Trade Wars Bring Pain… And Opportunity

It’s game on for the trade wars.

After months of threatening tariffs on U.S. trading partners during his 2024 presidential campaign, Trump has now taken definitive action on that front. On Saturday, February 1, Trump announced that the U.S. was imposing 25% tariffs on all goods imported to the U.S. from Mexico and Canada (with the exception of Canadian energy, which was tariffed at 10%) and additional 10% tariffs on all goods imported from China.

These new Chinese tariffs were on top of tariffs Trump imposed on China in 2018, many of which were left in place during the Biden administration. All of these new tariffs were to take effect on Monday, February 3rd.

Trade Wars Are Heating Up

Canada announced they will retaliate against Trump’s tariffs with 25% on a list of U.S. imports and warned Americans that Trump’s actions would have real consequences for them. Mexico has said it will also impose retaliatory tariffs, without mentioning any rate or products.

Meanwhile, China struck back at the United States by announcing tariffs on select American goods, escalating the trade war. Some U.S. goods imported into China will be subject to tariffs of up to 15%, as they rolled out a series of retaliatory measures to counteract Trump’s planned tariffs.

The new trade wars have now gone global. In addition to the Mexican, Canadian and Chinese tariffs, Trump announced that EU tariffs are coming soon. Trump tentatively indicated that the EU tariffs would be 10% across the board.

Even though there have been concession moves by both Canada and Mexico recently, Trump has only delayed his tariff plans in the negotiations.

But It’s clear that a full-scale global trade war is now underway. And it could be devastating for investors who don’t know how to maneuver through the landmines.

Neighborhood Wars

Canada ($419 billion) and Mexico ($475 billion) account for almost 30% of all goods imported by the United States. Canada, Mexico and China are the three largest trading partners of the U.S.

Obviously, Canada and Mexico are our closest neighbors, and each shares a long border with the U.S. The new trade wars will have many facets, but solving problems with regard to Canada and Mexico will be a big part of the global puzzle and establish benchmarks by which other countries will be judged by the U.S.

The extent of Canadian and Mexican trade with the United States is difficult to overstate. Twenty-three of the fifty states rank Canada as their number one trading partner measured by imports. That includes the entire northern tier of U.S. states from Washington to Maine (with the exceptions of Idaho and Michigan) and most of the Midwest.

Ten of the fifty states rank Mexico as their number one trading partner measured by imports. That includes the entire southern tier of U.S. states (with the exceptions of California and Florida), plus the states of Missouri, Kentucky and Michigan. From automobiles to avocados, Canadian and Mexican imports are everywhere.

Trump cited three reasons for imposing tariffs on Mexico and Canada: illegal immigration, fentanyl and unfair trade practices. The issues of illegal immigration and fentanyl are closely linked because they both involve securing the border.

A bigger issue lurking behind the U.S.-Mexico negotiations is the extent to which Chinese companies have taken over Mexican companies or built their own factories in Mexico to do an end-run around direct tariffs on China.

The Chinese are putting automobile assembly plants in Mexico and exporting the cars to the U.S. free of tariffs under the U.S.-Mexico-Canada Trade Agreement (USMCA, the successor treaty to NAFTA). It may be the case that U.S. auto companies (Ford, GM) will be able to continue bringing in cars to the U.S. without duties while the Chinese-owned companies in Mexico get whacked.

That leaves open the issue of European car makers with plants in Mexico. I spoke to a well-informed source at Audi recently. They’re frantic. They just built a multi-billion-dollar plant in Mexico to do final assembly on the Q5 SUV (their most popular model). They expect that new Mexican tariffs will price it out of the market (compared to Toyotas and Nissans that are built in the USA).

Volkswagen, which owns Audi, may be in financial distress as a result of Audi’s mistake. It was clearly a major blunder on Volkswagen’s part not to locate their Audi factory in Tennessee or South Carolina as other foreign car manufacturers have.

The trade situation with Canada is more problematic.

Even with the one-month delay in imposing tariffs on Canada, the substantive policy issues remain. Trudeau is not in a strong position to negotiate anything because he has already agreed to step down as party leader and Prime Minister. The fight to replace him as party leader is being led by former Deputy Prime Minister Chrystia Freeland, a trade-hawk and neo-fascist sympathizer.

National elections in Canada are scheduled for October 20, 2025, but could be held sooner. The national election could come down to Chrystia Freeland as the Liberal Party Leader and Pierre Poilievre as Conservative Party Leader. Poilievre is far more reasonable on trade issues than Freeland.

The Freeland Plan to fight Trump includes dollar-for-dollar tariff retaliation, an international anti-Trump trade coalition including Mexico, Denmark, Panama and the EU, a ban on purchases of U.S. goods by all Canadian federal government agencies, a ban on American companies bidding on Canadian government contracts, a ban on American firms participating in projects funded by Canada, and support for Canada’s cultural sector against “Donald Trump’s billionaire buddies.”

The even more radical Ottawa Premier Doug Ford has proposed halting Canadian energy exports to the U.S. and “ripping up” Ottawa’s contract with Elon Musk’s Starlink company.

Canadian exports to the U.S. are dominated by energy products (about $165 billion) followed by automobiles and parts (about $83 billion), and consumer goods (about $70 billion). Electronics, food, fish and aircraft make up a relatively small part of the total.

Investors should accustom themselves to continual trade wars and the market volatility that goes with them. But this also means there are profit opportunities as Trump pursues the art of the trade deal.

Why Higher Tariffs?

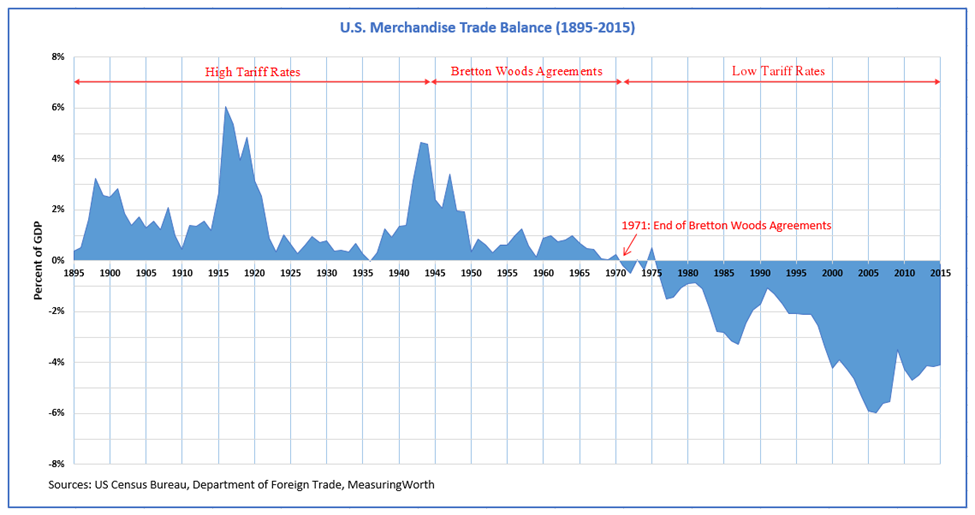

Trump wants America to enter a “new golden age”. He wants to do that by a revival of the American System. Part of that system was imposing high tariffs on imports to support manufacturing and high-paying jobs in the United States. You can see from the chart below how historically America ran trade surpluses when high tariffs were in place.

Foreign companies will be free to sell goods to Americans, but only if they are manufactured in the U.S. This will lead to a wave of inbound investment in the U.S., a reduction in U.S. trade deficits, a stronger dollar (as the world demands dollars to invest here), and higher wages for U.S. workers.

Higher wages will raise real incomes, stimulate consumption, decrease income inequality and expand the tax base to help reduce deficits without raising tax rates. Trump’s plan is designed to rebuild American factories, the American economy, and support American workers.

The increase in investment in the U.S. also accelerates the U.S. lead in high technology including semiconductors, artificial intelligence, nanotechnology and quantum computing. China has kept pace in these fields by stealing intellectual property and providing massive government support. Now, the U.S. can pull away from China by importing some of that technology and relying on private investment along with government support.

Contemporary critics of tariffs (basically all mainstream economists) claim that these tariffs will invite retaliation by trading partners and may cause a replay of the collapse of world trade that did occur in the 1930s.

This flawed analysis ignores the initial conditions qualifications described above. China is in the opposite position of the U.S. It produces too much and does not consume enough. China’s best approach would be to lower its tariffs, encourage consumption by its citizens and attempt to strengthen its currency so that its consumers can afford more imported goods.

In fact, we expect China to do the opposite and hunker down in its neo-mercantilist approach by cheapening its currency and attempting to flood the world with more exports.

If China takes the latter approach, it will fail. That won’t be the fault of the United States, it will be China’s own failure. U.S. policy should not be designed to Make China Great Again. That’s China’s job.

U.S. policy is to Make American Great Again. That means high tariffs, lower taxes, more productive investment (including public investment) and high-paying jobs that will support consumption side-by-side with increased investment.

The global tariff and financial wars will feature countries stealing growth from their trading partners. There will be pain but also opportunity. Some sectors will do better than others as this chess match plays out.

Comments: