Gold's Not Fooled By April's Dollar Dance

The US Dollar index pushed toward its February highs during a strong April Fool’s Day rally.

No, this isn’t an elaborate practical joke. The buck is on a tear again after bouncing off its March lows. It’s now threatening to sneak back toward its November highs, erasing the steady drawdown that helped trigger the melt-up rally in late 2023.

If traditional market relationships hold true, these developments should be decidedly bearish for risk assets, including precious metals.

Yet gold doesn’t seem to care.

The shiny yellow metal refuses to yield to the dollar and continues to extend its historic breakout into the early days of the second quarter. Despite less-than-ideal conditions during a short training week leading up to the Easter holiday, gold broke free from a brief consolidation to post new all-time highs as it topped $2,200 for the first time. It’s now up more than 8% year-to-date with nothing but blue skies ahead…

I always pay close attention when the market deviates from the script. Gold isn’t supposed to rally in these conditions. Therefore, we can only assume there are more than a few strong buyers defying market relationships and buying as this historic breakout unfolds.

The action we’re seeing this week is once again working in favor of my 2024 prediction that the gold breakout will accelerate and run to $2,600.

Here’s a quick recap:

All the way back in 2023, we discussed the fact that most of the experts and forecasters believed gold would finally break out above $2,100 and stay above this mark into the new year.

The only problem leading into last week was that gold’s first attempts at a generational breakout were anything but clean. Despite numerous moves above $2,000 since the Covid crash, gold couldn’t finish a month above the 2K mark until last November. Then, when it finally broke through, gold bulls were forced to endure several false starts toward all-time highs that developed into mean little pullbacks.

The market is sending a clear message right now: gold is done messing around and is now resolving higher following more than a few months of cautious optimism.

It’s finally time to get greedy.

Here’s how…

Your Best Gold Buys

Whether we’re talking about gold, tech stocks, or crypto, you should always approach your trades with the same simple question: What’s my goal with this investment?

Are you looking to hold for months, years, or decades? Will precious metals be a speculative or core portfolio position? What is your stop loss – or the price/event that will trigger a get out or take profits?

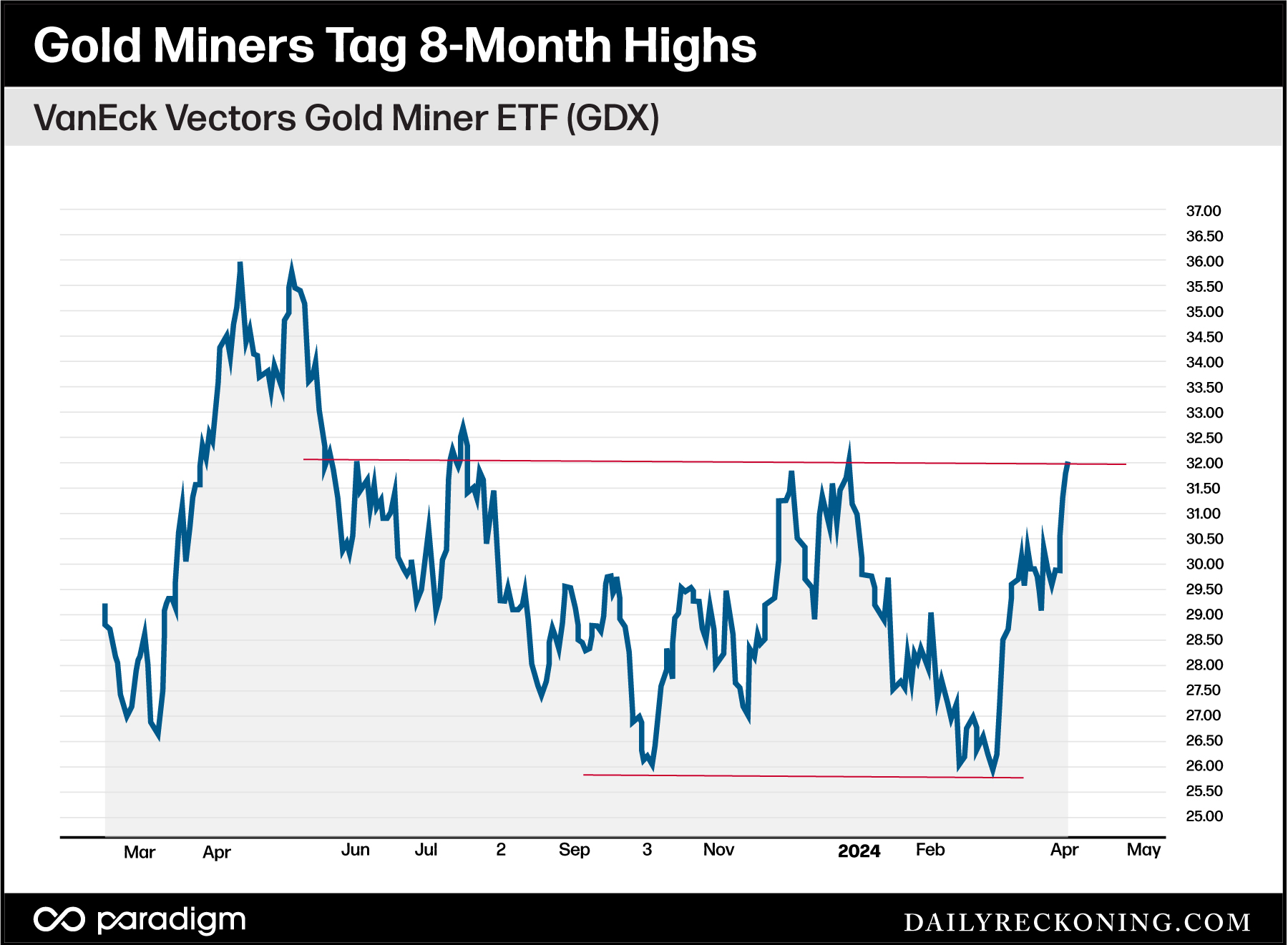

You have plenty of choices. A trader can capitalize on shorter-term moves in gold via the futures market, mining stocks, or through gold funds. The environment for gold trades is improving by the day. For the first time in many years, you can now employ some shorter-term breakout strategies to potentially capitalize on upside moves in precious metals.

Maybe you don’t feel like messing around with quick hits. If so, you could easily employ a “buy-and-hold” strategy with gold using various funds such as the popular SPDR Gold Shares (GLD) or the Sprott Physical Gold Trust (PHYS).

These are all viable methods to gain exposure to gold’s big breakout. Remember, I believe the investment environment is at a critical turning point right now. Because gold has just recently exited a secular bear market, we’re going to begin to see greed-focused investors emerge in the space, as opposed to those holding gold as a form of disaster insurance.

That’s right, the gold bug ranks are expanding before our eyes. That’s a good thing! The more buying pressure exerted on gold, the higher it goes. Even those hanging onto physical gold as a form of wealth protection against a doomsday event or unprecedented financial disaster will benefit.

One final note about strategy: You don’t have to be “all-in” on one investment or trading goal. There’s nothing wrong with a physical gold owner who also trades mining stocks when the timing’s right. There’s plenty of room for gold in longer and shorter-term portfolios right now.

Tracking the Next Metals Boom

Gold isn’t the only metal flashing bullish signals right now.

As more “mainstream” market watchers begin to climb aboard the gold bandwagon over the next several weeks, we’ll see additional opportunities emerge in the metals space. In fact, we’re already starting to see some key breakouts take shape.

Last week, I explained that during ideal gold bull market environments, silver should be outperforming. Spoiler alert: silver has not been outperforming gold over any meaningful timeframes. As of right now, silver is still stuck below its December highs.

But it is starting to look more constructive as it coils near this potential breakout zone…

If silver can climb back above $26, we should see a quick breakout extension. The poor man’s precious metal has a lot of catching up to do… it can happen quickly!

Looking beyond precious metals, opportunities are also cropping up in copper and uranium.

Copper has successfully held its $4 breakout and industry pure plays are exhibiting impressive momentum. Southern Copper Corp. (SCCO) tagged new highs to begin the second quarter and is up more than 25% year-to-date.

Meanwhile, uranium plays are popping again following a brief drawdown. The Global X Uranium ETF (URA) gained more than 4% yesterday to top its March highs. While it remains off its recent highs, it’s still up almost 10% year-to-date.

Yesterday’s move should trigger some follow-up buying. I wouldn’t be surprised to see URA take out those early February highs in short order.

Gold’s decade-long bear market has scared virtually everyone out of the metals trades. In 2024, they’re beginning to find their way back. This is only the beginning. As performance improves, investors will have to work to gain exposure to these emerging market themes. That’s when the real gains start to stack up…

Comments: