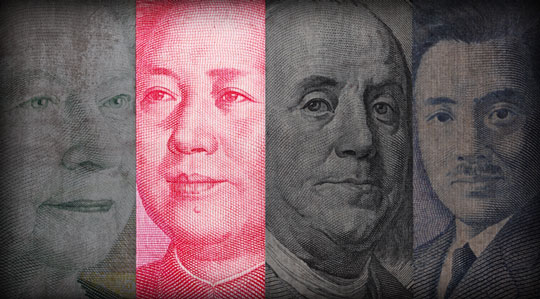

Yuan Devaluation Likely

China’s economic model of export-led and investment-driven growth is in crisis. With no one left to export more to every year, China now finds itself with extraordinary excess capacity across every industry. Product prices are falling, companies are unprofitable and bank loans are going bad. Any further investment will just worsen the situation. Therefore, China is buying much less raw materials from the rest of the world. As a result, commodity prices have collapsed. Last month China’s imports were 20% less than during the same month last year. So, China is no longer a driver of global growth. In fact, it is a very significant brake on global growth. For that reason, many of the emerging market economies around the world have suffered a very sharp economic slowdown or even gone into recession. Many emerging market currencies have dropped substantially in line with the economic growth prospects of the emerging markets. As many of these countries have borrowed heavily from abroad in recent years, often borrowing U.S. dollars, there is now a growing chance that they will not be able to repay those loans. Many creditors are attempting to withdraw their money from the emerging markets before the debt defaults begin. The resulting capital outflows are compounding the problems those countries now face by making credit more expensive. All of these problems combined have thrown the global economy into a new recession that seems likely to become considerably worse before it gets better. The dollar is the principal international reserve currency for one reason: the United States runs massive trade deficits with the rest of the world every year. That means that the rest of the world accumulates hundreds of billions of dollars every year. These they must invest in U.S. dollar-denominated assets, like U.S. government bonds. The yuan is not an important international reserve currency because China does not have a massive trade deficit. Instead, it has a massive trade surplus every year. For that reason, other countries don’t own a lot of yuan. If China began to run a huge trade deficit with the rest of the world, then other countries would have a lot of yuan and they would be forced to buy yuan-denominated debt instruments. Then the yuan would be an important reserve currency. But running a large trade deficit would cause tens of millions of Chinese factory worker to lose their jobs, leading to social instability. For this reason, the yuan is unlikely to become an important reserve currency within the foreseeable future — if ever.END Pull Quote Right China’s economy is now under severe strain. Chinese policymakers would like to devalue the yuan against the dollar to boost China’s exports and economic growth. But China’s trade surplus with the United States was $340 billion last year. That means that, in the absence of intervention by the Chinese central bank, the yuan would appreciate against the dollar, not depreciate. The value of the yuan relative to the dollar is something that is negotiated between the U.S. and Chinese governments on an ongoing basis. The U.S. government would like the yuan to continue appreciating against the dollar so that China’s trade surplus with the U.S. would stop expanding. The U.S. government certainly does not want the yuan to be devalued. Not only would that further weaken the competitiveness of U.S. exporters relative to Chinese exporters, it would also export deflation to the United States since the U.S. buys $500 billion worth of goods from China every year. Any yuan devaluation would cause the price of those imports to fall and that would cause the U.S. price level to fall. China, on the other hand, does not want the dollar to strengthen any further relative to the euro and the yen. That’s because the yuan is closely tied to the U.S. dollar, so when the dollar strengthens against the euro and the yen, so does the yuan. A stronger yuan hurts Chinese exports to Europe and Japan. Therefore, China does not want the Fed to increase interest rates since higher U.S. interest rates would cause the dollar and the yuan to appreciate against other currencies. If the Fed does increase U.S. interest rates, China may devalue the yuan vs. the dollar so that the yuan does not appreciate against other currencies. One theory suggests that the small yuan devaluation in August was a warning to the Fed not to hike rates or else China would devalue. A large devaluation of the yuan would be a terrible blow to the Fed because it would push down U.S. inflation (perhaps into negative territory), making it much more difficult for the Fed to reach its 2% inflation target.

|

Comments: