The Great Gold Bust of 1976

Today many investors view the 1970s as one epic bull market for precious metals.

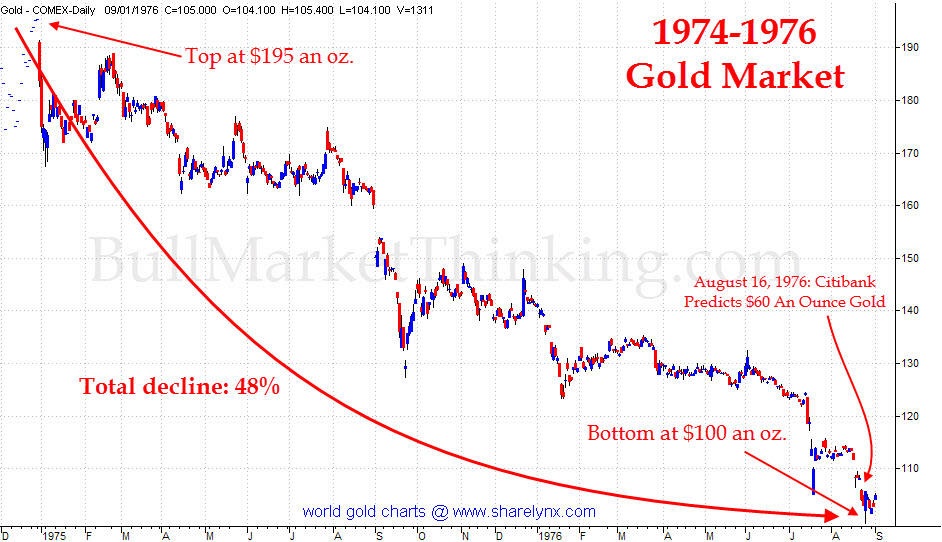

But in reality it was two separate bull markets separated by a 2-year bear market.

From 1971 to 1974, gold rose from $35/oz to $195/oz.

Then, from December 1974 to late 1976, it fell 48% to around $100/oz.

Source: Sharelynx

Those of you who have studied gold during the 1970s know that after this selloff to $100/oz, gold went on to rally to over $850/oz by 1980.

How many people managed to trade this rollercoaster perfectly? Few. I would guess that most of the people who profited from the entire 1970s move either held strong throughout, or consistently took profits while buying the dips.

Almost nobody traded it perfectly. But with such large gains, even selling within 30% of the top is just fine. And the gains in select gold miners were even larger than the underlying metal.

I don’t think we’ll get a 48% drop in gold like we did in the mid-1970s. Governments and central banks were major sellers back then, and today they’re buyers. We’re simply reviewing this period to reinforce that even in long bullish periods, there will be selloffs.

Today, let’s look back at what caused the mid-1970s bear market in gold.

Reason #792 to Ignore Mainstream Media

Let’s start with an article from Time Magazine dated August 2nd, 1976. It was titled “The Great Gold Bust”. As a reminder, this is just after gold fell from $200/oz to $120.

Let’s look at an excerpt:

“What has taken the glitter off gold so suddenly? One major factor is that the U.S. has been relatively successful in its campaign to remove gold from the international monetary system. Last year the U.S. persuaded other countries, including a reluctant France, that the International Monetary Fund should auction off one-sixth of its gold hoard, or 25 million ounces.”

The United States, as the world’s economic, military, and monetary leader, led the charge to de-monetize gold. And our decision to break from the gold standard set off a chain reaction around the world.

As a result, the IMF, governments, and central banks reduced their gold reserves by selling into the open market.

Let’s look at one more interesting section from the 1976 Time article:

“Meanwhile, the economic conditions that triggered the gold boom of 1973-74 have largely disappeared. The dollar is steady, world inflation rates have come down and the general panic set off by the oil crisis has abated. All those trends reduce the distrust of paper money that moves many speculators to put their funds in gold.”

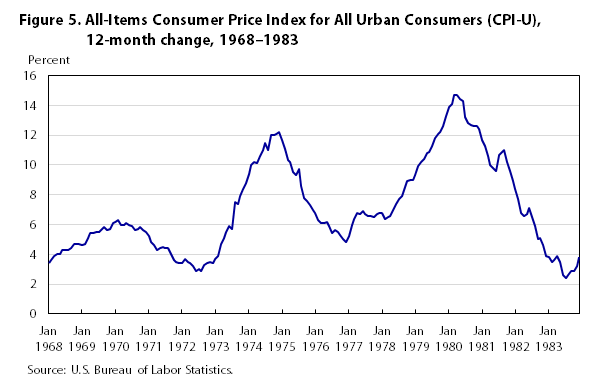

Now this is fascinating. By 1976, the crisis seemed to have passed. Inflation had cooled off, and the dollar had steadied.

This article in Time, and similar pieces in mainstream media, undoubtedly scared many gold investors out of their positions at the worst time.

Another wave of inflation was coming. They just didn’t know it yet. See the chart below, which shows the 3 waves of inflation during that period.

Notice how each wave was progressively larger. This is ultimately what drove gold from around $35 in 1970 to over $850 in 1980.

Takeaways

The 1970s was a unique period. A time when the world abandoned hard money and switched to paper currency.

During the 1970s the U.S. dollar lost about 75% of its purchasing power. And debt wasn’t even the primary concern. Here in the U.S., debt-to-GDP was only in the 35% range throughout the 1970s. It’s well over 120% today.

Today debt and deficits are front and center. Simultaneously, trade and currency wars are raging.

This is why central banks and investors are seeking refuge in precious metals.

While I don’t expect a 48% drop in gold like we saw during the mid ‘70s, we can’t expect it to be a straight line up.

Corrections like the one we’re currently experiencing are to be expected.

But the fundamental forces driving this bull market aren’t going away. So those with patience should sit tight. That’s what I’m doing.

I may trim some positions later this year, but will continue to hold an oversized allocation to gold, silver, and miners for years to come. This is my portfolio insurance, and I don’t plan to abandon that until global debt and deficit are reigned in. And that’s not going to happen anytime soon.

There will be a recession sometime in the next few years, and when it hits, deficits will reach unprecedented levels. Spending will soar, tax revenue will plummet, and stimulus checks will flow.

Vast sums of money will be printed, and the rush into precious metals will be one for the record books. What we’ve seen so far is just a warm-up.

In 1976, those who sold gold may have gotten out with a significant profit. But they missed the 8x gain to come.

The ‘70s era bull market only ended when Fed Chairman Paul Volcker jacked interest rates up to around 20% in 1980.

Before then, the Fed and U.S. government had tried to get by with half measures. That’s what we’re seeing today. Half measures, at best.

Until governments around the world get serious about solving their debt problems, gold and silver should trend higher.

Comments: