Start a Roth IRA for Your Kids/Grandkids

Last summer my 16-year old worked at the pool we belong to.

Here in Ellicott City, Maryland, the minimum wage is $15/hr. Not bad for a teenager these days.

Over 3 months he earned about $2,800 after taxes.

He wanted to invest the money. So we started a custodial Roth IRA. The most he can contribute is the total he earned, and we agreed to match 50%.

I explained the benefits to him, and he was sold. A Roth IRA is an incredible tax shelter. When that money is withdrawn (in 50 years or so), it will be completely tax-free.

He won’t need to worry about capital gains taxes at all. This allows the money to compound far more efficiently.

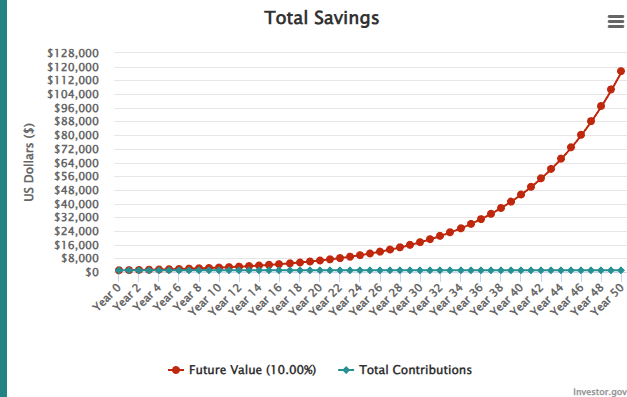

At 10% annual returns, each $1,000 invested over 50 years will turn into $117,000.

The Roth IRA is one of the few no-brainers for investors. And by starting his as a minor, we’re giving him a major leg-up on retirement.

Investing for 5 Decades Out

The hard part was deciding what to invest in.

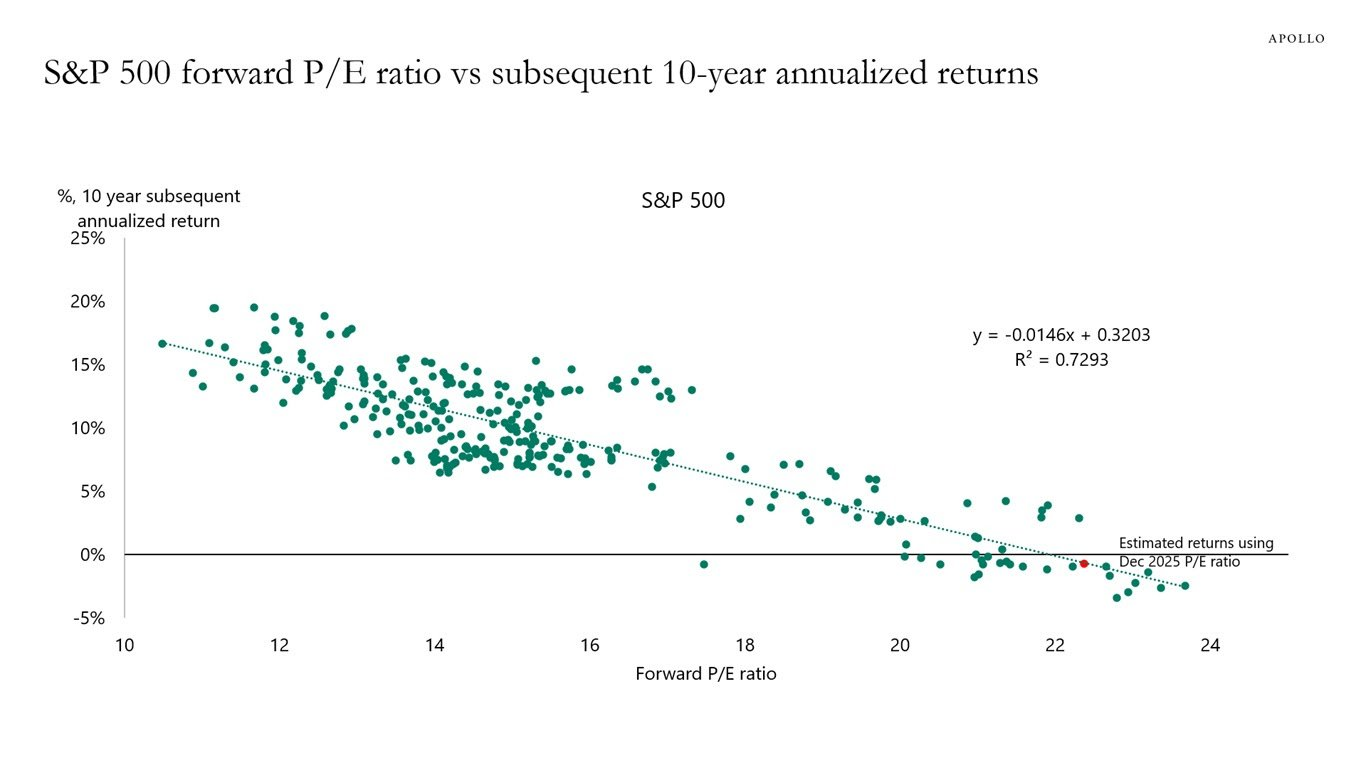

As you all know by now, I believe U.S. stocks are broadly overvalued.

Historically, when the S&P 500 is trading at current valuations (22x forward P/E), returns over the next decade have been zero. Here’s a chart, via Apollo:

We saw this play out in 2000. After the dotcom bubble popped, it took 7.5 years for the S&P 500 to reclaim its previous high. And then the bubble popped again in 2008.

For investors who bought the S&P 500 near the dotcom peak, it took about 15 years to get back to even (accounting for both inflation and dividends).

As the chart shows, when the S&P 500 is trading at a P/E of 12, forward returns average around 15% a year. But today it’s far from those cheap levels.

So we excluded U.S. stocks from the running.

Emerging Markets and Natural Resources

You already knew where this is going.

Yep, we set him up with a diversified EM and hard assets portfolio.

Here are the assets we chose:

- VWO – broad emerging markets ETF with a tiny .07% expense ratio

- FLLA – Latin America ETF with very low expenses and nice yield (mostly Brazilian stocks)

- PBR.A – Petrobras, my favorite oil stock for the long-term

- VALE – the Brazilian industrial metal miner we featured yesterday

- GDX – the largest gold miner ETF

Before some of you ask, why not silver?! Our kids don’t know it yet, but they’re already well allocated there.

My goal was to select assets which are essentially set and forget for the next 5-10 years. Let the dividends be reinvested and watch the returns compound (hopefully).

The portfolio is doing pretty well so far. But we’ll make adjustments as necessary based on what’s happening in markets.

By setting this account up for him early, we’re giving this money 5 decades to compound, tax-free. And that’s a very powerful thing. Even starting with a relatively small amount.

This summer, Sharp Jr. will work at the pool again before starting his electrician apprenticeship in the fall. Earnings will go straight into his Roth IRA.

He is NOT taller than me. It’s just a bad angle…

My 13-year old daughter, meanwhile, has been working for 3 years at the barn where she rides horses. But since she was under 13, she worked in exchange for additional lessons.

This summer, she’ll finally be able to collect a real paycheck, and guess where that money’s going? Yep, directly into a tax-sheltered custodial retirement account.

If you have kids or grandkids, I strongly recommend setting up a Roth IRA as soon as they get a job. You can even employ them. Just make sure you make them do real work, document everything, and talk to a tax pro if you’re unsure about anything.

Comments: