Trading the Bitcoin Sucker Punch

Bitcoin’s done it again.

I’m back from the beach and catching up on the charts. It was great to get a little sun and unwind with the fam. But I did miss some important developments in cryptoland…

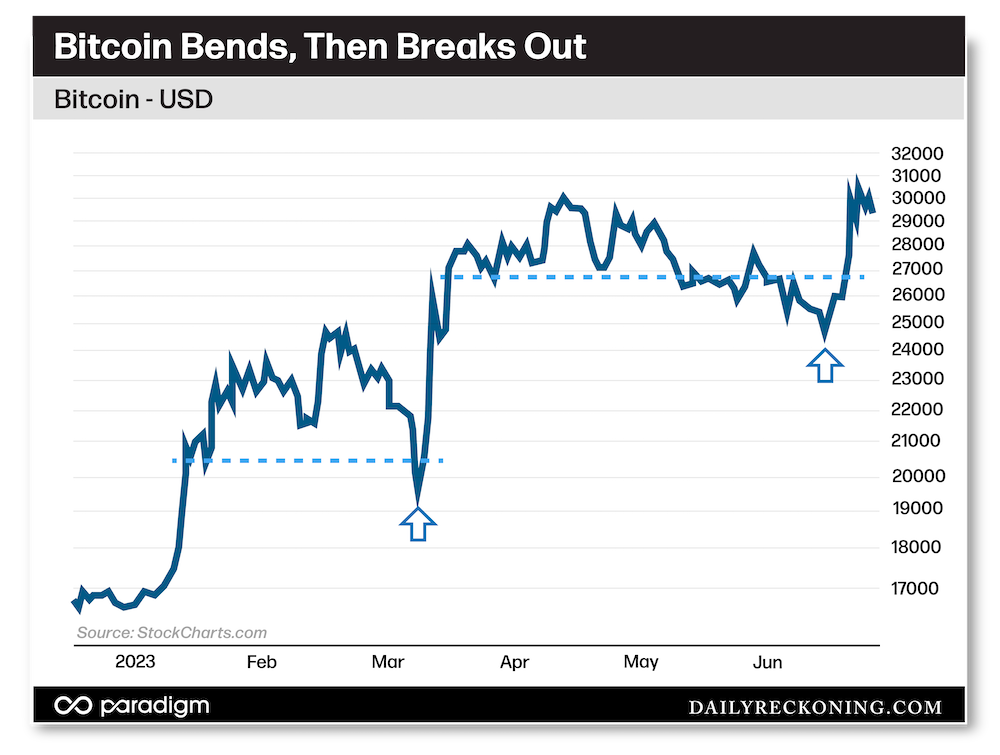

While the major averages took a break last week, Bitcoin exploded off its lows to retake $30K, post new 2023 highs, and, most importantly, keep its bigger comeback rally intact as the third quarter approaches.

The move was classic Bitcoin as the flagship crypto flashed a false breakdown we’ve seen more than a few times recently.

It goes a little something like this:

- Bitcoin quietly builds toward an obvious area of resistance.

- It briefly breaks above this resistance level and appears to extend toward a legitimate breakout.

- Instead of building on the gains, Bitcoin abruptly falls back into its range – then fades back to near-term support.

- Bitcoin then appears to break down, making new lows and trapping anyone who chased it higher.

- Then, for the grand finale, Bitcoin suddenly catches a bid and zooms higher to post its “true” breakout move.

I know that might seem a bit convoluted. Don’t worry! We’ll break it all down in a moment. To sum up what’s happening, all you need to know right now is that Bitcoin loves to lure longs and shorts into jumping in at the exact wrong time.

Crazy? Sure.

But I expect nothing less from Bitcoin. Crypto has the uncanny ability to trick everyone into chasing their own tails. Yes, one could argue that the crypto market has come a long way over the past decade. But make no mistake – it’s still the Wild West. With no real price anchors, earnings announcements, scant analysts targets, and 24/7/365 trading, we should expect more than our fair share of weird and unexpected moves.

Let’s break it all down and discuss what happened, how the move resembles other recent fakeout breakouts, and where the price of Bitcoin could go from here.

Bitcoin’s Sleepy Spring

Wild crypto moves can happen in an instant. But before the storm, Bitcoin loves to lull traders to sleep.

Just a couple weeks ago, the lack of action in the crypto space had me wondering if we’d squeezed the last drop of speculative juice from crypto – and passed the baton to tech-growth and AI bubble stocks.

My logic was simple enough: Crypto ran with the bulls back in January, yet Bitcoin and Ethereum had gone nowhere since March, despite frothy action across the tech space.

It’s important to remember that Bitcoin and tech have danced arm-in-arm since the Nasdaq first started to crack in late 2021. A leg lower in the tech-growth stocks led to a drop in crypto, and vice-versa. This relationship continued into 2023 and the powerful rally that kicked off the year. Many stocks (including the bruised and battered tech names) shot higher in early January, followed by a powerful crypto rally.

Yet while the major averages – led by the Nasdaq Composite – extended higher in May, crypto didn’t play nice. In fact, Bitcoin topped out in April and steadily leaked lower into mid-June, effectively going nowhere for three months.

As Bitcoin spun its wheels into late spring, there were no signs of positive momentum in the crypto space since the failed push above $30K in April. And while I was patiently watching for a sharp move higher to materialize, it was becoming clear that Bitcoin needed more time.

Buy the Rip After the Dip

The formula that’s worked for buying Bitcoin so far this year is to wait for the sucker punch, then lay your money down.

Here’s how the two head fakes lower have played out so far this year:

In this chart, you can see how Bitcoin looked coiled and ready to break higher in February. Then, it proceeded to tumble toward $20K before sharply reversing – then breaking out in mid-March.

It also helps to keep the news cycle and economic climate in mind during these events. Remember, Bitcoin was rallying during the beginnings of the bank turmoil back in March. Silicon Valley Bank goes down in flames and crypto catches a bid. You can argue that traders were viewing Bitcoin as a potential safe haven during the regional banking crisis – but I don’t believe that was the case.

During these larger uptrends, Bitcoin demonstrates it likes to rally on bad news – which could also explain the move above $30K we’re witnessing right now. The Fed has been bad mouthing crypto lately. Plus, we have the SEC suing Binance and Coinbase. All this negative press over the past few weeks – no wonder Bitcoin started to make a run.

I don’t think this move is over, either. We’ve witnessed some constructive consolidation here above $30K following the initial thrust last week. Assuming Bitcoin can hold the line at $30K (which is also where it failed back in April – resistance turned support), there’s plenty of room overhead for Bitcoin to extend higher.

The last time Bitcoin held above this mark for more than a couple weeks was the halfway point of its early 2022 meltdown. If it can hold here and extend the rally, $40K appears to be a reasonable summer target.

What do you think? Will we enjoy a Summer of Bitcoin while stocks consolidate? Or is this just a nasty bull trap in the making? Let me know by emailing me here.

Comments: