Turkey, Touchdowns, and Trading

The market melt-up is in full force as we enjoy the Thanksgiving trading week.

This is easily my favorite holiday. I get a midweek break in the market action filled with food, family, and football — without the added stress of exchanging gifts and all the cleanup that comes after a busy Christmas morning with the kids…

This year, the vibes couldn’t be more bullish. The crypto and market bulls have converged into one massive year-end rally for the ages. And with the election and major earnings announcements out of the way, there’s now little standing in the way of higher prices into 2025.

Stocks have exploded higher following the election, quickly reset, and then continued on their journey to new highs as some of the most speculative areas of the market have seized key leadership roles.

Melt-up conditions are exciting times for traders. Even better, we were totally prepared for this rally! I’ve spilled more than my share of virtual ink talking about this melt-up since the early days of fall.

If you ignored this message before, here it is, again: The market’s in the perfect spot to continue running into the holiday season – maybe even well into Q1 2025. If you’re looking to kick your trading into overdrive, now is the time to take on more risk. You could make your entire year in just a little more than four trading weeks left on the 2024 calendar.

Of course, not every holiday season triggers an automatic stock market melt-up. Sometimes, the market even reveals critical information when it fails to melt up during the final months of the year… and begins to lose ground.

In the spirit of Thanksgiving, I’m going to show you how to spot a stalled-out holiday rally. You’ll see the telltale signs of a distressed market cracking under the surface of the major averages. We’ll also review what happens after a melt-up fails…

Unfortunately, we don’t have to go too far back in time to find a failed melt-up move that triggered a nasty bear market.

It all starts during the final weeks of the pandemic trading boom…

The Abrupt End of the Covid Bubble

The S&P 500 was having a banner year in 2021, gaining more than 25% into the final trading days of the year.

Investors were riding the high of the pandemic bubble, highlighted by insane squeezes in stocks like Tesla Inc. (TSLA) and the biggest meme play of them all, GameStop Corp. (GME). Both delivered staggering short-term gains during the first quarter — and traders were looking for a repeat performance.

Back in 2020 and early 2021, you could mindlessly buy any tech stock and book profits. A new (and bored) trading class was born — the lockdown speculator. Can’t go out? Might as well make some money. Message boards buzzed with hot stock tips. Crypto and NFTs took flight. Free money rained down for anyone with a WiFi connection and a Robinhood account.

Most large caps were riding high during the fourth quarter. But the speculative retail trading bubble was quietly bursting right under everyone’s noses.

I distinctly remember the day after Thanksgiving that year. The averages were consolidating near their highs earlier in the week. But the mood abruptly changed on Black Friday — normally a quiet half-day for stocks. The averages plummeted, setting off a small selloff that would last through the first week of December, turning into a pullback of nearly 5% for the S&P, and 7% for the Nasdaq Composite.

In the grand scheme of the markets, these are routine drops. It’s what happened after the indexes stabilized that tipped the market’s hand…

How “Quiet” Selling Started a Bear Market

The strong semiconductors and mega-cap stocks stabilized the averages and helped them finish December at their highs.

Yet the frothiest stocks had peaked in early February and couldn’t seem to find any momentum heading into the holiday season.

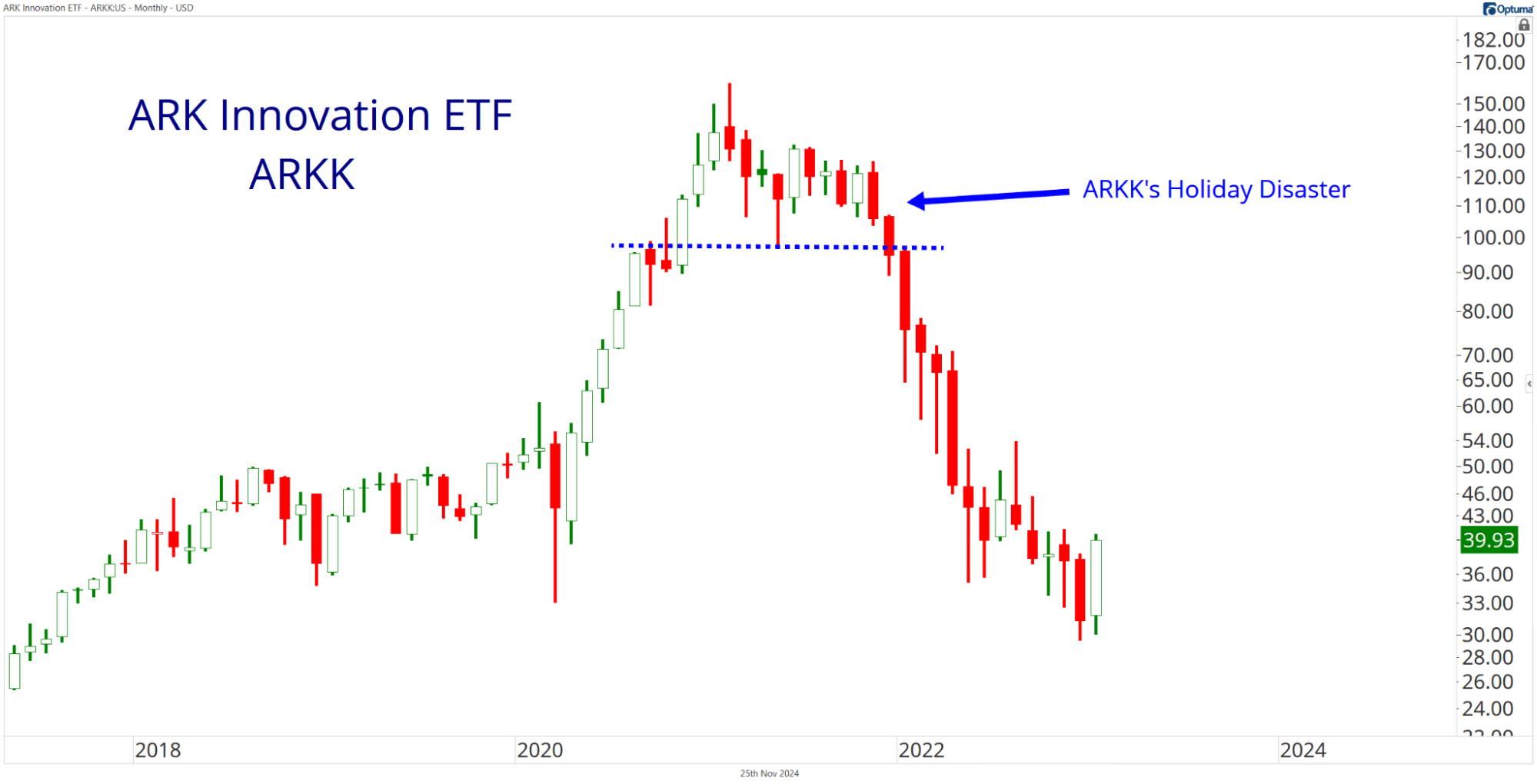

In fact, a few key groups were beginning to roll over. Cathie Wood’s ARK Innovation Fund (ARKK) — the same tech-growth wonders that doubled, tripled, and quadrupled (or more!) as the Covid Bubble inflated — started to slip. As the Nasdaq Composite stubbornly caught a bid and marched higher leading up to Christmas, ARKK completed a massive top.

ARKK lost nearly 13% in Nov. 2021, followed by a December drop of nearly 10%. But the selling was still “quiet” as most investors and the financial media were content that the major averages were doing just fine.

But the sellers cranked up the volume in January. All those growth stocks that couldn’t possibly go any lower did, in fact, continue to fall.

After rallying more than 325% off its Covid crash lows, ARKK was embarking on a round trip for the ages.

Investors holding too many of these tech-growth stocks were beaten to a pulp during the early days of the 2022 bear market. ARKK’s underperformance rippled through the markets as the selling intensified, leading to the Nasdaq Composite lagging the S&P 500 in 2022 for the first time in six years.

Could it Happen Again?

Could we witness a similar melt-up failure this holiday season?

I suppose it’s possible.

But the market looks very different today than it did in late 2021.

For starters, those beaten-down tech-growth stocks that put in multi-year bases are actually leading the market while big tech and many semiconductors lag. That’s the opposite of what we were seeing in Q4 2021. We’re also seeing constructive action in smaller stocks — again, not the same as the top-heavy market that was running out of steam three years ago…

Crypto’s performance is another indication that the speculators are still partying hard. Bitcoin and the NFT frenzy topped out months before the market started breaking down in late 2021. This year? Well, we probably haven’t seen the highs yet as Bitcoin continues to tease the $100K area and smaller tokens pick up momentum.

Now is not the time to sell everything and hide from an impending bear market. Instead of fretting about the market, spend some time this weekend enjoying a turkey sandwich. Your brokerage account will thank you…

Comments: