A Stagflation Survival Guide

Stagflation is a grim economic diagnosis. High inflation, stagnant growth, and elevated unemployment.

The United States from 1972-1982 is the textbook case. Inflation raged as high as 14%, real economic growth was practically non-existent, and unemployment reached 9.7%.

Now the threat of stagflation once again looms large. Inflation is set for a comeback, growth is slowing, and widespread layoffs have begun.

Today we’ll explore how to survive and even thrive during what will likely be a sustained period of stagflation.

The Right Investments

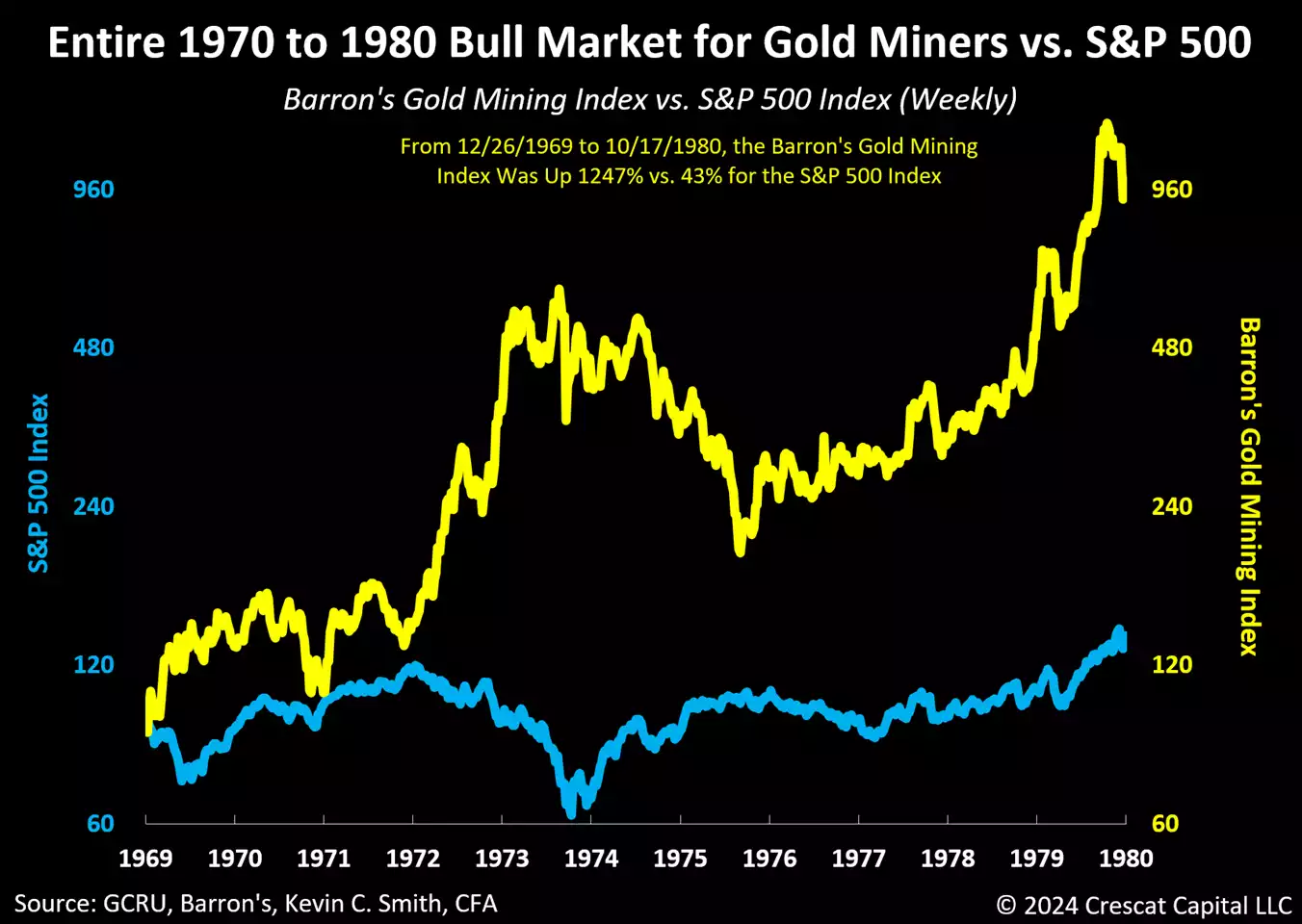

During the 1970s, the S&P 500 rose just 43%. But once you factor in inflation, investors actually lost money in real terms.

Meanwhile the 70s was a golden era for precious metal investors. Gold started the decade priced at $35/oz and rose to a peak of near $850/oz. That’s a 24x return in a decade. It absolutely trounced inflation.

Meanwhile silver went from a low of around $1.60/oz to a peak of near $50. That’s a ridiculous 33x maximum possible return. Even if you don’t get in at the lowest prices, you can still do extremely well on precious metal investments during inflationary periods.

Below is a chart showing how the Barron’s Gold Mining Index performed versus the S&P 500 during the 1970s stagflation.

Source: Crescat Capital

George Soros and Jim Rogers made their initial fortunes by betting on gold, silver, miners, and commodities during the 1970s.

During stagflationary periods, precious metals simply can’t be beat. If we’re headed into one now, owning a healthy portion of your portfolio in gold and silver will be critical.

The rapidly rising price of gold is trying to tell us something. And the message seems to be that we’re headed for hard times and high inflation.

Belt Tightening Time

During stagflation, unemployment spikes. Companies conduct layoffs. Living costs rise and wages don’t tend to keep up.

If you haven’t already begun to reduce spending, now is the time. Even if you’re doing well today, it never hurts to cut expenses. We don’t know how bad things could get over the coming years.

If your rent or mortgage is too high, get out of it if possible. If your housing costs more than 30% of your net income, that’s probably too high. Only spend what you can afford on rent or mortgage. If that means living in a mobile home, there’s absolutely no shame in that.

See what recurring monthly expenses you can eliminate. Shop around for a cheaper phone plan. Hang onto your old phone for a bit longer than you normally would.

See if you can find a better deal on car and home insurance. If you have cable, see if calling your company and threatening to cancel will get you a discount.

Cook at home. Shop at bulk discount stores like Costco or Sam’s Club, where a membership quickly pays for itself.

Additionally, make sure you’re getting a decent yield on your savings account. If you’re still at one of the big banks offering a pitifully small yield, now is the time to switch to an FDIC-insured bank that actually cares about its customers and pays a fair yield. If you’re earning 0% on your savings, you are essentially losing 4-5% annually due to the high costs of inflation.

By taking these steps, we can prepare for the uncertainty to come.

Comments: