Bitcoin Bros Never Learn

I was mindlessly scrolling on my phone waiting for my turn at the barber shop when the kid started talking about crypto.

I popped my head up from my screen and the barber and I exchanged annoyed glances. Like most old-school barber shops, this was a safe space for old men to complain about taxes and enjoy politically incorrect conversations without fear of cancellation. It was not a place to speak enthusiastically about pretend money.

But the young lad didn’t seem to care. He went on to explain he just graduated college and was in the process of moving out of his apartment to head to California, where he was going to work at a crypto startup.

Now, this particular barber was an old-school, motorcycle riding rock-and-roller who kept a loaded .38 by his beard trimmer and liked to collect silver coins. But he was polite enough to tell the kid he didn’t know jack about crypto, brushed off his neck, and wished him luck with his cross-country move. No one else in the shop said a word.

It’s important to note this event took place well before Bitcoin’s first full-fledged rocketship ride to $18,000 in 2017. But Bitcoin was gaining traction. And normal folks (including a few old men who sit around in barber shops) were vaguely aware of its existence.

But by my calculations, this occurred almost ten years ago. At the time, there was no reason to view crypto as a viable career path, trading vehicle, or money-maker in any capacity. Which is why the young crypto scholar received nothing but cockeyed stares when he revealed his master plan.

All the Wrong Moves

I still think about this encounter whenever something “big” happens in the crypto space.

I wonder if he hit it rich, bought a Lamborghini, and lived the high life of a young mogul during the post-Covid crypto bubble…

I wonder if his crypto startup ever got off the ground and cashed in on the alt-coin boom…

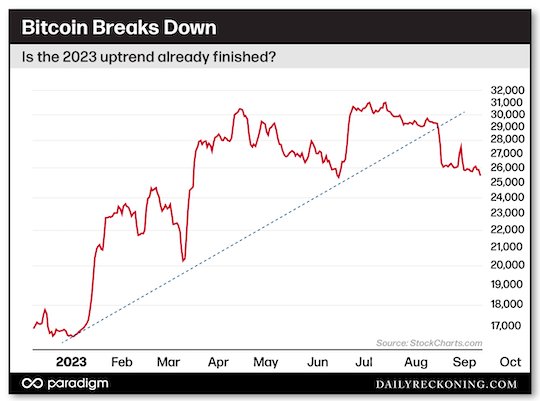

And as Bitcoin knifes below support at $25K early this week, I wonder if the barber shop crypto savant ever had a moment of clarity and took some profits off the table during the boom times.

As much as I hope he cashed out and rode off into the sunset with a few suitcases of US Dollars, a more realistic prediction is that he crashed and burned alongside so many other crypto believers.

I wish this wasn’t true. But I’ve spent my entire career studying the bizarre habits of the investing masses. While I’ve encountered some smart (or lucky) folks who were able to break the spell and take profits near the top, most of us possess an inescapable urge to double-down or hold tight when the charts go parabolic.

I suspect our young, inexperienced crypto bro did the same. After all, he had only known a world where the line goes up. Buy the dip! Any dip! It will always snap back!

This strategy can lead to spectacular results in roaring bull markets. That’s why savvy fund managers love to lean on young, inexperienced traders during frothy markets. Older traders who’ve lived through a crash or two can hardly ever rake in the wildest gains due to their annoying reliance on risk management.

But don’t worry — these grizzled vets are much better suited for today’s environment.

Meanwhile, the young guns who survived last year’s bust are hopefully learning some valuable lessons.

Crypto Reset vs. “Echo Boom”

Back in February, we discussed the 2022 post-boom cleanse in crypto.

Bitcoin was in the earlier stages of its rally off the November lows below $16,000, and had gained more than 40% thanks in part to the January tech-growth snapback. At the time, I asked if the previous year’s drawdown was enough pain to effectively reset the market and help launch a new rally.

“My main concern with this crypto rally is that it’s happened too soon,” I wrote. “Yes, we’ve witnessed bankruptcies and scandals throughout the crypto world. The NFT market completely collapsed. The worst of the froth has evaporated. But was it enough?”

In March, the market decided it was enough when Bitcoin broke above my line in the sand at $25,000. For reference, this is an important pivot as it also marks the relief rally highs from summer 2022.

Six months later, we’re right back where we started. Yes, Bitcoin broke above $25K and rallied above $30K into the summer. But it failed to extend higher, and the rally is now losing stream.

More importantly, Bitcoin price action has been uncharacteristically tame lately. Huge price swings and weekend volatility used to be crypto hallmarks. Now, Bitcoin barely budges. The most excitement we’ve enjoyed recently came after the Grayscale ruling snapped the coins out of their funk — but only for a hot second. The fact that Bitcoin and Ethereum posted big rallies on the news, then immediately gave back the gains speaks volumes.

It’s beginning to feel like this year’s rally is turning into an echo boom — a temporary pop form a formerly hot asset that fails to kickstart a move to new highs.

I’m also starting to see signs of some other Covid-era trends that are quietly dying off. We’ll talk more about these ideas next week.

What do you think? Am I right about Bitcoin? Is this the end of the boom? Or just another long crypto winter we must endure before the inevitable march higher? Let me know here.

Comments: