Phony Growth From Higher Debt

“For me, apart from the Federal Reserve still cranking the QE handle to the tune of $85 billion per month, having more than tripled base money over the past five years, the most worrying concern is debt issuance.” wrote Liam Halligan for The Telegraph on Saturday.

“For it’s pretty clear, if you’re willing to look,” he continued “that this recent U.S. recovery derives not from more economic activity but from the issuance of sovereign debt.”

Our eye couldn’t help but be drawn to the headline “Lack of Genuine Reform Is Sowing Seeds of Next Crisis.”

We agree with Mr. Halligan’s take, but offer a slight tweak — both QE and debt issuance are two heads of the same hydra — not separate creatures.

Despite Mr. Bernanke’s best wishes, the Fed doesn’t drop money from a helicopter. QE is debt financing for the federal government.

“Consider the data.” instructs Halligan. “America’s nominal GDP grew $140 billion during the first three months of 2013. Over the same period, the U.S. Treasury issued $340 billion of new debt. Had that not happened, America’s national income would have shrunk $200 billion over the first quarter.

“It was the same story between October and December last year, to an even greater extent. American GDP increased by around $50 billion during the final quarter of 2012, while the Treasury issued $370 billion of new debt. In seven of the past eight quarters, in fact, the rate at which the U.S. government has churned out IOUs, receiving money in return that’s then immediately spent, so feeding directly into nominal GDP, has exceeded the rise in nominal GDP for the economy as a whole.

“For most of the past two years, then, and the whole of the past six months, American ‘growth’ has depended on higher national debt. Without it, the U.S. economy would still be shrinking.”

Heh. We covered the phony number game Uncle Sam plays with the nation’s income accounting. GDP stats aren’t worth the reams of paper they’re printed on — unless you’re a politician, perhaps.

Recall what we wrote in The Demise of the Dollar:

“In 2007, the famous refrain in the poem by Emma Lazarus describing the flood of foreigners streaming to U.S. shores needs to be updated to ‘Give me your tired, your rich, your huddled masses yearning to shop free.’ Seven out of every $10 that fuels our gross domestic product (GDP), the measure of a nation’s productivity and, hence, security, comes — not from goods and services that we produce and sell — but from shopping. We’re addicted to cheap credit.

“Alan Greenspan, the longtime chairman of the Federal Reserve, set us on this runaway course, and Ben Bernanke, the new chairman since February 2006, is steadily following in his footsteps. In late October, he voted with the rest of Federal Open Market Committee (FOMC), the Fed’s policymaking arm, to cut interest rates for the third month in a row this year. He is not the ‘un-Greenspan,’ as the financial press called him early in his tenure; he is the reincarnation of Mr. Irrational Exuberance himself, and he’s pushing the same old monetary policy.”

The problem of debt through cheaper credit hasn’t disappeared; it’s grown faster.

Each round of QE has purchased larger amounts of securities than the previous one. They went a step further now and made it open-ended — “QEfinity” as it’s affectionately called.

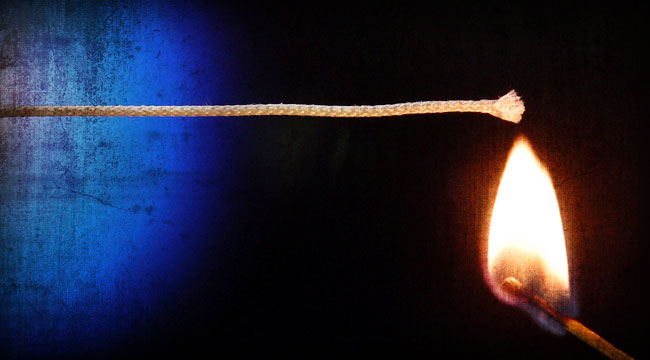

Debt as a percentage of GDP grows as cheap credit flows. Take a look:

You would think this news would be great for gold. Yet gold sits at $1,396 as we go to press. What gives?

“Gold was up 12 years in a row without a down year,” our good friend Jim Rogers explained to Lauren Lyster on Yahoo’s Daily Ticker.

“That’s extremely unusual. The unusual thing about the gold market is how strong it had been and that it hadn’t had a correction. Now it’s having a correction, long overdue, I hope a proper correction. And if it goes down, I hope I’m smart enough to buy more.”

Heh. We don’t think that will be a problem for him.

Regards,

Addison Wiggin

for The Daily Reckoning

[Ed. Note: The timing of today’s essay couldn’t be better. Over the past few weeks, we’ve been telling you about our new online seminar featuring precious metals experts Jim Rogers, from above, and Ed D’Agostino from the Hard Assets Alliance. Today, we finally unveil it to you. It’s called Countdown to the Zero Hour, and it’s airing on June 11, 2013 at 11 a.m. EDT.

Both Jim and Ed will discuss the enormous impact the Zero Hour will have on your savings, investments and even your routine transactions. The entire event is completely free to you provided you act now. As an added bonus, the Hard Assets Alliance has promised participants six months of free bullion storage — that’s a much better deal than our usual arrangement. Simply click here to register now!

And if you haven’t signed up for the Daily Reckoning email edition… what are you waiting for? It only takes a minute and it is completely free. Click here now to sign up today.]

Comments: