Trump Triples Down: A New Warning For Chinese Stocks

Over the past six months, we’ve shared many investment ideas.

Most are working out well. Gold, silver, tobacco. Even Brazil is holding up pretty well compared to the rest of the market. We’ve recommended raising cash and limiting exposure to U.S. stocks.

However, there is one investment idea I proposed which needs an update due to recent developments.

Chinese technology stocks…

Beijing in Trump’s Crosshairs

Back in February, I wrote about the bullish case for Chinese tech stocks. Fundamentally, the case seemed sound. Chinese tech ETF KWEB was down about 66% from all-time highs (it’s now down 71%).

In terms of valuation, Chinese tech stocks were and are cheap. They trade at about half the price of U.S. ones. For example, the Chinese tech ETF PGJ trades at an average P/E ratio of 13 (full disclosure: author owns PGJ). The Nasdaq 100, meanwhile, trades at an average P/E ratio of 27.

So China’s market trades at bargain prices. However, there’s a reason for that. The geopolitical environment has gone from bad to worse.

We have no idea what effect 125% tariffs on China will have on that country, or ours. We don’t know if these extreme levies are temporary, or permanent.

Additionally, it’s becoming clear that a big chunk of Trump’s policy is directed squarely at China.

A Rising Manufacturing Threat

For many decades, China played in the low-end of the manufacturing value chain. Plastic toys, tools, and other simple, low-margin items.

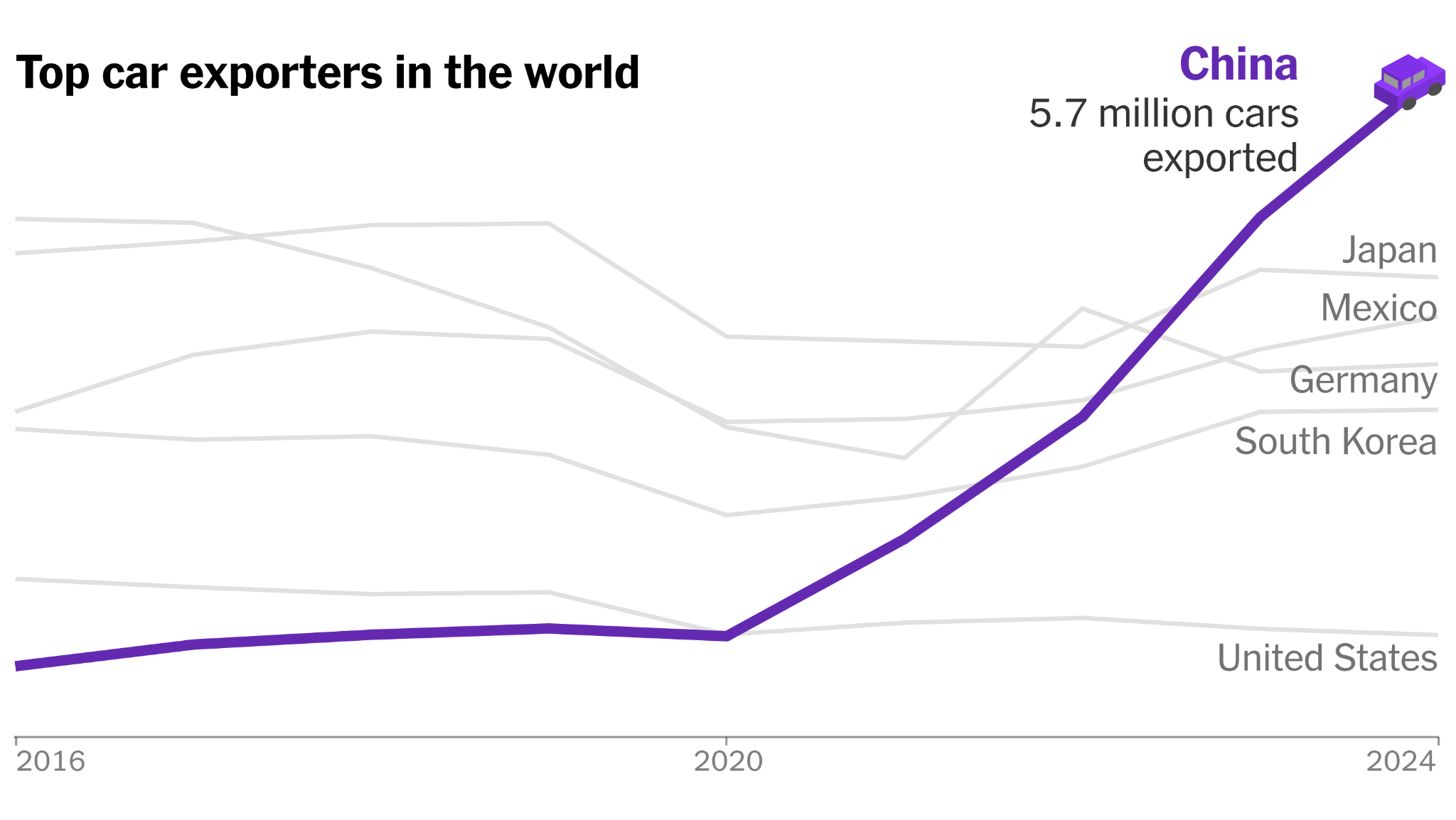

However, the country has steadily moved up the value chain and suddenly dominates in goods such as cars and electronics. Here’s a chart of the world’s top car exporters, which we featured in last months’ Tesla’s Existential Threat:

Source: New York Times

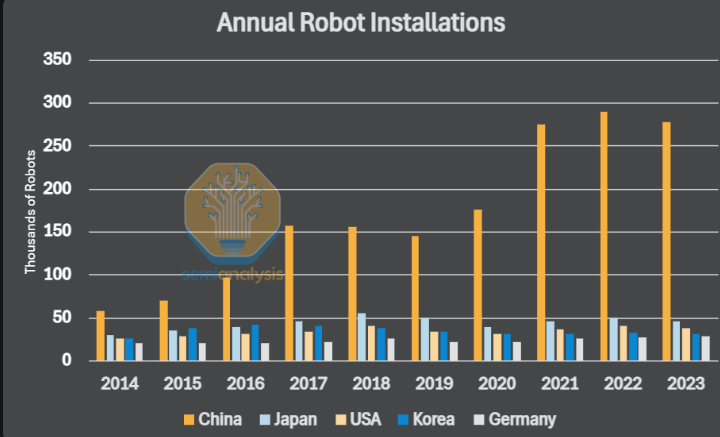

Additionally, China has been busily upgrading its factories with the latest in robotics technology:

Source: SemiAnalysis

A recent U.N. report warned that by 2030, China’s share of global manufacturing could grow to 45% from 31% today.

China is clearly a rising economic power, whether we like it or not. But they are primarily seen by America’s political leadership as a massive threat.

Everything’s On the Table

Trump’s team is acutely aware of the potentially destabilizing effect of China’s unbalanced economy. They build and export too much, and don’t consume or import enough. So Trump and his economic team are looking to counter China in a number of different ways.

For example, in a recent interview on Fox News, Maria Bartiromo asked Treasury Secretary Scott Bessent, “Are you willing to go that far, to remove Chinese stocks from U.S. exchanges?”

Bessent replied, “Well Maria, I think everything’s on the table.”

As someone with a position in Chinese stocks, this was naturally not a pleasant thing to hear. However, Bessent ended his answer with some nuance, stating:

“It will be President Trump’s decision. But at the end of the day, President Trump and Chairman Xi have a very good personal relationship. And I am confident that this will be resolved at the highest levels.”

To be clear, removing Chinese stocks from U.S. exchanges would be a dramatic move. The only time in recent history such an action has been done is when Russia invaded Ukraine, and all Russia-based companies were delisted and put into a sort of financial purgatory (more on that here).

However, Russian stocks are a tiny portion of the overall market. Less than half of 1% of the global total.

Chinese equities make up about 12% of the global equity markets. So to remove these companies from US markets would be a drastic measure. Such a move would threaten America’s reputation as the largest and freest equity market in the world.

However… it could happen. We’re in uncharted territory here. So the possibility has to factor into our thinking, and I felt the need to update readers on this potential threat.

My suspicion is that Trump and Xi will eventually reach a deal where both leaders can save face. But there is a chance that it simply doesn’t happen, or takes years to play out.

Over the coming weeks I’ll be shifting some of my China exposure into precious metals and miners, which are increasingly attractive in this chaotic environment. If you’re more of a play-it-safe type of investor, there’s really no safer place to hide out than precious metals.

Chinese stocks are cheap on paper, with significant growth potential. But the geopolitical forecast is increasingly murky.

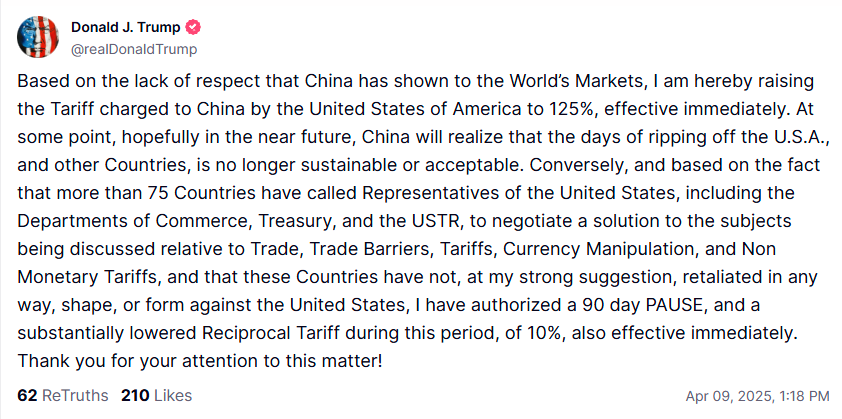

Addendum: As your humble editor was finishing this article, news broke that Trump is pausing all reciprocal tariffs for 90 days, EXCEPT for China, which he is raising to 125%. Stocks ripped higher globally, somehow including China. Large Chinese tech ETF KWEB was up 5.5% as of 2:15pm, and broad index FXI was up 6%.

Here’s the full text of Trump’s post on Truth Social:

Source: Truth Social

The only explanation as to why Chinese stocks would be up so sharply is that the 90 day tariff pause shows that Trump is open to negotiation. Welcome to bizarro world.

We’ll keep readers updated as this story develops.

Comments: