Watch Out: FOMO Trading Is Back

FOMO is finally back!

Fear of missing out is one of the most powerful forces in the market. When conditions are just right, FOMO latches onto our lizard brains, leading to terrible investing decisions. We chase overbought stocks, fall for dubious stories and scoop up shares of some of the most risky, speculative garbage companies we can find.

What could possibly go wrong?

Well… everything, of course.

To be fair, I’m not knocking stock market speculation. After all, I’m a trader. I have no trouble buying less-than-perfect stocks or flipping shares of fundamentally challenged companies. Different stocks and sectors fall in and out of favor all the time. And improving or deteriorating fundamentals have little to do with short-term performance. Market conditions and narratives are the main determinants of how a stock will perform over shorter time frames.

Consider the broader market narratives and how they’ve evolved since late 2022…

Many stocks — including mega-cap leaders Apple Inc. (AAPL) and Tesla Inc. (TSLA) — were in free-fall in December. Investors had endured a painful correction lasting the entire year. Not only were the averages in bear market territory — the popular Covid Bubble stocks had been decimated. Anyone heavily concentrated in these names was sitting on huge losses — far deeper than the 20% correction in the S&P and 30% drop in the Nasdaq Composite.

It’s safe to say that most (if not all) investors were less than enthusiastic about stocks heading into 2023. Then, a funny thing happened.

The market rallied.

A few weeks later, stocks were still zooming off their lows.

But no one believed it.

We’ve talked about these early-stage bull moves before: the disbelief rallies. After a few failed relief rallies leave overeager buyers stuck in their trades, most folks simply give up.

Then, when a rally does finally stick, the market’s cried wolf so many times that most investors simply don’t trust the move. They sit on the sidelines and wait for the market to prove itself.

This perfectly describes the market action during the first quarter. Most analysts, fund managers, and individual investors simply did not believe that the rally would last.

Instead of buying stocks, they waited for the market to roll over.

But the averages weathered their first meaningful pullback in February. They also survived a banking crisis the very next month — and even rallied into the second quarter.

In fact, every single time the so-called experts said the market would roll over, we saw another rally.

As the S&P approaches year-to-date gains of 15% and tops its August 2022 relief rally highs, we’re finally seeing investors come around to the idea that the market has turned a corner.

But not everyone is happy about it.

The Chase is On!

“People will hate on this stock-market rally,” a recent Bloomberg Surveillance note begins, “They’ll say it’s fake, or just a handful of tech stocks making everything look better than it is. But the bottom line is, the S&P 500 and the Nasdaq — and especially the Nasdaq 100 — are up significantly, despite all the naysayers, and that alone is enough to drag cash in.”

There’s that FOMO talking again…

It’s not only retail investors getting “dragged in” to this rally. The pros are also getting sucked back into stocks. Fund managers who missed the earlier stages of the rally that began in January are significantly lagging their benchmarks. The big-tech Nasdaq 100 has already gained 35%-plus year-to-date!

If you’re managing money and you’ve been twiddling your thumbs worrying about elevated valuations in this group, you might be in a bit of trouble here. The runaway performance of the big tech names has created a hold your nose and buy situation that’s powering this rally higher into the summer months. As Citigroup’s Stuart Kaiser explains in that very same Bloomberg piece, “We are reluctantly staying in the tech trade.”

In other words, get onboard — or your job might be in jeopardy.

Now, we have the strongest stocks attracting even more attention. Mega-cap tech, semiconductors and artificial intelligence names are rolling as summer approaches.

Can the good times keep rolling? Or will these trends run into some trouble as the summer heat approaches?

Buying Into the Summer Doldrums

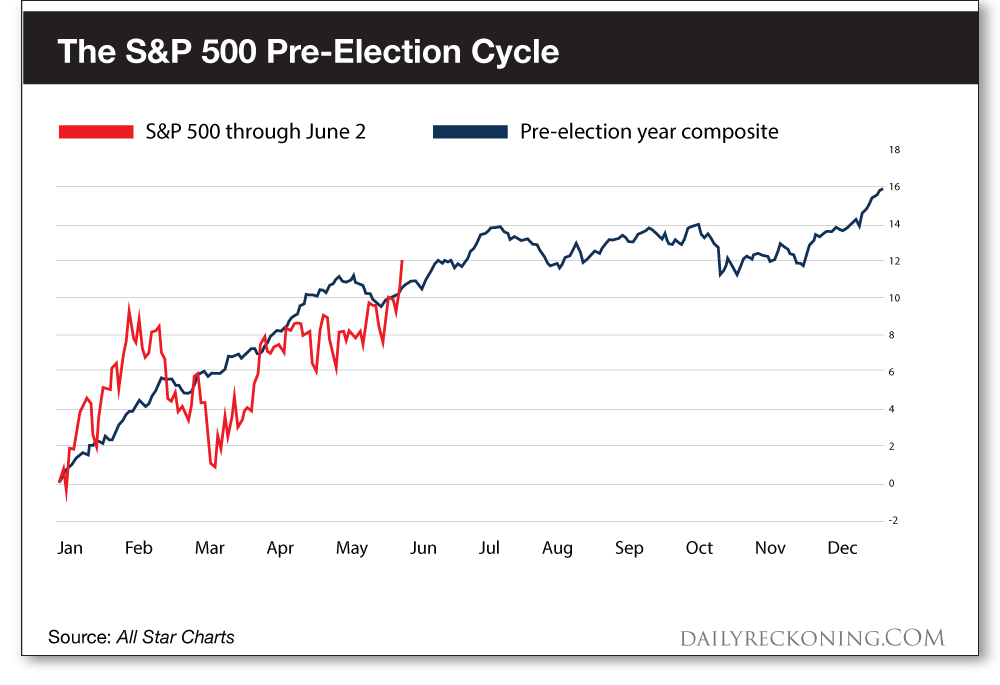

Now that the herd is backing up the truck and pushing many market leading stocks to new 52-week highs, we should take a moment to see how the S&P fares during a typical pre-election year.

Here’s a look at the S&P 500’s year-to-date performance, overlaid with a typically pre-election year:

A couple of key takeaways from this comparison…

First, don’t get too hung up on the S&P’s performance perfectly mirroring the pre-election year composite. The trend is what counts. And so far this year, it’s closely followed a typical pre-election cycle.

Next, take a look at how the composite behaves at the end of the second quarter. In a pre-election year, the S&P typically tops out at the end of June and remains in a range until an end-of-year push in November – December.

Will the market follow the blueprint this year? I doubt it will match up perfectly. But the composite does give us a general idea of what we could expect as this rally matures.

Plus, it’s fitting to see so many investors scrambling to buy just as the cycle is potentially topping out into July.

The market loves to get everyone bulled up at the wrong time. No one wanted anything to do with stocks when they were ripping in January. Now, they’re buying with both hands into a potential short-term top.

What do you think? Is the market running too hot? Or, will the good times roll through the summer? Let me know by emailing me here.

Comments: