How Silver Could Rise to $100/oz

During precious metal bull markets, silver tends to significantly outperform gold.

But we haven’t really seen that yet this cycle. Today we’re going to explore why this is the case, and what it means going forward.

Over the past year, gold is up 39%, and silver is up 37%. Don’t get me wrong, both are doing very well.

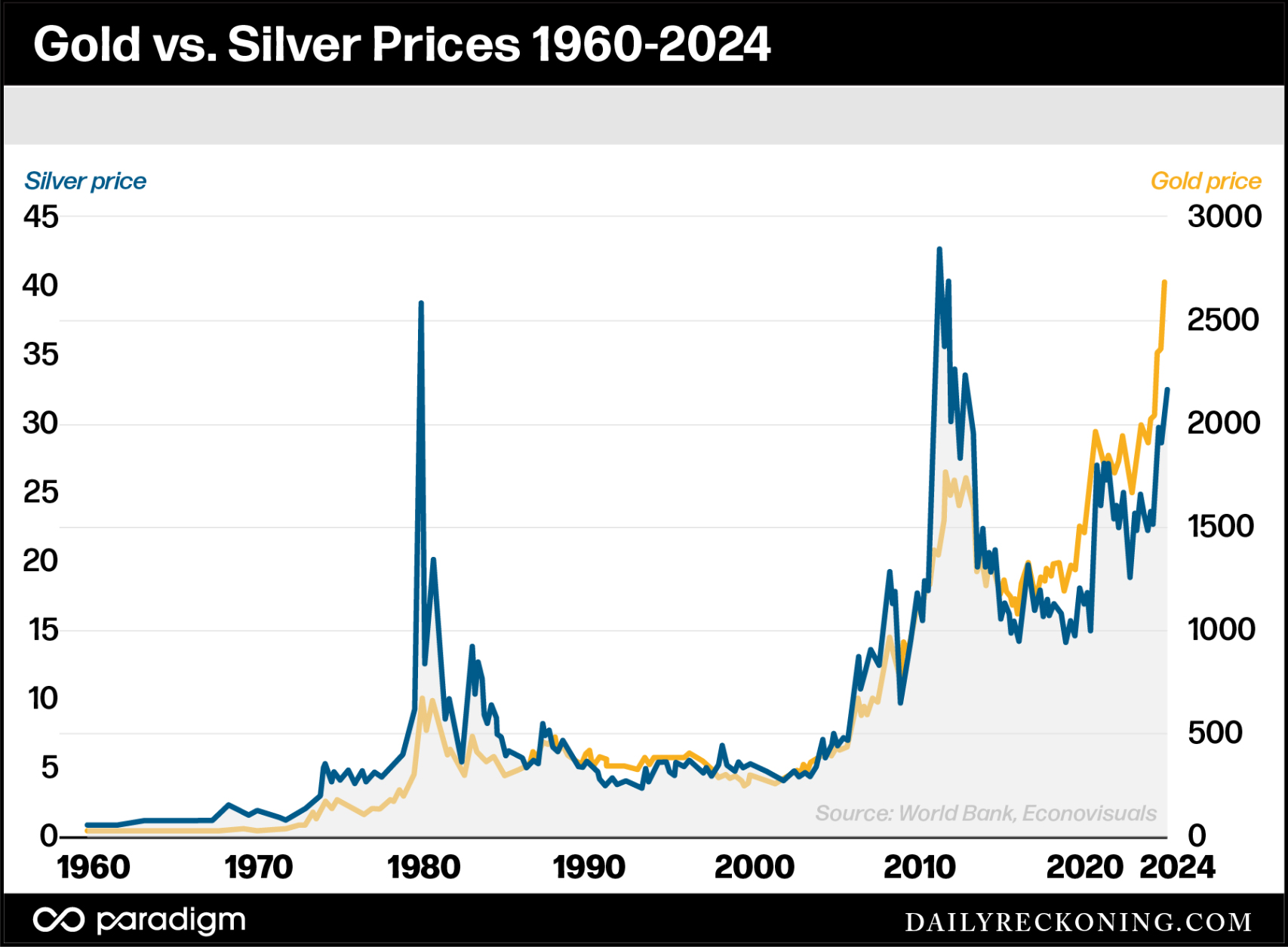

But it helps to get a historical perspective. Let’s look at a long-term chart of both metals covering 1960-2024. Silver is blue and gold is yellow.

Note the historical spikes around bull market peaks in 1980 and 2011, and how much silver outperformed during these periods.

Obviously, the 1980 spike was exaggerated due to the Hunt Brothers’ cornering of the market. But the 1970s and 2011 periods are worth studying.

In 2011, the gold/silver ratio reached around 30x ($1,500 gold and $50 silver). Today it’s around 89x, meaning that going by historical norms, silver is undervalued compared to gold.

Now back to the chart. Contrast 2011 with the past few years, when gold has been leading prices higher. Let’s dig into why this is the case.

What Changed?

Silver, like gold, has traditionally acted as an excellent store of value. But it trades with higher volatility than gold. Returns are magnified on the way up and the way down.

So silver has historically been a favorite of investors looking for a store-of-value with more “juice” than gold.

Today much of silver’s thunder has been stolen by cryptocurrencies. Many people looking to speculate on monetary assets today prefer to buy Bitcoin or alternative crypto coins.

In 2011, Bitcoin was a tiny asset most people had never heard of. Silver was still the prime choice for those looking for an inflation hedge with more upside.

My theory is that crypto has essentially suppressed the price of silver. But that’s a good thing if you’re looking to buy. Because I still believe silver has a long way to run.

The Economic Setup

We are entering an extremely disruptive period in history. Even with Trump’s impressive reforms, inflation is almost certain to return, as are QE and stimulus checks.

The debt burden has gotten too large. Shrinking it will require a sacrifice of one kind or another.

We could dramatically raise taxes to start paying it off. But that’s clearly not going to happen (under Trump, at least). It would absolutely crush the economy.

Alternatively, we could let inflation run hot for a while. It could look something like this:

- Monetize the debt (print money to pay off debt and deficit)

- QE + cut interest rates

- Lower taxes to boost the economy

- Cut government spending significantly

- Stimulus checks as needed

Regarding stimulus checks, some of you may be skeptical. But Trump wasn’t shy with issuing $1,800 worth of checks to qualifying adults in 2020. And let’s not forget about the $800 billion Paycheck Protection Program (PPP).

If the American public needs some help meeting basic needs, I don’t think Trump will shy away from stimulus. And I expect we’ll be at that point soon.

Yes, stimulus would also fuel inflation. But remember, in a strange way inflation may be our path out of this mess. Inflation can be a tool to lower real debt loads (as inflation rises, the debt becomes smaller in real terms).

This path would be painful, but there really aren’t any good options to choose from. Silver would be an ideal asset to own in such an environment.

Silver to $100 by 2028

Silver still has time to shine. It’s a tiny market compared to gold, bonds, or stocks. So it will only take a modest amount of additional investment demand to send it soaring higher.

As we have covered extensively, industrial demand (primarily solar) is what’s currently driving silver prices higher. Add in a lot more investment demand, and we’ll see fireworks.

Silver is one of my favorite ways to hedge against the coming economic reset.

Comments: