Hockey Stick Profits

It’s a trader’s market.

While the major averages chop along, the frothiest stocks in the hottest industries continue to defy gravity and soar to incredible gains.

Many of the bubblier themes that exploded higher following the election have consolidated their gains in an orderly fashion. Some are even extending much higher as new money flows into the strongest themes.

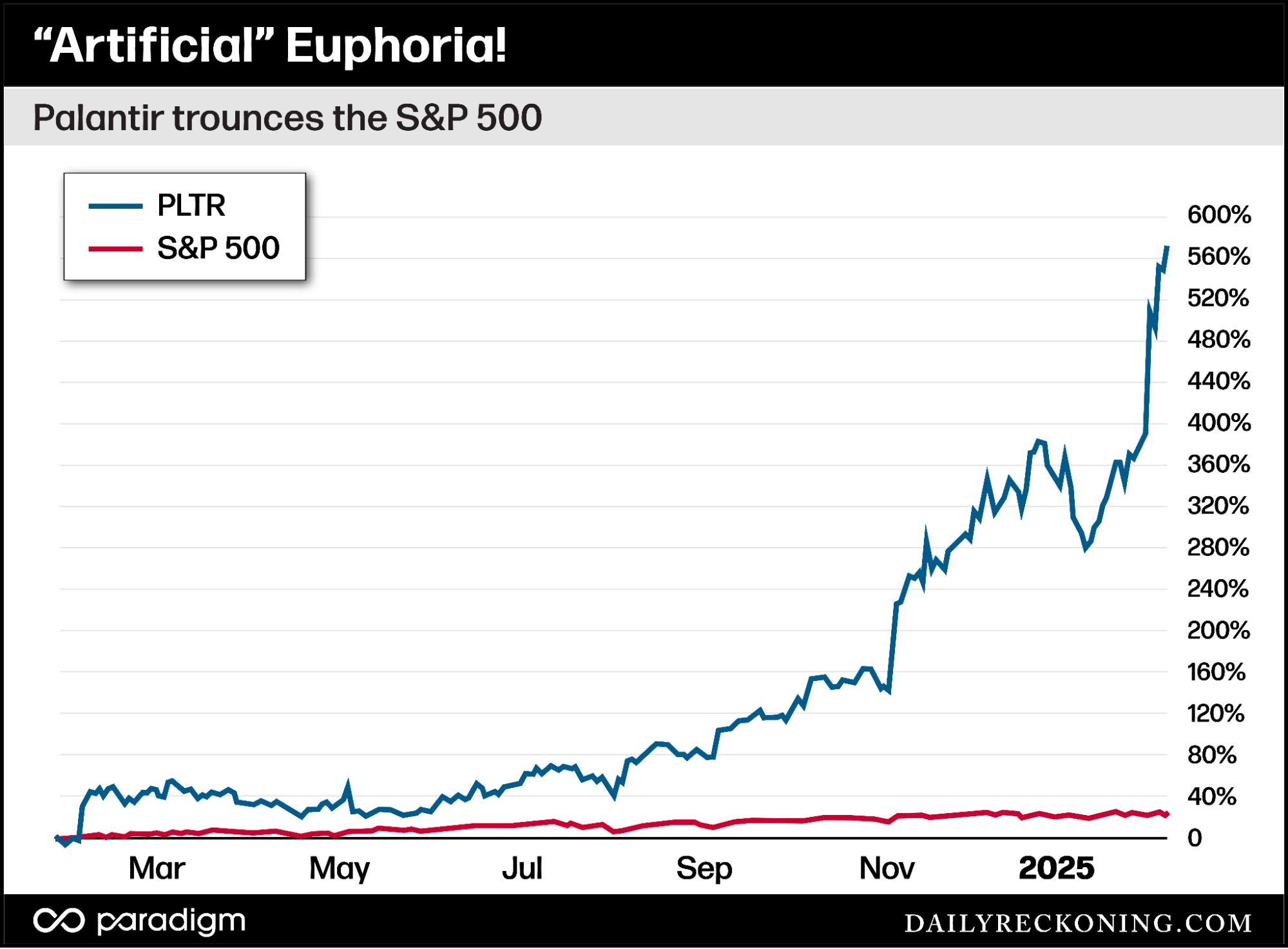

While the S&P 500 has clocked a modest 2.75% year-to-date gain, we’re witnessing tremendous gains piling up in the best speculative industries, from alternative energy and artificial intelligence to space rockets and flying cars. The fast gains are capturing speculators’ imaginations.

They just can’t seem to help themselves…

Impressive short-term returns and reckless trading behavior go hand in hand. And no, these traders are not limiting their focus to the forty growth names. They’re diving headfirst into any stock (large or small) that’s making waves, eagerly chasing every momentum move.

Right now, we’re seeing a record-setting surge in retail trading, according to a JP Morgan report via MarketWatch.

“Retail traders bought $3.2 billion in shares of individual stocks on a net basis earlier on Tuesday,” the report states, noting a short list of mega-cap stocks making up a whopping 70% of the trading activity.

The so-called “dumb money” has fallen in love with the high-flying winners, while unceremoniously dumping any name that fails to perform. Just look at Palantir Technologies Inc. (PLTR) and its 25% overnight earnings rally. And let’s not forget Meta Platforms Inc. (META), which just logged a 16-trading day win streak.

Action like this can sometimes make investors nervous. As we discussed last week, market moods are shifting at warp speed these days. News stories come out of nowhere and rattle the markets — then disappear even faster. And depending on which area of the market has commanded your focus, stocks are going everywhere and nowhere at the same time.

For the casual market watcher, all these distractions can be a bit overwhelming. And too much worry can lead to decision paralysis. Sometimes, it’s more daunting to watch a beloved stock skyrocket, especially when the rally stretches higher without any attempt to consolidate or blow off steam.

Tracking AI Euphoria

Here’s an important question every investor should consider:

What should I do when a popular stock goes parabolic?

Today, I’m going to focus on PLTR and its aforementioned 25% earnings rally as a real-world, real-time example of what happens when a hot stock starts to defy gravity.

First, the setup:

PLTR is an intelligence/AI/software mega-play that has been marching higher for the better part of the past 12 months. Most investors can’t seem to articulate exactly what the company does or how it does it, but that hasn’t stopped the herd from running with the bulls.

It finished 2024 with a gain of nearly 350%, thanks mostly to a fourth-quarter surge that has carried over to the new calendar year. Investors were then treated to an incredible 25% earnings gap last week after PLTR dropped strong numbers and guidance.

The one-day move was a marvel to behold. Here we have a stock that had already doubled since its previous earnings report, only to once again appease the animal spirits and leap to new highs.

But it wasn’t done yet! Instead of attempting to fill its earnings gap (or even rest, for that matter), PLTR has continued to rise double-digits since last week’s earnings report, closing at another round of all-time highs Monday afternoon.

PLTR shares are now up more than 50% year-to-date, and more than 360% year-over-year, easily cementing it as one of the most popular stocks on the market today.

PLTR’s abrupt move that began in January is what folks in the charting world call a hockey stick – a parabolic rally wherein a stock shoots higher in a nearly vertical ascent, forming the namesake shape.

Obviously, PLTR is overbought following its latest earnings rally. In fact, the stock has reached overbought levels many times over the past several months, so this fact alone isn’t enough to trigger a sell.

But the sheer speed of the rally should give you pause. That’s the thing about parabolic rallies – they don’t correct sideways. When you have a stock that’s ripping higher every single day, it will eventually need to reset at lower prices.

Managing Market Froth

PLTR’s rally has my full attention. It hasn’t set off any alarm bells just yet. But these incredible rallies in the market’s most popular stocks make me think it’s getting a little too frothy out there.

I’m not interested in arguing about valuations or the validity of the artificial intelligence boom. Neither of these topics has much to do with the timing of market turning points. PLTR is expensive by any metric. But it was expensive coming into the year before this latest rally, too. AI has its evangelists and naysayers – and the narrative will evolve no matter what happens to this one specific stock.

Yet from a purely tactical perspective, it’s difficult to imagine a situation where PLTR doubles again before experiencing some sort of dramatic pullback. If I were involved with this stock, I would do everything in my power to convince myself to take at least partial profits. And if I were stalking this name, I would not want to start a new position at these levels.

I’m also interested to see how parabolic moves in popular stocks like PLTR affect the market over the next several weeks. While I’m not officially worried about a broad market drawdown just yet, I am keeping my antennae up for any signs of exhaustion.

Would a momentum reset in PLTR lead to a bigger market correction? Will we finally see that elusive 10% pullback investors have avoided for the past 16 months?

These are the questions you should keep in mind as these popular momentum stocks gap higher and run nearly every single day.

Right now, the averages are challenging all-time highs and investors are being rewarded for buying the dips.

Eventually, the hockey sticks will break.

Will you be ready?

Comments: