You Are Here ⇒ [Chart]

I’ve got one teenager with an active driver’s license and two teenagers in the “learning stage.”

Sometimes I think I’m going to lose my sanity!

The other day I was trying to give my son directions and I mentioned a major intersection near our house. It turned out, he didn’t even know the names of the streets!

It’s not because he’s a bad driver. Quite the contrary! He’s made it well past his 18th birthday without a single fender bender (knock on wood).

But when it comes to directions, my kids can be clueless at times. That’s because they’re never more than two taps away from pulling up the maps app on their phone. And from there, they can see exactly where their car is and exactly how to get where they are going!

Too bad there’s not an “Apple Maps” for the market…

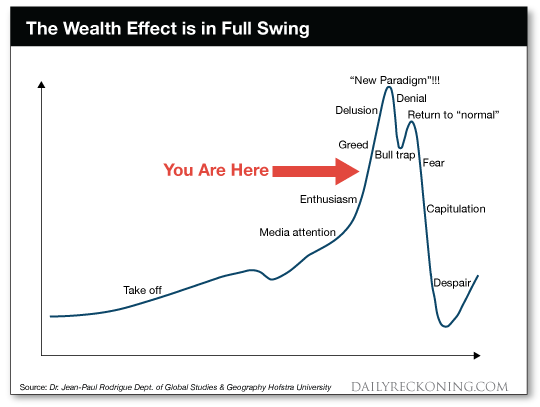

Still, experienced traders who understand market dynamics can get a good idea of where we are — just by looking at a market cycle chart.

Let’s take a look at where we are in the market as 2018 kicks off…

The Current Market Wealth Effect

To understand where we are in the market, it’s helpful to look at what is currently driving stocks higher.

Today, we’re in the midst of what I call the “wealth effect.” This wealth effect is a powerful force that is driving not just the U.S. stock market, but the entire U.S. economy!

Investors, (and consumers, workers and citizens in general) are feeling more and more “wealthy” this year. The data is showing up in consumer confidence surveys, as well as in the way investors are allocating their capital.

Did you know that the brokerage Charles Schwab recently recorded the lowest portion of cash balances in customers’ accounts ever?1 Investors are putting more of their capital to work in the markets because they’re confident that stock prices are rising.

This scenario has a self-reinforcing tendency because the more people believe in the market, the more they invest. And the more they invest, the higher the market goes.

On top of strong market trends, we also have a very healthy housing market. We’ve talked about this a lot here at The Daily Edge. But suffice it to say there are plenty of potential buyers for new homes, and not enough inventory to sell to them.

Naturally, home prices are moving higher because of the supply / demand imbalance. And as home prices rise, homeowners are seeing the value of their “investment” increase. Today, most homeowners have the ability to pull cash out of their homes in the form of a home equity loan.

Whether they choose to do this or not is immaterial. Consumers will spend money more aggressively if they know that they have more wealth available because of higher home prices.

And then you have a strong jobs market. Employment continues to expand and companies are currently complaining about having a hard time finding qualified workers. This is a great market for anyone looking for a job or interested in moving into a better job.

Add it all up and the wealth effect is in full force.

- The market is trading higher, inspiring confidence

- Home prices drive spending, leading to corporate profits

- Profitable corporations are hiring workers who spend money and invest in stocks.

So even though the stock market has been moving higher for quite some time now, the wealth effect means there’s still plenty of ammunition to keep it moving forward!

You Are Here ⇒

That brings me to today’s market map.

You’ve probably seen a chart similar to the one below. It shows how markets typically move steadily higher until optimism reaches an extreme point.

As I look at the market today, I definitely see signs of optimism and strength. Some investors are buying stocks at high valuations simply because they expect even better things in the months to come.

That’s optimistic.

But we’re not yet at the “greed” or “new paradigm” stage yet.

How do I know?

Because I don’t see the same excesses that typically accompany a major market top. There hasn’t been a widespread movement to quit jobs and start day trading from home. Everyone I talk to is still wondering about what risks lie ahead. So while investors are hopeful, they’re certainly not euphoric (yet).

Another thing to keep in mind is that the recent corporate tax cut will dramatically increase companies’ profits. And as profits move higher, it helps to better justify the higher stock prices. It may be several quarters (or even a few years) before we see a large-scale pullback in the markets.

Now, I don’t want you to think that I’m turning a blind eye to the risks.

We certainly need to be vigilant, and helping you protect your capital is one of my most important jobs.

I don’t recommend buying expensive shares of inflated stocks like Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Alphabet (GOOG).

But as long as you’re making wise investments in solid companies with legitimate earnings, the wealth effect should help you continue to accumulate profits as we begin this new year.

Here’s to growing and protecting your wealth!

Zach Scheidt

Editor, The Daily Edge

Twitter ❘ Facebook ❘ Email

![You Are Here ⇒ [Chart]](https://dweaay7e22a7h.cloudfront.net/wp-content_3/uploads/2018/01/chart-650x360.jpg)

Comments: