Trump’s Microcap Renaissance

In 2008, the U.S. government entered into a strange relationship with one of America’s largest companies.

It was about to go bankrupt.

And… the government swooped in to save it. All at the taxpayer’s expense.

Fast forward to October 1, 2024…

This same company?

It is now America’s LARGEST company based on the assets it holds on its balance sheet.

It manages a $4 trillion portfolio.

The company itself is worth $90 billion in net assets… about the same as Nvidia.

It has $38 billion in cash.

And its stock… trades for $1 billion.

Read that again.

It’s trading 99% below value…

And about 97% below CASH.

How on earth could America’s largest company by assets be trading in microcap territory…

When a company like Nvidia, which is technically “worth” the same, is trading for $3 trillion?

The answer will shock you…

And highlight the strangest dichotomy playing out in the stock market today.

The Toppled Titan

I’m talking, of course, about the Federal National Mortgage Association (OTCMKTS: FNMA).

Otherwise known as “Fannie Mae.”

We all know the story…

Fannie Mae bundled a bunch of worthless loans in 2008 and sold them to investors in the form of a “mortgage backed security.”

When the music stopped, investors suddenly realized they were holding onto worthless paper…

And fled for the exits, grabbing whatever money they could.

Globally, cash dried up…

Governments were forced to turn on the money spigot…

And Uncle Sam put Fannie Mae in a permanent time-out.

Ever since, Fannie Mae has been in a “conservatorship” with the U.S. government.

For good reason. They were instrumental in causing the global financial crisis… and got a $190 billion bailout.

That’s like getting a F in school and getting a $100 allowance from your parents.

The Deal of the Decade

But here’s where the story gets weird.

Fannie Mae has technically been a publicly traded company this whole time.

It’s not listed on the New York Stock Exchange or the Nasdaq…

But you can buy it in the secondary, over the counter markets.

Most, of course, didn’t buy the stock.

For 17 years, shares were stuck in the toilet.

While under conservatorship, the company could not distribute profits to investors.

No dividends.

No buybacks.

No incentive to own the stock whatsoever.

So… demand vanished.

Creating this weird situation where America’s largest company by assets was trading for 99% off.

And Then… Trump Happened

And then last year… Trump started shooting up in the polls.

And… Fannie Mae followed.

What happened?

Well, late in his first term, Trump started floating around this idea he wanted to end the arrangement and set Fannie free.

So, when Trump started to climb in the polls… speculators moved back into the stock.

The Trump team argues that the government’s conservatorship makes it difficult for the company to achieve its stated mission “to make housing more affordable and accessible.”

Skeptics of big government tend to agree…

… While critics point out the company’s problematic history of, you know, crashing the global economy in 2008.

Nevertheless…

Fannie Mae paid off its debts to the government years ago.

Almost 10 years ago, in fact.

And there is an argument to be made that with home prices so expensive… Fannie can’t do the job that it needs to.

Personally?

I have no opinion.

I’m just here to make money…

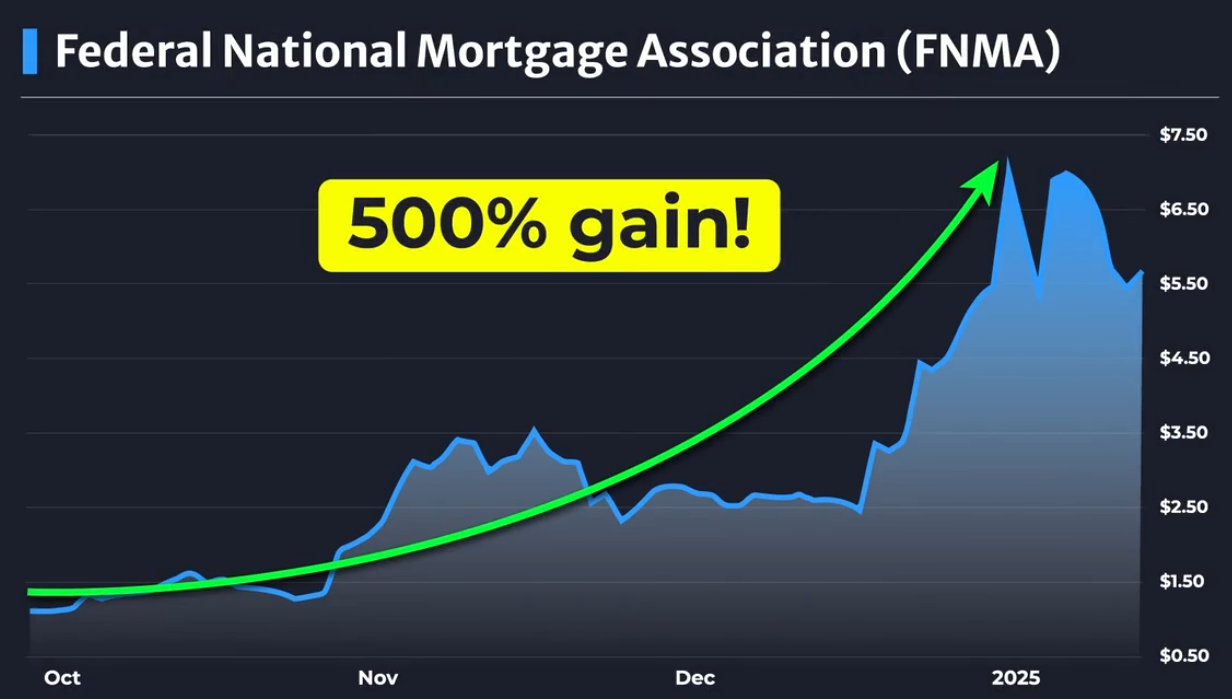

We Made 500% on Fannie

On October 1, hundreds of our subscribers gathered at our annual conference for Paradigm Press, “America’s Next Move.”

And… we recommended Fannie Mae when it was trading for just over $1.

Then… it happened.

Trump won.

And Fannie took off.

The stock is worth about $6 now.

On January 14, we sent attendees a message saying to sell half their position for a 500% gain.

We bought in October and sold half in January.

So within three months, we called out the exact moment Fannie was about to shoot up and hit a 17-year high.

Today, Fannie Mae’s stock is worth over $6 billion.

And with $38 billion in cash… the stock still has plenty of room to run higher.

If the company goes private, Fannie will use this cash to buy back all the outstanding shares, likely at a premium to the stock’s current value.

The reason I bring up this story…

Is because it is the ultimate example of a weird dichotomy playing out in the stock market right now.

You had this huge market leader…

Literally trading in microcap territory…

And then, it shot up. Why? Because it was ridiculously undervalued.

And by the way…

Fannie Mae is just one example.

I see this same thing playing out ALL over the market.

Tiny microcaps … that just so happen to be the market leaders in their respective fields … are popping off all over the place.

One of the stocks I recommended to my microcap readers recently … it literally doubled in one day.

Because investors are waking up…

$30 Trillion Paradigm Shift

Since 2011, large caps have been the only game in town.

They’ve outperformed the little guys by 2-to-1.

And driven over $30 trillion in stock market gains.

Now, the tide is turning.

Last year, 9 of the top 10 stocks were these tiny microcap stocks that I’m talking about.

GeneDx holdings, up 2,694%…

Quantum Computing Inc, up 1,718%…

Rigetti Computing, up 1,441%…

Red Cat Holdings, up 1,360%…

Sezzle Inc, up 1,146%…

And the list goes on.

This year, I expect this paradigm shift to continue.

This Friday … Wall Street is going to open their books and show us the stocks they were buying last quarter…

You know, when Trump got elected and the Fed was cutting rates and all that.

My hunch?

A lot of institutional investors are buying these microcaps.

They’re seeing the same deep value we saw in stocks such as Fannie Mae…

And, once investors see what they’re buying … they’ll go up and up.

The Start of Something Big

Large caps have outperformed the little guys for the last 14 years.

Typically, these cycles last 12 years … then shoot in the other direction.

So, I think we’re very … very early in a new microcap supercycle that will define the next decade or more.

I recently started sharing my microcap research again with the public.

And in six short months, we’ve already seen a few of our stocks double.

But I think this is just the beginning.

After Friday … I think everyone is going to be looking for new opportunities in these microcaps.

And, I think we’ve found the best of the bunch.

Attractive, high quality businesses that just happened to be really really small … and really really cheap.

But, those are the kinds of stocks that can do the best overtime.

Last year, some of them literally went up 1,000%.

Overtime, they can do 5,000% … and even 10,000%.

If you missed the AI boom … if you missed the crypto boom … don’t miss the microcap boom.

It’s just getting started.

Comments: