, 2001 and 2002 swung around in the year’s 10th month.

The facts are the facts.

Justice, Finally

Thus the presiding judge unseals the jury’s verdict…

“Not guilty,” it reads. And so he dismisses all criminal charges against the guiltless month of October — with prejudice.

In conclusion: An innocent man has been pitched into infamy… and packed off to prison on a wrongful charge.

Let us then — in the highest spirit of justice — clear his blackened name.

Assume then that October is not the mighty fee-fo-fi-fum many believe it to be.

Does another month take its place in the gallery of evil? Is there a month truly deserving of October’s label?

The Market’s Worst Month

The record argues that yes, another month is a menace greater than October. Which month?

That month is September — the month underway tomorrow.

“Since the Dow Jones Industrial Average was created in the late 1890s,” financial columnist Mark Hulbert notes, “September has produced an average loss of 1.1%.”

“The 11 other months of the calendar,” adds Hulbert, “have produced an average gain of 0.8%.”

Nor do one or two roguish and renegade Septembers explain it, says Hulbert:

“On the contrary, the month has an impressively consistent record at or near the bottom of the rankings.”

Not Just the Dow

September’s ill luck covers both the Dow Jones and S&P… incidentally.

Yahoo Finance:

According to LPL Financial, September has been the worst-performing month for markets, on average, since 1950. The S&P 500 has dropped about 1% on average that month since 1950, LPL Financial data shows. The only other month to notch a drop on average (and a minuscule one at that) going back to 1950 is August.

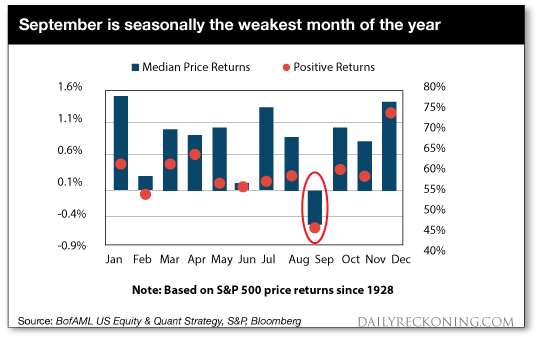

Meantime, Bank of America’s Savita Subramanian has pieced together the S&P’s median September return since 1928.

The facts confirm it. September is the great thief of investor money, not October.

Here is her evidence — the red-handed evidence — exculpatory of October and inculpatory of September:

Yet you insist upon additional evidence. And additional evidence you will receive.

Mr. Cory Mitchell, analyzes markets for Trading.biz. His researches reveal that:

The NYSE Composite has witnessed 11 September increases these past 20 years. That is 55% of Septembers under scrutiny.

Yet the average September return is -0.4%.

And September losses in the nine negative years exceed September gains in the remaining 11.

The S&P 500 posts a similar record. It has gained in 12 Septembers of the past 20.

Yet it too shed an average -0.4% across the same space.

And the Nasdaq-100? It has retreated -0.3% — on average — across the past 20 Septembers.

The “September Effect”

Next to September, we must conclude, October is nearly a month of nectar, a month of honey.

And so today we correct a cruel and libelous wrong…

It is time to replace the “October effect” with the infinitely more deserving “September effect.”

Thus we gird for heavy weather next month. We expect the winds to gather pace… the sky to dim… and the barometric pressure to drop.

Here CFRA chief investment strategist Sam Stovall posts an advisory:

As a result of September’s track record for benchmark beatings, we remind investors to prepare for the possibility of disappointing results for both the S&P 500 and Nasdaq in the month ahead.

Yet do we hazard a prediction of September doom?

No we do not. We have posted too many false advisories in times past.

That is, we have been forced to munch crow many times in the past — without salt, without butter, without lubricating beverages to help it down.

We harbor little appetite for another dose.

Yet if history is a reliable barometer… which we believe it is… September is perhaps the most dangerous month to speculate in stocks.

Along with, as the great scalawag Mark Twain noted…

July, January, April, November, May, March, October, June, December, August — and February.

Comments: