THIS Will Turbocharge the Metals Bull Market

Something unusual is happening.

Prices in Canada are soaring…for Americans. I’m preparing for a trip to Toronto for the giant Prospectors and Developers of Canada (PDAC) conference. As I looked at flights and hotels, I noticed a significant increase in costs from year’s past.

Here’s why: the U.S. dollar is falling compared to Canadian currency.

This chart shows the exchange rate between the U.S. and Canadian dollars. We just hit the lowest rate since 2022. That’s because the dollar plunged 9% over the past year or so. Today, the exchange rate is about C$1.30 to $1. A year ago, it was about C$1.50 to $1.

That’s a big jump.

Even if the prices in Toronto remain the same, it will cost me about 10% extra in exchange rate. That’s a huge price hike in just a year.

What’s going on with the dollar today?

The value of paper currency is a simple supply and demand problem. It works just like any other system. If there is more demand than supply, the value rises. More supply than demand, it falls.

However, the reasons for the supply and demand are different than a simple T-shirt.

The currency can attract buying by selling bonds at high interest rates. If you buy a U.S. bond, you are trading your money (Canadian dollars, Euros, Yen, etc.) for U.S. dollars.

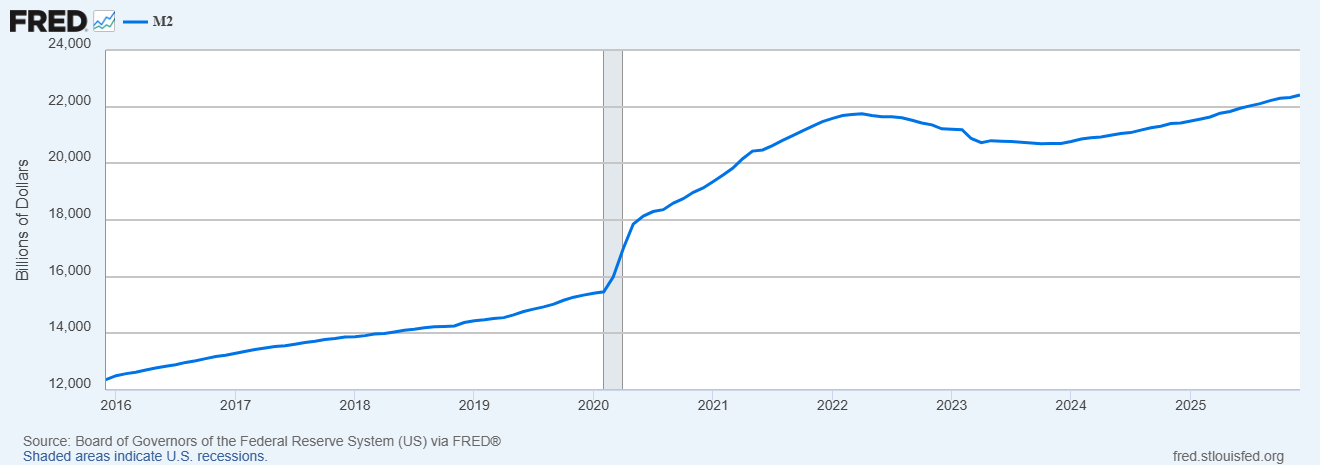

However, only the speed of the digital printing press limits the supply. And the U.S. government massively increased supply of dollars over the past few years:

This chart shows the M2 money supply. That’s all the cash in circulation plus the money in bank accounts. It just hit an all-time high, up about 80% since 2016. In other words, supply is massive at a time when demand is declining.

The move away from the dollar started back in 2022, when the U.S. froze Russia’s foreign exchange reserves. It demonstrated the risk of holding too many dollars in reserves. Countries like China and India saw that as an unnecessary amount of risk.

In addition, countries around the world (including our allies in Europe) began selling dollars to avoid the impact of U.S. economic policies…namely debt. As we’ll discuss, the U.S. debt is a massive risk to holding dollars.

Finally, there is a global movement away from currencies and into gold as a hedge. This is a slow, long-term trend. However, it will have the largest long-term impact on global financial markets.

For Americans, the weaker dollar will bring some good and some bad news.

As the dollar weakens, it makes imported goods more expensive and exports more attractive. A weaker dollar can strengthen demand for U.S. exports like agricultural products. But it makes travel abroad (like my trip to Canada) more expensive.

It makes imported goods more expensive. Like tariffs, this will have broad impacts. All the parts that need to come from outside the U.S. will cost more. And the cost of building construction and home renovation are going to go up.

That’s because commodity prices are global.

We can already see the price of metals like copper reacting to the weaker dollar:

The chart above shows the performance of the dollar (in red) versus the performance of the copper price (in black).

Not all the copper price move is due to the weakening dollar, but it helps. In periods when the dollar strengthens, copper prices sag or move sideways. But as the dollar weakened in 2025, we can see the copper uptrend surge.

Gold prices reacted similarly. The gold trend (in black) didn’t go parabolic until the dollar weakened:

This trend won’t end soon. The current administration likes a weaker dollar. According to a recent Bloomberg article:

In recent days, the president appeared to fully embrace a weaker dollar. Asked on Jan. 27 whether he was worried about the dollar’s recent slide, Trump told reporters, “No, I think it’s great.” His remarks all but cemented the view that the currency is headed for further declines.

That’s great news for metal prices and mining investors. It confirms that the trend should continue. And for those investors still on the sidelines, it signals the opportunity to get in. You haven’t missed out yet.

The weakening dollar will add to the speed of metal prices’ rise.

Combined with decades of underinvestment in new mines, and booming demand, the setup we see today is a rare one.

Comments: