How to Trigger a Bank Crash

- Insane price targets are back…

- Tesla shares are sliding…

- Is the market’s newest mini-bubble bursting?

Shares of First Republic Bank (FRC) cracked early last week after management revealed the bank had lost half its deposits during the first quarter.

Oops!

To be fair, the stock had already plummeted as much as 90% in March during the crisis sparked by the Silicon Valley Bank debacle. But the earnings revelations once again spooked investors, opening a trap door that sent shares down more than 60% early last week.

As the SVB failure unfolded during the first quarter, we discussed how financial media was quickly losing interest in the banking crisis – but that it probably wasn’t totally finished. It still felt as if another shoe (or three) needed to drop.

Luckily, I was in New York late last week to help FRC take its final lap as a publicly traded company.

I just so happened to be at the New York Stock Exchange to attend an event celebrating the 50th anniversary of the CMT Association. I was even dragged into a few photos with friends and colleagues on the exchange floor.

Here’s one for the scrapbook:

you’ll see the stock had stabilized back above $6 by Thursday’s close.

But my presence on the exchange floor apparently sealed its fate.

The bank was once again in free-fall the next morning, only to die a quick death over the weekend. Now, Jamie Dimon and the folks at JPMorgan – along with the FDIC – have to sort out whatever’s left.

A couple of important lessons as another Bay Area bank bites the dust…

Much like SVB, First Republic stock gave investors zero reasons to attempt to scoop up shares following the March rout. The stock never came close to rallying after its initial 90% collapse. Instead, shares were stuck in a tight, sideways range.

Not good!

With the benefit of hindsight, we know FRB is a zero. But even in real-time, any attempts at scooping up shares over the past couple months would have been insane. Remember, every stock that does eventually crash will likely have peaked many months before the main event that seals its fate.

Sometimes, the downfalls can be lightning fast. But most of the time, a company will gradually deteriorate and the stock will begin to slowly trend lower.

Sellers are orderly at first. But if things start to fall apart, the real crash will happen quickly. Still, speculators love to gamble on potential snapbacks in stocks like FRB.

They even bought FRB ahead of last week’s earnings announcement!

Don’t be like them. Leave the banks alone – and all the other stocks struggling in downtrends right now.

The Real “Smart Money” Indicators

While I was in New York, I also had a chance to check up on how the real “smart money” feels about two important asset classes: stocks and gold.

Analysts love to toss around the numbers from various sentiment indicators, most notably the American Association of Individual Investors (AAII) bull-bear poll. But I’m much more interested in what the technical analysts are doing with their money.

This information is especially important right now considering the key levels approaching in stocks and gold as we kick off a new trading month. The averages are trapped in some sideways chop. Meanwhile, gold continues to flirt with a true breakout above $2,000.

What do the best technicians and money managers in the country think?

First, let’s talk stocks…

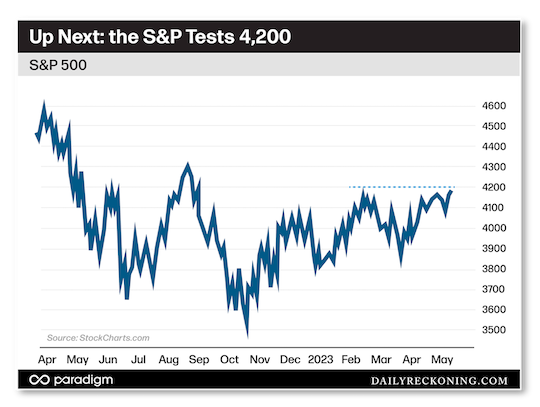

Unfortunately for the bulls, most of the smart money traders believe the S&P 500 will remain range bound for the rest of the year. Very few are expecting the S&P to finish below 3,600 – yet they also don’t see the market taking out all-time highs by the end of December.

There were some folks who think the S&P can clear 4,500 by year-end. That’s not too far-fetched, especially with a big test of 4,200 approaching. If the large-caps can extend here, we could see another thrust higher before encountering any summer consolidation.

Next up: Gold!

While most of the experts anticipate a choppy stock market, almost everyone thinks gold finally breaks out above $2,100 and stays above this mark into 2024.

That’s great news for gold bugs…

The bad news – at least, in the short-term, is that it might not be a clean move.

In fact, gold is running into trouble at $2,000 again. The early April run to $2,050 has fizzled out. Gold once again failed to post a monthly close above $2,000 in April. It will have to try again this month – which is also a seasonally weak time for the yellow metal.

Keep alert for a bounce in the dollar index. That could cause some weakness in precious metals in the weeks ahead. The longer-term outlook for gold is strong. But some turbulence in May might require a hard reset before it gets moving higher once again.

Let me know what you think of this article, or if you have any feedback, suggestions or questions by emailing me here.

Comments: