Why Powell Will Cut in September

Jerome Powell doesn’t like to surprise the markets. That much we know. The man’s a lawyer, not a cowboy. He’s not Volcker puffing cigars and shoving rates into the stratosphere. He’s not Greenspan mumbling gibberish while the markets hang on every syllable. He’s not even Bernanke, that academic deer frozen in the headlights of the 2008 crisis.

No, Powell is more like a risk-averse corporate counsel. He plays it safe. He gives the Street what it expects — and when it doesn’t expect, he finds a way to justify it later.

Well, except last September. Then, he cut rates by 50 basis points for what I could see as no reason at all… other than to goose that spluttering shit-fo-brains Kamala Harris’ polling numbers.

Thank the Good Lord he failed even to do that!

That’s why this September could be the month Powell pulls the trigger on a rate cut, even as stocks are at all-time highs, unemployment is comfortably low, and inflation — while not quite 2% — has cooled enough to lull the public back into complacency.

On the surface, it makes no sense. A rate cut is supposed to be a lifeline to a struggling economy. America doesn’t look like it’s struggling. But if you scratch just a little beneath that shiny surface, you’ll find cracks, fragility, and a political calendar that screams for Powell to take action now.

The “All Clear” Narrative

First, Powell needs a cover story. Lucky for him, he’s got one.

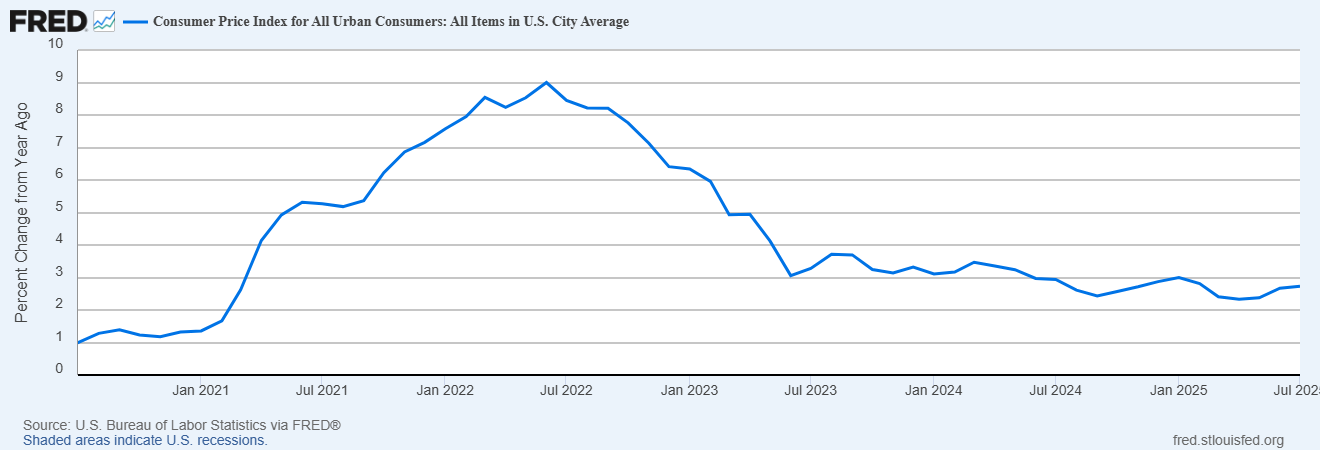

- Inflation: It’s rolled over. CPI isn’t back to the Fed’s mythical – and ECB-suggested – 2%, but at 2.73% it’s low enough for Powell to declare victory. When you’re a central banker, “near enough” is good enough.

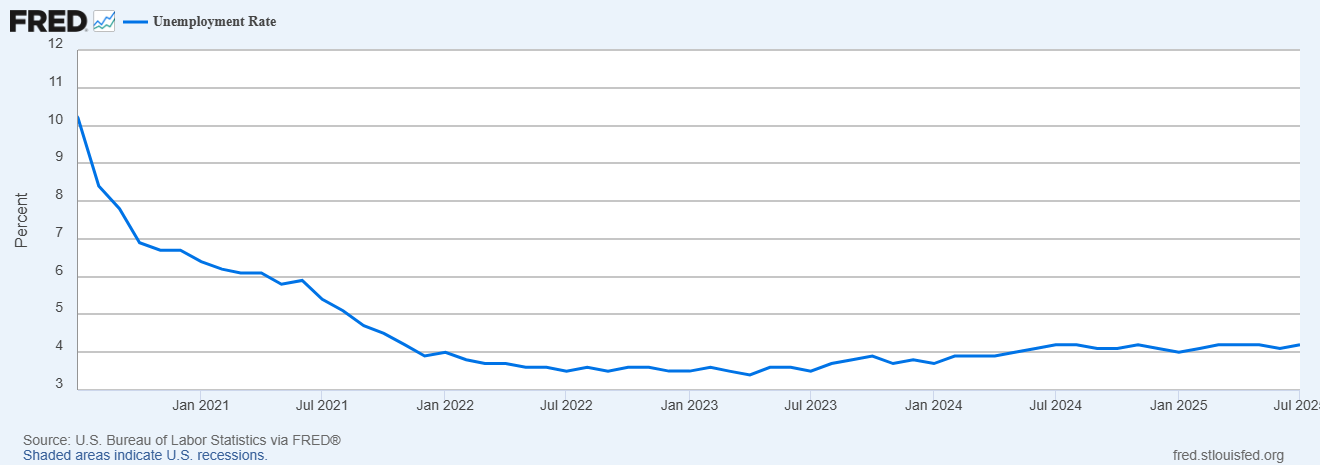

- Jobs: Unemployment is still scraping the bottom of the barrel. Even if some cracks are appearing in the labor market, Powell can still claim the jobs picture is “resilient.” A 4.2% unemployment rate is below what’s commonly accepted as the “natural rate of unemployment” of 5.0%.

- Stocks: At record highs. Nobody can accuse him of panicking into a recession call when the market ticker is glowing green.

Ironically, Powell has the perfect camouflage. He can cut without looking like he’s cutting out of fear. He can say, “We fought inflation, we won, and now we’re balancing growth.”

The Real Reason: Fragility Everywhere

The true drivers aren’t in the headlines. They’re hiding in the plumbing, like a reticulated python waiting for the right moment to pounce and then squeeze.

U.S. companies gorged on free money for more than a decade. They issued mountains of bonds at dirt-cheap yields. But those maturities are coming due. Rolling them over at 5–6% instead of 2% is a slow-motion wreck. Powell knows that one or two big bankruptcies would cascade through credit markets like wildfire.

Remember Silicon Valley Bank and the regional banking panic of 2023? That wasn’t a “one-off.” Banks are still sitting on piles of underwater U.S. Treasuries, thanks to higher-for-longer rates. Keep the screws tight for too long, and another round of failures isn’t just possible — it’s probable, and perhaps even, inevitable.

Other central banks — the ECB, BOE, and even parts of the emerging world — are leaning dovish. If Powell keeps U.S. rates significantly higher than theirs, the dollar strengthens. And a too-strong dollar crushes exports, hammers emerging markets, and makes globally issued USD-denominated debt unpayable. That’s a recipe for financial chaos — and guess who gets blamed for it?

Powell doesn’t want any of those headlines landing in October or November, weeks before America votes (even in a seemingly meaningless set of elections).

The Political Elephant in the Room

Let’s not pretend central bankers live in some monastic world above politics. Powell’s every move is judged through the lens of Washington.

Does he want to be remembered as the guy who wrecked the economy in the first year of DJT’s second administration? Hardly.

Even if Powell doesn’t like Trump, and he doesn’t, Powell doesn’t want the Fed dragged even deeper into the mud-slinging machine. A September cut lets him say:

“We did our job. Inflation’s under control. Now we’re adjusting to support growth.” (And Donald, now you can shut your pie hole.)

That’s an apolitical soundbite Powell can sell to both sides of the aisle.

But don’t be fooled — it’s as political as it gets.

The Powell Put

The Fed has trained Wall Street like Pavlov’s dog. Ring the bell, and the Street salivates for stimulus.

By cutting in September, Powell keeps the “Fed Put” alive. Stocks may be at records now, but everyone knows they won’t stay there forever. By easing policy now, Powell signals to Wall Street: “Don’t worry, we’ve got your back.”

It’s a confidence game. And Wall Street loves confidence games. Liquidity keeps flowing, IPOs keep coming, and credit spreads stay tight.

That’s what the Fed really cares about. Forget Main Street. This is about Wall Street.

Why Wouldn’t He Cut?

That’s the better question. Why wouldn’t Powell cut in September?

- Is inflation too sticky? No, he can fudge the numbers enough to claim progress.

- Is unemployment spiking? No, the labor market is still tight.

- Is the stock market collapsing? Quite the opposite — it’s euphoric.

There’s no cost to cutting now. But there’s an enormous risk in not cutting. Something breaks — corporate debt, banks, global markets — and Powell is the man on the hook.

Cutting buys him insurance in the form of breathing room.

History’s Rhymes

Think back. Greenspan cut rates aggressively in the mid-90s, even as markets were frothy, because he feared “irrational exuberance” might flip into irrational panic. Bernanke slashed to zero after the financial crisis blew up. Yellen tried to normalize but folded at the first sign of market stress.

Powell’s no different. He hiked late, cut late, and followed the herd every step of the way. September won’t be a bold act of leadership. It’ll be yet another example of Powell bowing to pressure and finding a justification after the fact.

Wrap Up

The truth is simple: Powell is Wall Street’s errand boy.

The stock market at an all-time high isn’t a reason not to cut. It’s the perfect cover. He can say the economy is strong, inflation is tamed, and therefore the Fed has “room to adjust.”

Meanwhile, under the hood, the debt bomb ticks, the banks tremble, and the dollar looms over fragile emerging markets. Powell knows it. You know it.

And that’s why, come September, don’t be shocked when Powell delivers exactly what the market expects: a friendly cut wrapped in technocratic jargon about “balance” and “resilience.”

It’s not courage. It’s not foresight. It’s self-preservation.

The Powell Put, formerly known as the Greenspan Put, Bernanke Put, and Yellen Put, lives on.

Comments: