Lexmark Intl (NYSE:LXK) -- Revenue Expectation Missed, Stock Slammed

Lexmark International (NYSE:LXK), the Lexington, Kentucky-based printer manufacturer, revealed third quarter revenue that fell far short of expectations and, not surprisingly, the stock was slammed. Many of the company missteps and problems that Strategic Short Report editor Dan Amoss has been busily bringing to our attention are finally coming home to roost.

This week, he explained to his readers exactly happened and where we go from here:

“Lexmark (NYSE:LXK) missed its revenue expectations for the third quarter. The market hated the report. So much for the ‘efficient market hypothesis’:

“Considering Lexmark’s long-run track record, the stock’s moon shot in September and October was totally unjustifiable. It seems the market was extrapolating Lexmark’s recent (temporary) market share gains far into the future.

“But Lexmark’s profit margins and earnings are likely peaking right now, and HP is preparing to compete more aggressively.

“Revenue wasn’t the only disappointment in the third quarter report. Inventories also surprised on the upside. Management described on today’s conference call what it considers an ‘inventory overshoot’ — one that’s expected to be worked off quickly. That may be the case, but working off excess inventory typically depresses gross margins.

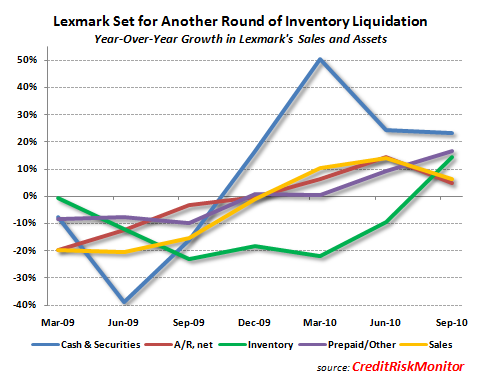

“Lexmark’s earnings quality has deteriorated. On a year-over-year basis, inventories and accruals (prepaid expenses) are now both growing faster than sales. You can see this in the chart below:

“Finally, in another shock to the market, CEO Paul Curlander announced his retirement, effective next spring. There doesn’t appear to be any nefarious reasons for the management change. Curlander said he’s fulfilling a career goal of retiring ‘early.’

“Many negative factors are at work here. The U.S. stock market is extremely overbought and complacent, and I suspect the market is also misreading how the Fed’s QE2 will impact the U.S. economy. GDP growth is still decelerating, and soaring commodities will crimp margins at many companies.

“Further, we could easily see a return of bearish sentiment after next week’s U.S. election and Fed meeting.

“With no sell-side analyst wanting to be the last one to ‘downgrade’ Lexmark stock, we’re also likely to see a more negative tone from the stock cheerleading community going forward.”

LXK’s share price has been crippled by the revenue announcement, but, as described above, the bad news continues to pile on. The profit margins and earnings are already peaking, competition is heating up, the executive office is in transition, and then there’s, of course, the weak state of the broader economy. In this environment, Lexmark’s future looks bleak. How can you benefit from the situation? Well, you can catch the opportunity to profit despite Lexmark’s impending downtrend by signing up for Dan Amoss‘ newsletter, the Strategic Short Report. It’s available through the Agora Financial reports page, which can be found here.

Best,

Rocky Vega,

The Daily Reckoning

[Nothing in this post should be considered personalized investment advice. Agora Financial employees do not receive any type of compensation from companies covered. Investment decisions should be made in consultation with a financial advisor and only after reviewing relevant financial statements.]

Comments: