Will Rate Cuts Herald a Crash (Again)?

Since the Fed’s larger-than-expected rate cut on Sept. 18, both the S&P 500 and the Dow Jones reached new all-time highs.

Investor reactions seem almost Pavlovian. Lower rates = higher stock prices.

But why do many believe this? And is it even true?

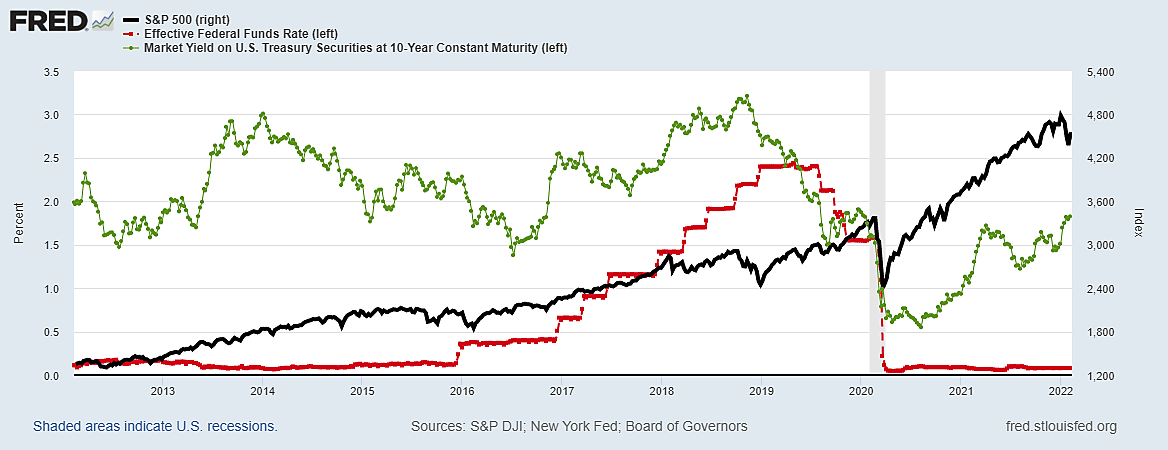

Let’s take a look at the Fed’s drastic actions in 2019 and 2020, and explore the effects they had on markets.

Pre-COVID, the Fed began cutting rates in 2019, and by the end of that year, the fed funds rate was down to 1.5%. Then the pandemic hit, markets crashed, rates were slashed to near zero and trillions of dollars were pumped into the economy.

Stocks eventually soared to fresh all-time highs, but it’s important to realize that before and during the crash, the Fed was actively cutting rates.

In the chart below, the fed funds rate is red and the S&P 500 is black…

Source: Cato Institute

Of course, in 2020 we had the pandemic, so let’s discount that one.

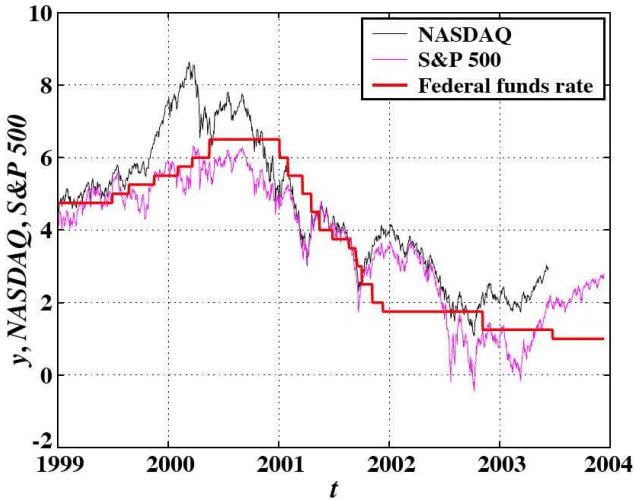

Unfortunately, we saw the same thing in 2001, as that bubble collapsed. Alan Greenspan’s Fed attempted another stick-save. They slashed rates from over 6% down to 1%, but it wasn’t enough to turn things around.

As you can see in the chart below, stocks cratered along with interest rates and didn’t bottom out until late 2002.

During that cycle, the first rate cut was on January 3, 2001. The S&P 500 bottomed out 448 days later, down 39%. The Nasdaq performed even worse.

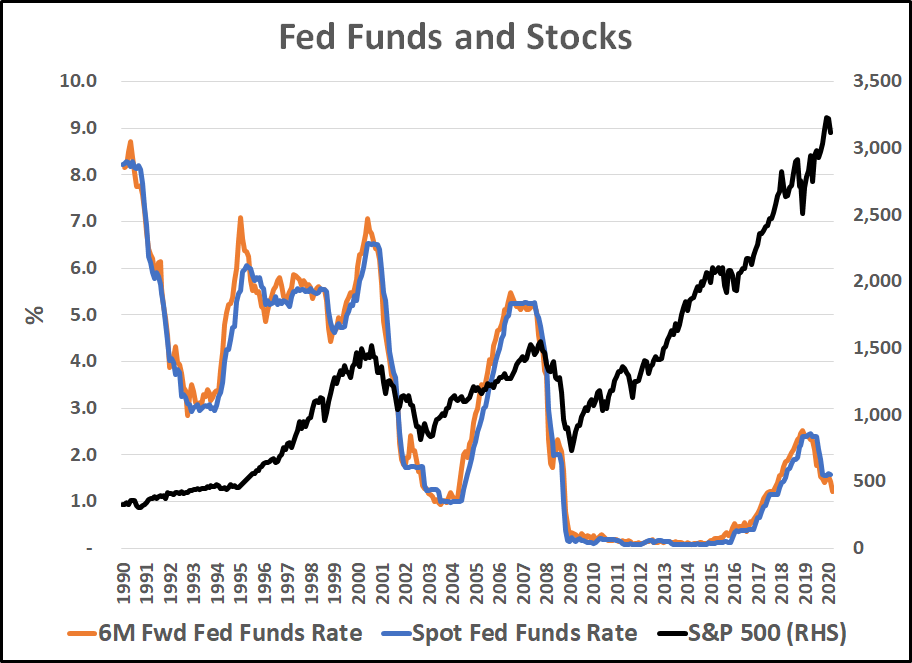

The pattern repeated in 2008 as the Global Financial Crisis unfolded. The Fed again slashed rates starting in September of that year, only to see markets slump. The S&P 500 bottomed out 372 days later at -54%.

Accordingly, rate cuts can be quite bearish over the near term. It’s often a sign that the economy is in trouble and policymakers are worried sick.

So why do some people believe that lower rates are bullish?

I suspect it’s simply due to the fact that rates were near 0% for much of recent history, which saw one of the longest and best-performing stock bull markets in history. But during the actual crashes, rates were usually moving sharply downward.

Of course, this isn’t to say that rate cuts always happen alongside market crashes.

In 1980, for instance, the S&P 500 rose 30% in the year following the first rate cut. In 1998 the Fed cut rates three times and the S&P 500 ripped 27% higher over the next 12 months (the good times didn’t last long though). In 1987 and 1995 we also saw positive market reactions after the first Fed rate cuts.

My point here is that when the Fed cuts, they’re trying to get ahead of something. Or, more cynically, to keep the party going.

Here are a few of the issues that might be top of mind for the FOMC today:

- Soaring interest costs on US debt

- Weak employment numbers

- Increased stock market volatility

- Bank instability

- Potential wars

Entering The Fed’s ‘Lag Period’

Indeed, rate cuts can have a powerful stimulative effect on markets. But there is a significant delay involved. It takes time for liquidity to work through the system, lever up and deploy.

This period of “Fed lag” — which we just entered — can be a hazardous time. Sometimes the selling gets out of control as our baser instincts take over.

The question is: Did the Fed act in time to preserve the bull market? Or did they wait too long?

Well, they certainly started off with a bang with a “double cut”. And they didn’t wait for inflation to get to their 2% target. So maybe they did act in time.

But if the Fed waited too long, or simply can’t contain momentum, we could see a major correction in high-flying stocks such as NVIDIA, which currently trades at a rather silly 29x revenue.

Our own Jim Rickards warns that certain stocks could fall 50% or more in the coming volatility. With the Fed now officially in “rescue” mode, the clock is ticking on the possibility of a severe correction.

There’s certainly a good chance nothing happens for a while. The market seems relatively calm and complacent, having just reached new highs. But history shows things could go the other way.

That type of situation is concerning, but it also tends to bring a wealth of opportunities. And that nexus is precisely Jim Rickards’ area of expertise.

Comments: