What Happens When the Snapback Breaks?

The first quarter is almost in the books – and it looks nothing like the Great Tech Reset that shoved the stock market off a cliff in 2022.

Bitcoin has exploded higher, posting new 9-month highs after breaking out above $25K.

The Nasdaq 100 – the biggest, baddest tech names on the market – just hit new 7-month highs as household names such as Microsoft (MSFT) and Meta Platforms (META) continue to build on recent gains.

Semiconductors are also proving the naysayers wrong. The VanEck Vectors Semiconductor ETF (SMH) has rallied more than 50% off its October lows – and it doesn’t have that much farther to travel before posting new 52-week highs. That’s a remarkable turn of events from one of last year’s worst performing sectors.

It’s clear that the tech trade (and yes, I consider anything crypto-related a tech trade) has breathed life into the market during this first-quarter snapback. While the financial sector cratered during this little bank crisis we’ve enjoyed over the past few weeks, tech grabbed the torch and continued higher. Without any bank stocks weighing it down, the Nasdaq Composite has gained more than 3.7% during the month of March. The S&P 500 is up less than 1% on the month, while the Dow remains in the red.

Evidence of this bifurcated market is easy to find. Even the market’s year-to-date gains are heavily clustered in tech. Stocks like Tesla (TSLA) and Nvidia (NVDA) are up 57% and 83%, respectively, while more than a handful of banks, energy stocks, and healthcare names are down double digits.

We can’t complain too much about the market offering up the tech space as a place to hide from the bank drama that’s dominated the market landscape this month. But even short-term minded traders need to take a step back as the quarter ends this week.

It’s time to ask some tough questions…

For starters, can this period of tech outperformance continue?

Or, will the market’s lagging sectors reel in high-flying tech as bank problems fade from the front page?

Let’s dig in and see if we can find any clues…

Bizarro Market

First, we need to reset our brains to December 2022.

Tech stocks were plumbing new lows. Covid Bubble poster child Tesla Inc. (TSLA) saw its stock nearly cut in half over the course of about four weeks. Tech-growth was obliterated and many of these stocks were going out at or near their lows.

Fear was palpable as the calendar flipped to 2023.

That’s when the market flipped on its head…

While industrials, metals, and value names were in focus late last year, tech snapbacks stole the show in January. No one was ready for it. The chase was on!

Following a rocky February, semiconductors, the crypto-sphere, and mega-cap tech (consisting of most of the former FANG-plus complex) were once again attracting eager buyers. Against all odds, market leadership remained firmly in the tech sector as regional banks imploded.

Except for one little problem…

Many of the tech-growth leadership during the frothiest period of the Covid Bubble wasn’t keeping pace.

Grab Your Life Vest

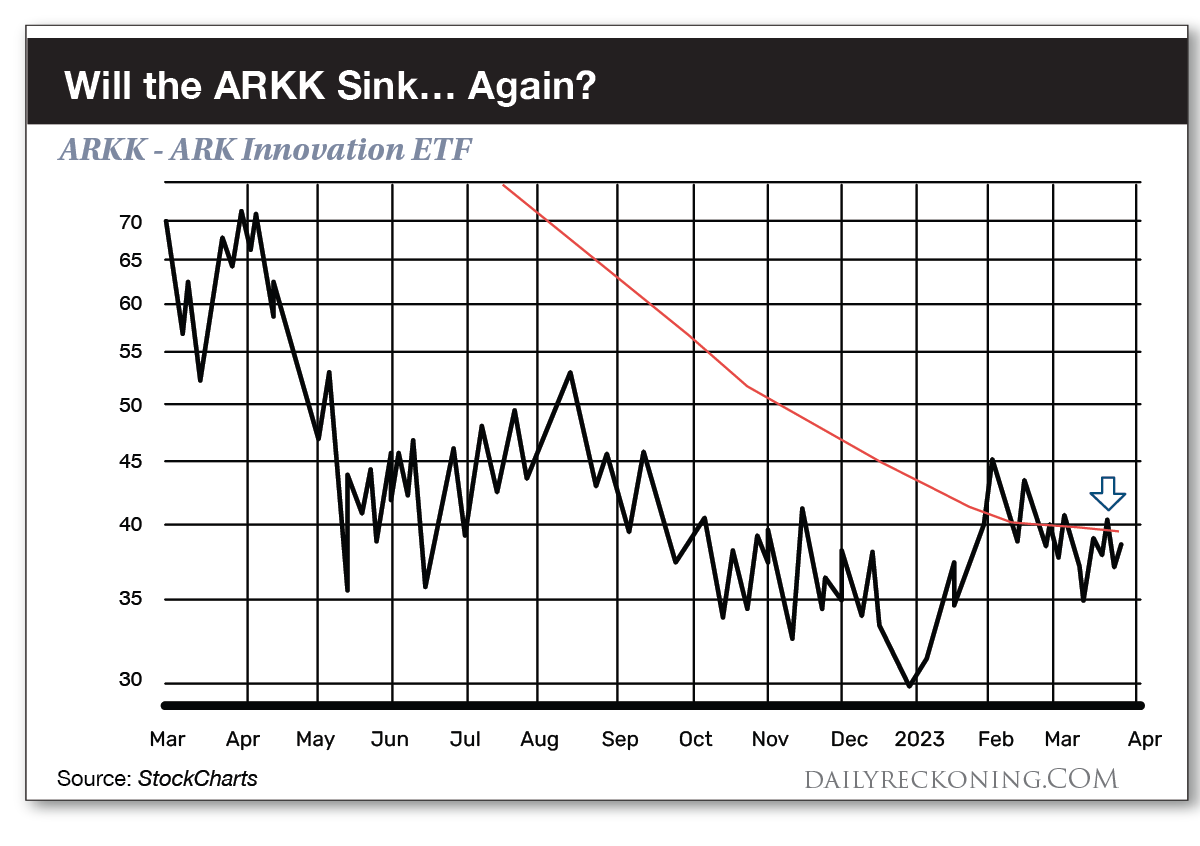

Considering everything that’s happened so far this year, I think it’s safe to ask if Cathie Wood’s ARK Innovation Fund (ARKK) has sprung a major leak.

Our favorite tech-growth proxy hasn’t played nice since the January snapback rally – despite continued outperformance from the greater tech sector.

Yes, ARKK was one of the leaders of the January rally. It even managed to jump nearly 50% off its lows by early February. But it hasn’t been able to recapture that momentum following the February pullback. In fact, ARKK continues to pull back. The EFT failed to hold a brief breakout back above its 200-day moving average last week, retreating to its choppy trading range.

Remember, semiconductors, big-tech, and crypto have all pushed to new year-to-date highs. ARKK has not. It remains dangerously close to slipping back into a bigger downtrend if it fails to push higher out of what has been an incredibly choppy March performance.

Why does this matter?

For starters, using ARKK as a “hype proxy” for the tech market could tell us if there’s ample risk appetite for the more speculative tech-growth names that have remained out of favor for the better part of the past two years. Since late 2021, none of ARKK’s rallies have produced a major change in trend. This attempt looks no different… not yet.

Then, there’s the matter of ARKK’s biggest holdings. TSLA is the fund’s top dog, which hasn’t exactly had an amazing March despite a strong start to the year. But it’s ARKK’s other major holdings: ZM, SQ, U, TDOC, and others that remain stuck in their respective downtrends. Many of these stocks are still lingering near their lows.

That’s where we’re finding trouble. Some of these stocks will eventually find a bottom and begin carving out bases. Others might get bought or go to zero. But we’re still early in this process. Despite the positive developments in the tech sector, many of these tech-growth ARKK components remain a complete mess. My concern here is whether a bigger breakdown in these names leads to corrective action that reverberates across the tech space – including the stocks that have contributed to a majority of the market’s gains so far this year.

If it is time for yet another tech-growth gut check, investors should pay close attention. The outcome could have major implications for stocks as the second quarter quickly approaches.

Let me know what you thought of today’s article… and if you want any more topics covered by emailing me here.

Comments: