Total (Trade) War

Around the world, governments are shifting onto trade war footing.

When preparing for financial warfare, nations aim to become as self-reliant as possible. In agriculture, manufacturing, refining, mining, drilling, and more.

The stronger a nation is in these areas, the stronger its negotiating position will be.

America is doing decently well when it comes to preparation. Under Biden, we fell behind in certain areas, but the outlook has improved under Trump.

Importantly, our country is nearly self-reliant when it comes to food and energy. And the Trump admin is set to boost our drilling and mining sectors by increasing access to federal lands and cutting red tape. This will be a tremendous help.

We’re also making progress in the tech sector, where the upcoming launch of TSMC’s gigantic semiconductor manufacturing facility in Arizona will enable us to build our own cutting-edge chips domestically. This new foundry will soon make us far less reliant on Taiwan for the chips needed to power phones and AI infrastructure.

Meanwhile, the Trump administration is using tariffs, and the threat of them, to bring manufacturing jobs back home. And we’ve already seen considerable early success here.

Hyundai Motor Group just announced $21 billion worth of investment into U.S. manufacturing, prompting President Trump to applaud the company and note that Hyundai would “not have to pay any tariffs”.

This is the tariff plan in a nutshell. Classic carrot and stick incentives. Build domestically, get rewarded. Build overseas, get penalized.

And of course, America is in a strong negotiating position due to the fact that we’re the largest consumer economy in the world. The dollar is still the world’s reserve currency, so we’re still the richest country with the most purchasing power.

Access to the U.S. market is incredibly valuable by itself, and Trump will leverage this to the fullest. Overall, we’re in a fairly good place.

But it’s not all sunshine and roses.

The Achilles’ Heel

One major weakness we must deal with is America’s dependence on China for certain materials. Especially rare minerals and metals. Examples include gallium, antimony, and rare earth elements. The West is working on developing alternative sources, but in reality it’s going to take at least a decade to get rolling at scale.

For now, China has a significant lead in mining, separating, and refining these rare elements and metals.

Additionally, over recent years China has significantly scaled up its already massive manufacturing infrastructure.

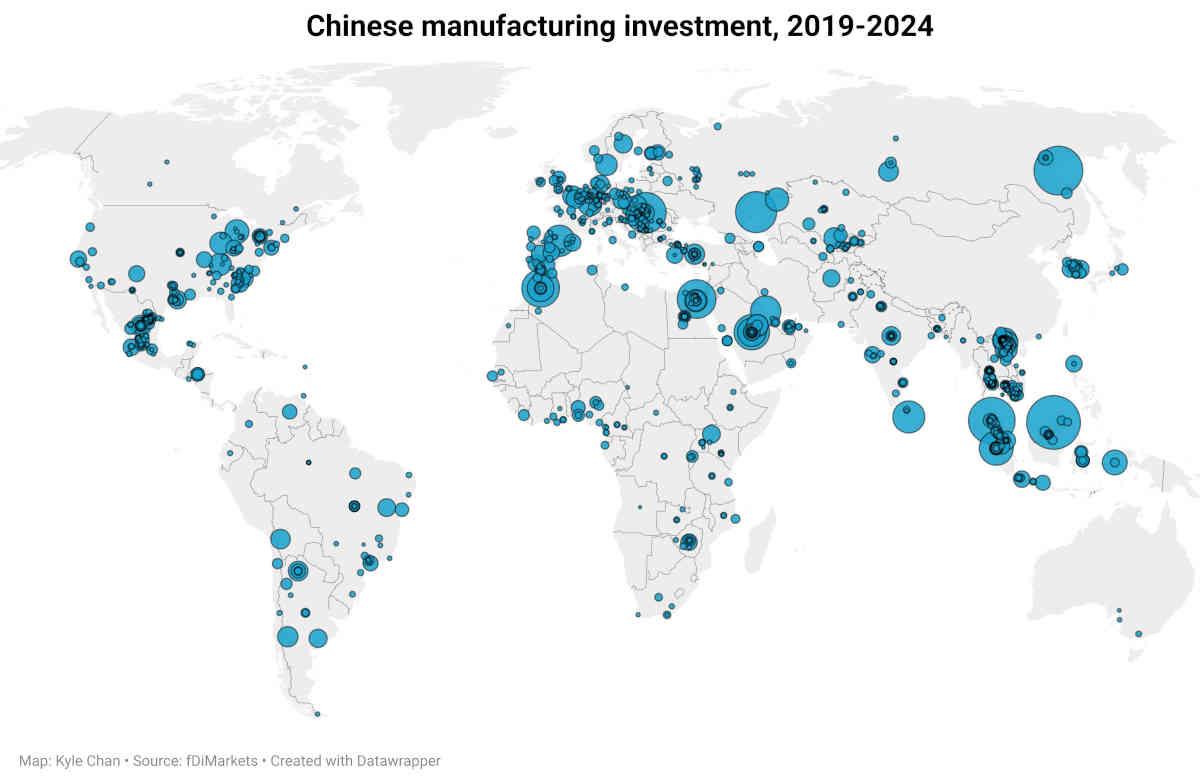

Take a look at this map, which shows China’s manufacturing investment around the world from 2019-2024. The size of the circle represents the size of the investment.

Source: High Capacity

As you can see, since Donald Trump’s first round of tariffs on China in 2018, the country has been busy decentralizing its manufacturing empire, which now spans the world.

Today China has two primary strengths: it controls key rare earth elements and metals, and has spent trillions to modernize its global industrial infrastructure.

China has been preparing for this financial battle for decades. So, no, this trade war isn’t going to be a one-sided battle where America quickly emerges victorious, unscathed. China is our primary competitor here and they are capable of putting up a serious fight.

Eventually, President Trump will make a deal with President Xi, but there is much at stake so we can expect significant disruption and negotiation before that happens (and likely after, too).

Stockpiling Gold

Gold will be another key factor in the trade and currency wars ahead. Russia, China, Turkey, and many others have been rapidly building their bullion reserves over recent decades.

The U.S. has a strong position here already, with more than 8,000 metric tonnes of gold bullion in reserve. Officially, that remains the largest stockpile among nations, but it’s almost certain that China’s true reserves match or exceed ours.

President Trump is planning an audit of America’s gold reserves, and hopefully it’s all there. Meanwhile there’s suddenly an influx of gold flooding into the country, which doesn’t seem like a coincidence. As we have speculated about previously, it is possible that some of America’s gold was leased out and is now returning under duress.

Gold has a key role to play in the coming financial battles. As investors, owning gold remains the simplest way to hedge against the chaos to come. But there will be many chances to take advantage of the upcoming disruption. Change of this magnitude always brings opportunity.

We’ll keep looking for ways to preserve and even grow wealth as these financial wars heat up.

Comments: