Why You Should Save in Hard Money

In 1964, U.S. minimum wage was $1.25 an hour.

That’s 5 quarters, which at the time were made of 90% silver. There was 0.18 oz of silver in each coin.

With silver priced at $44/oz today, the melt value of those 5 silver quarters is now $39.

So minimum wage in 1964 was equivalent to $39 an hour today, as priced in silver.

1964 would be the last year that U.S. quarters and dimes contained silver. The half-dollar was reduced from 90% silver to 40% from 1964-1970, but even that became untenable eventually.

One catalyst that led the government to remove silver from coins was that the value of the silver in them started to outpace the face value.

Smart speculators had begun to hoard silver coins, which led to a nationwide shortage of small change.

Silver’s growing use in photography and other industrial uses contributed to the problem.

But the root of the issue was something deeper.

The desire of government to spend untethered by the constraints of hard money.

Prelude to the Nixon Shock

The removal of silver from American coins in 1965 was a preview of what was to come in 1971, when Richard Nixon ended the gold standard.

Due to obscene government spending, these two acts were essentially unavoidable. LBJ’s simultaneous expansion of the welfare state and the Vietnam War essentially sealed the deal. Guns and Butter, indeed.

As long as the gold standard was in place, foreign central banks could redeem gold for $35/oz. America’s gold reserves were being drained. It was unsustainable.

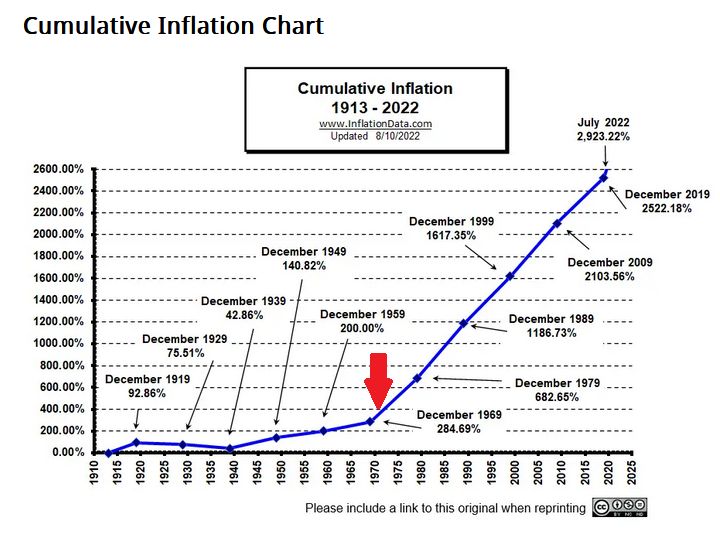

The result can be seen in the chart below, which shows cumulative inflation from 1913-2022.

Source: InflationData.com

The red arrow points to 1971, when the dollar’s last official tie to gold was severed.

But as you can see, even before ‘71, inflation picked up with every major war. WW1, WW2, Korea, and Vietnam. The massive spending and borrowing required increased the money supply, and hence inflation.

The end of the gold standard, and silver coinage, was the result of many decades of overspending by the federal government.

Once the dam broke in 1971, government spending was no longer even partially restrained by precious metal ties. And we can see the result clearly on the chart above.

In the first half of the 20th century in America, inflation was a periodic problem. But starting in the 1960s and culminating in 1971, it became a devastating problem.

The government has attempted to cover up the devastating effects of inflation by cooking the CPI books. We recently laid this out in Is Gold Cooked?

The problem, of course, is that government inflation is a horribly flawed measure of price.

For example, if you look at CPI price data for new cars, the BLS tells us that the price of a new auto has increased about 2x since 1980.

However, the average price of a new car in the U.S. back in 1980 was around $7,600. Today it’s around $48,000, about 6x higher.

But CPI tells us that new car prices have only risen 2x since 1980? How come the actual price is up 6x?

This is a great example of how the BLS cooks the books on inflation data (CPI). They say that because modern cars come with electronic windows, airbags, and more efficient engines, the price is basically irrelevant. You’re getting so much more for your money, that the true price increase shouldn’t matter.

Instituting a Personal Hard Money Standard

There is no quick or easy solution to these problems. Eventually we may return to a gold or silver standard, but if it happens, that’s probably at least a decade off.

And the only way the government would be desperate enough to re-institute a gold standard would be to instill confidence following hyperinflation, or something close to it.

For now, the best we can do is create a personal gold/silver standard.

In other words, instead of saving only in fiat money, save in gold and/or silver. Physical bullion is a great option, but if you’re looking for something more liquid with no transaction costs, Sprott’s Physical Gold (PHYS) and Silver (PSLV) ETFs are good options too.

Personally, I think it’s perfectly fine to have up to a 25% allocation in gold and silver (including miners) in this environment.

Eventually the time will come to shift some of that precious metals allocation into long-term growth stocks.

But we’re not even close to that point yet. Growth stocks remain ridiculously overpriced, and gold and silver still have at least 5 years to run, by my estimation.

For now, hold onto those precious metal investments tightly. It’s going to be a bumpy, but profitable ride.

Comments: