An Idiot’s Guide to Bitcoin (Part 2)

Idiots, rejoice!

Crypto isn’t just for math geeks, tax evaders and anarchists. Even a normie stock trader can figure it out. You might even make a buck or two along the way…

If you’re going to survive the post-bubble crypto hellscape, you need to think differently from the social media pumpers and whatever’s left of the HODLer crew, desperately clinging to their worthless alt-coins.

Fortunately, there’s hope for us all – and we don’t need any technical expertise to trade our way out of this mess. In fact, I believe these alluring crypto narratives will cause more harm than good to your portfolio.

If you want to actually make money playing cryptocurrencies and their respective trends, you have to ditch the pipe dreams and nutty NFT pitches and tune into how buyers and sellers are actually behaving in the marketplace.

Last week, I explained how a responsible luddite should approach the crypto-sphere.

Today, I’m going to expand on these ideas. I’ll also dive into the charts to determine where we are in the crypto cycle – and where the sector could go from here.

And just in case you missed it, here’s where you can find the first part of my crypto guide.

Here are the key facts you’ll need to digest before moving forward:

First, you need to recalibrate your brain and start to think like a crypto outsider. Ultimately, price matters more than any convoluted crypto narrative. I’m not asking you to plug your ears and ignore everything you hear. Just don’t get sucked into the compelling storylines that might cloud your investing judgment. It’s all too easy to convince yourself to hang onto a bad investment when you’ve bought into the story.

Next important point: crypto and tech growth are two sides of the same coin. Cathie Wood was spouting some nonsense last week about how ARKK is the new Nasdaq. Sounds like something the brainwashed crypto masses would have latched onto during the Covid Bubble. Crypto is the new Nasdaq! Crypto will topple Wall Street and usher in a new era of world peace!

It’s no surprise crypto and the tech-growth trade captured the attention of the wildest speculators during the bubble times. They traded together on the way up and the way down. Crypto even led the stock market higher during the bear market’s extended relief rally last summer.

Therefore, it’s important to link crypto’s trends and prospects with the tech-growth trade until the market proves otherwise. Watch how the beaten-down tech stocks behave and compare these moves to the action in the cryptosphere. Pay special attention to any divergences.

I’ll lay out my price analysis in just a moment. But before we get to the charts, I need to explain why the Bitcoin narrative began to fall apart during the wild bubble times, and how the sector can heal in the aftermath of its latest bear market.

Anatomy of a Bubble

Early adopters and investors in any new idea are going to be the true believers. In this case, we’re talking about the folks who understand the tech and longer-term prospects of crypto.

But the market became much more complicated as crypto assets began to rapidly appreciate, creating bubbly conditions. This frothy action attracts a new class of investor: the greedy speculator.

Speculators and profit-chasers ultimately don’t care about the longer-term uses and prospects of cryptocurrencies. Sure, they might perform some due diligence and recite talking points about inflation or decentralization. But their primary concern is making fast money off rapidly rising asset prices.

Bubbles are bubbles. It doesn’t matter if we’re talking about tulips, dot-coms, or monkey JPEGs. You could have an asset with the noblest intentions in the history of markets. Bitcoin has been sold as an alternative to global fiat currencies, an inflation hedge, and the key to a decentralized future. That’s fine. The jury’s still out!

What’s important to understand is that none of this matters once the speculator class takes over. The prospect of infinite riches twists the entire marketplace into a raucous cash grab. Nothing matters except making as much money as possible in the shortest amount of time.

Bubble conditions also poison the minds of the true believers and early adopters. They feel vindicated! After all, their predictions came true and the market is rewarding their foresight. The rapid price appreciation eventually turns these “rational” investors into raving speculators. By this point, everyone involved in the bubble is cheerleading the daily action.

This is when a top begins to form.

When it comes to crypto’s most recent bubble, the bull’s last gasp came in late 2021. In the following year, Bitcoin lost more than 75% of its value. Many other crypto investments fared much worse.

A Post-Boom Cleanse

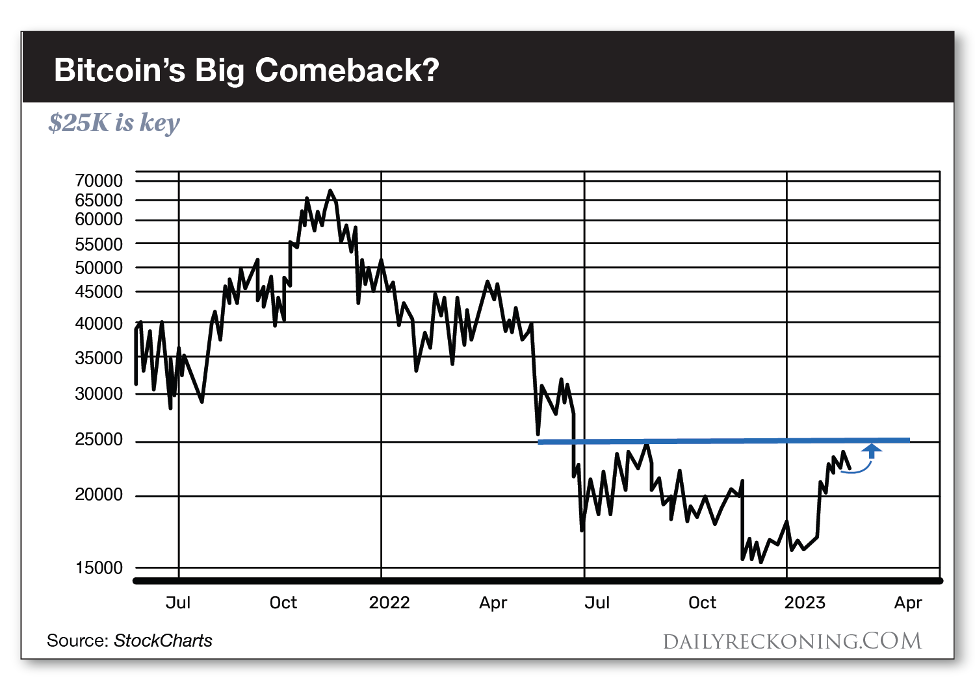

Bitcoin bottomed out just below $16,000 in November. The flagship crypto has since posted an impressive pop to begin 2023, gaining 40% on the back of a strong January rally.

The big question: Was 2022’s drawdown enough to chase out a majority of the bubble-era speculators and “reset” the market?

My main concern with this crypto rally is that it’s happened too soon. Yes, we’ve witnessed bankruptcies and scandals throughout the crypto world. The NFT market completely collapsed. The worst of the froth has evaporated.

But was it enough?

Does crypto need more time to lick its wounds?

We could get this answer sooner rather than later.

For Bitcoin, $25,000 is the pivot I’m watching:

Bitcoin (and Ethereum, for that matter) is constructively consolidating its January rally. If it can hold a move above $25K, it could very well break free from a nasty bear market and build a new, sustainable uptrend.

This move could take time to materialize. In fact, Bitcoin might need more time to churn in a wide range between $20K – $25K before making an honest attempt at a breakout. We won’t know how it will react until we see the price action close to the breakout zone.

We also need to watch tech-growth closely – as well as broader market conditions. Will Bitcoin diverge from tech and blaze its own path? Or are these trades going to continue to push and pull each other in the weeks and months ahead? Any change in this relationship will offer valuable trading information to anyone paying close attention.

No matter what, we should brace for volatility. Crypto is notorious for late night and weekend rallies and breakdowns. Just don’t jump the gun. We don’t need to make any grandiose predictions to play the next move.

Watch for the reaction at $25K and act accordingly. Barring some quick whipsaws, we should gain some valuable insight into crypto’s ultimate direction in the weeks ahead.

Comments: