We’re Screwed If We Don’t Do the Math

Happy Thursday from Northern Italy!

Most economists agree that there’s an inverse relationship between women’s literacy and birth rates.

Economists concluded that the more women read (and are educated), the less they want children.

I’ve always thought that conclusion didn’t match reality. I believe that the more women can do the math, the less children they want (for lifestyle reasons).

That is, numeracy, rather than literacy, drives the decision-making.

There are loads of examples of career women who can afford – and have – more children. Sara Blakely, Victoria Beckham and Amy Coney Barrett come to mind.

But this column isn’t about demographics. It’s about innumeracy, which we’ll define as incompetence with numbers. It’s what I think society’s big problem is.

But instead of whining about the causes, symptoms, and cures of innumeracy, I’m going to give you a few rules of thumb.

You can use them to see if your decision-making changes.

For my part, these simple equations and rules gave me a target. Specifically, I knew how far ahead or behind I was, and how far I had to go to reach my goal.

I won’t bombard you today, as I think the fewer and the simpler, the better.

So let’s start with five simple rules to see if they change how you think.

The Rule of 72

The Rule of 72 is one you’ve probably heard of. And you might be wondering why I’d even include such a rule. Well, let me first state the rule and then we’ll talk about how to use it.

For most people, the Rule of 72 tells them how long it will take to double their money if it’s invested at a constant rate of return.

For example, if you’re earning 10% per year on your portfolio, it’ll take 72/10, or 7.2 years to double your portfolio.

If you wanted to back out the math, let’s assume you had a $100,000 portfolio.

$100,000.00 x (1 + 0.10) ^ 7.2 = $198,622

The Rule of 72 isn’t perfect. But near enough is good enough in this case.

If you’ve got a superstar financial advisor earning you 20% per year, then it’ll only take 3.6 years to double your portfolio.

Now, let’s use this rule to look at inflation… something Sleepy Joe doesn’t want you to do.

Historically, central banks have tried to keep interest rates around 2%. That meant a currency lost half its purchasing power in 72/2 or 36 years. You’d barely notice the loss in purchasing power, as it’d take so long to rear its ugly head.

You’d probably go to the grocery store and wonder why eggs are “suddenly” double what they used to cost in 1983. We’ve all done something like that, haven’t we?

But with inflation hitting 10% as it recently has, a currency loses half its value in only 72/10 or 7.2 years.

Realistically speaking, let’s say Chairman Pow comes out and says, “We’d love rates to go back down to 2%, but that’s just not realistic. We’re now happy with a 4% target.”

In that case, the dollar would lose half its purchasing power in 72/4 or 18 years. If you think eggs are expensive now, just you wait until 2041!

The Rule of 72 is not only a great way to look at returns, but also at purchasing power erosion.

Net Worth Indicator

This is a great targeting mechanism, and one I’ve regrettably only just found. It’s from The Millionaire Next Door, by Thomas J. Stanley and William D. Danko.

Multiply your age times your realized pretax annual household income from all sources except inheritances. Divide by ten. This, less any inherited wealth, is what your net worth should be.

If you hit this number, you’re an AAW, or average accumulator of wealth.

According to the authors, to be considered a PAW, or prodigious accumulator of wealth, you “should” have at least twice this number.

What I like about this indicator is that it’s simple to calculate. And it gives you a target.

Full disclosure, I’m a UAW, which is an under-accumulator of wealth.

But I won’t use this number to feel bad. What I choose to do is to think bigger and get better results.

If you’re unhappy with what this number tells you, I suggest you do the same.

The 50-30-20 Rule Tweaked

This is a great way to allocate your monthly paycheck.

And it’s super-simple:

- 50% of your income goes to paying your “needs.” These include rent or mortgage payments, car payments, groceries, insurance, health care, minimum debt payment, and utilities.

- 30% of your income goes to paying down your debt. Once that’s done, this becomes discretionary entertainment expenses.*

- 20% of your income goes to future investment.

*In the original formulation, 30% go to your “wants.” That’s fine, but I think paying down your debt to zero takes priority.

I couldn’t believe how fast my debt disappeared. It took about six to twelve months. But it was gone and gone for good.

I’ve run a monthly credit card balance maybe once or twice in the last twenty years. And it’s thanks to this little system.

3x Rule for Buying a House

Another one I love and that would keep many a rich people out of trouble, let alone those of lesser means.

Never spend more than three times your gross annual income on a house.

I’m in the process of buying a house right now and I’m well within this rule.

My down payment is ready and won’t empty my account, and my monthly payments are easily manageable.

Far too many people only calculate what their monthly payments would be at the current rate of their mortgage. But if you’ve got an adjustable-rate mortgage, that could easily end in tears.

There’s no need to overpay for a McMansion.

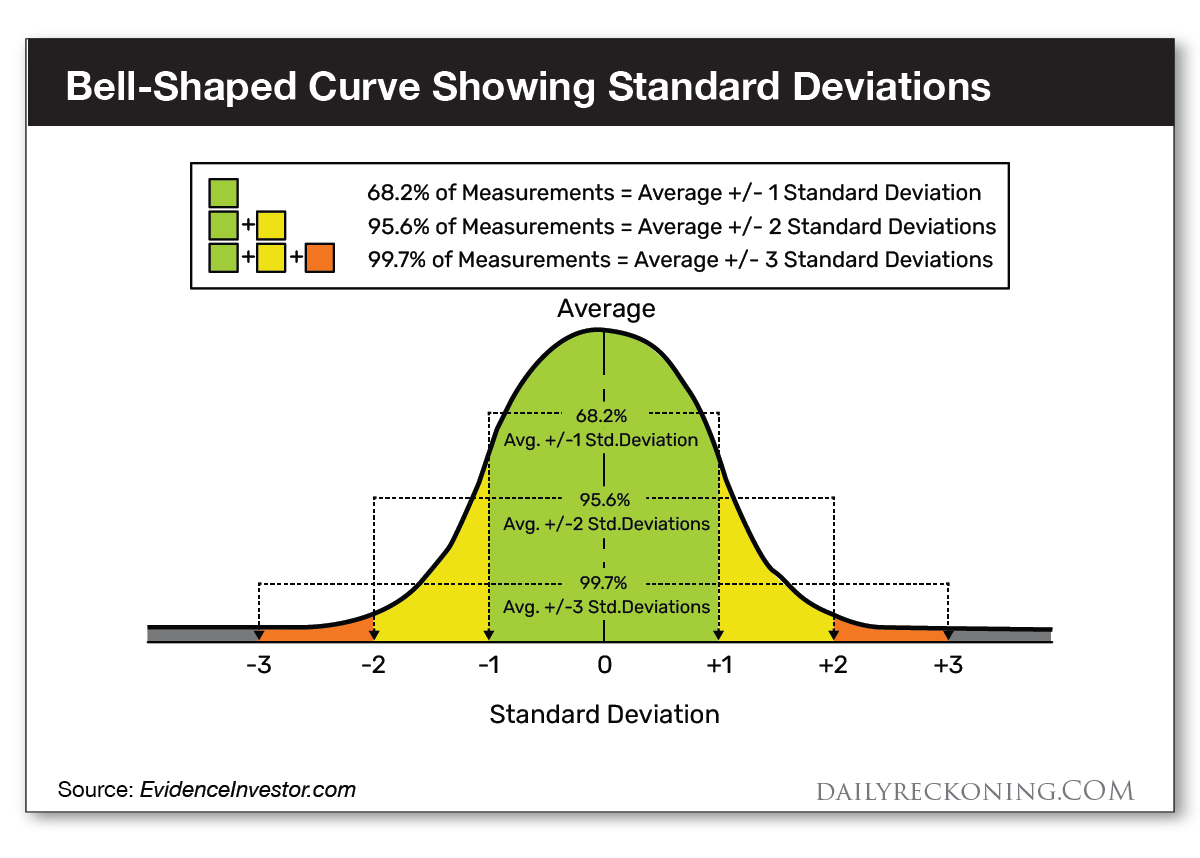

The Normal Distribution (Bell Curve)

Finally, we get to simple probabilities.

Again, this is just a rule of thumb. Nothing in finance is “normal.”

But this can help you distinguish investing realism from fantasy.

Let’s do an example.

Let’s say Stock ABC has earned on average 5% per year. But it’s accomplished that with a standard deviation around that 5% average of 2%.

If we assume normal returns – a dangerous thing in finance, but we do it all the time – then ABC has a 68% chance of returning between 3% and 7%.

It has a 95.6% chance of returning between 1% and 9%.

And it has a 99.7% chance of returning between -1% and 11%.

Here’s the thing, though: it certainly can crash far below a -1% return. And it may moonshot 45% on the FDA approving its new drug.

But the probability of either of those scenarios happening is very low.

Knowing this distribution is incredibly important for setting your expectations as an investor, and for also gauging what the market thinks of your potential investment.

If you can adjust your thinking to being more probabilistic, you’ll be shocked at how different the world looks.

Wrap Up

The absolute last thing I wanted to do was to patronize you.

But I also don’t want to assume you know things you may not know.

So I hope, at the very worst, this was just a refresher of things you may have put on the backburner.

But if there is a lot of new material here, I can’t encourage enough to deploy this new knowledge as early and as often as you can.

If this is the sort of thing you’d like to see more of, please let me know here. And if you found this the least bit unhelpful, do let me know that as well.

Have a wonderful rest of your week!

Comments: