The Stock Market’s Worst Month

The canine days of August are clearing out, beach sand through the hourglass. Tomorrow the calendar furls to September.

Many consider September a snoozing month of market peace before dreaded October.

They will remind you that the market’s most violent cataclysms — the Panic of 1907, the Crash of 1929, “Black Monday” 1987 — all came barreling through in October.

October’s reputation is so villainous, so felonious, it has even earned a title:

The “October effect.”

But is it true? Has October truly earned its blackened reputation?

Today we haul the accused into the dock, interrogate its record… and pronounce verdict.

Yet first: How did the stock market conclude this month of August? Apprehensively…

Four Consecutive Days of Losses

Today the stock market leaked steam for the fourth consecutive day.

The Dow Jones shed 280 additional points this day. In all, the index has yielded back some 1,850 anxiety-stricken points since Friday.

The S&P 500 lost another 31 points today; the Nasdaq Composite, 67.

Why the recent string of red numbers? Look no further than the chairman of the Federal Reserve and his Jackson Hole grunts, says Commonwealth Financial’s Brad McMillan:

Markets were counting on limited rate increases and quick rate cuts. The speech was clear, however, that the increases will be larger, and the cuts more delayed, than anyone expected.

Thus August has been a month of two tales, argues Goldman Sachs’ Chris Hussey:

Investors developed an appetite for risk assets in the first half of the month on expectations of a potential peak in inflation and an eventual Fed pivot, followed by a steep reversal (and then some) as markets digested Fed Chair Powell’s speech which reiterated the FOMC’s commitment to bring down inflation and outlined that the FOMC will likely need to maintain ‘a restrictive policy stance for some time.’

Gold — meantime — went $14.30 backward today while 10-year Treasury yields went forward to 3.133% — the furthest since June’s middle days.

Yet to return to our central question: Is October the stock market’s evil month?

History insists the answer is… no.

Wrongfully Convicted

October’s bankrupt reputation likely owes to a sour string of luck. And its conviction was based heavily upon hearsay evidence, upon circumstantial evidence.

Stephen Williamson, former vice president of the Federal Reserve’s St. Louis district court:

Stock market crashes have occurred sufficiently infrequently in history that there is not enough evidence on when they are more likely to occur.

The gentlemen and ladies of Yardeni Research further vindicate October of wrongdoing. The average S&P October return is not negative in the least, they inform us.

It is, in fact, a positive 0.4%. A slender gain, yes — yet a gain.

Meantime, Investopedia informs us that more bear markets ended in October than began in October.

Swoons in 1987, 1990, 2001 and 2002 swung around in the year’s 10th month.

Justice, Finally

Thus the presiding judge unseals the jury’s verdict…

“Not guilty,” it reads. And so he dismisses all criminal charges against the guiltless month of October — with prejudice.

In conclusion: An innocent man has been pitched into infamy… and packed off to durance vile on a wrongful charge.

Let us then, in the highest spirit of justice, clear his blackened name.

Assume then that October is not the mighty fee-fo-fi-fum many believe it to be. Does another month take its place in the gallery of evil? Is there a month truly deserving of October’s label?

The Market’s Worst Month

The record argues that yes, another month is a menace greater than October. Which month?

That month is September — the month underway tomorrow.

“Since the Dow Jones Industrial Average was created in the late 1890s,” financial columnist Mark Hulbert notes, “September has produced an average loss of 1.1%.”

“The 11 other months of the calendar,” adds Hulbert, “have produced an average gain of 0.8%.”

Nor do one or two roguish and renegade Septembers explain it, says Hulbert:

“On the contrary, the month has an impressively consistent record at or near the bottom of the rankings.”

Not Just the Dow

September’s ill luck covers both the Dow Jones and S&P… incidentally.

Yahoo Finance:

According to LPL Financial, September has been the worst-performing month for markets, on average, since 1950. The S&P 500 has dropped about 1% on average that month since 1950, LPL Financial data shows. The only other month to notch a drop on average (and a minuscule one at that) going back to 1950 is August.

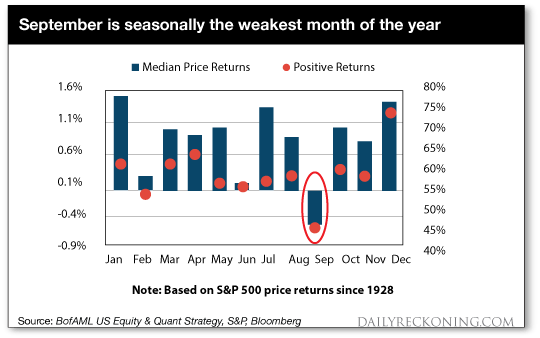

Meantime, Bank of America’s Savita Subramanian has pieced together the S&P’s median September return since 1928.

The facts confirm it. September is the great thief of investor money, not October.

Here is her evidence — the red-handed evidence — exculpatory of October and inculpatory of September:

The “September Effect”

Next to September, we must conclude, October is nearly a month of nectar, a month of honey.

And so today we correct a cruel and libelous wrong…

It is time to replace the “October effect” with the infinitely more deserving “September effect.”

Thus we gird for heavy weather next month. Already the winds gather pace, the sky dims and the barometric pressure drops…

Tomorrow Jim Rickards is holding what he describes as an “emergency briefing.”

It concerns unfolding events in Europe with potentially grave — and nearly immediate — impacts on American markets.

Jim notes that he rarely holds market briefings such as this. Yet he believes today’s urgent developments warrant one. Go here now to register for tomorrow’s critical briefing.

But let us return specifically to the September effect…

History Repeating?

“History may be repeating history itself,” laments Michael Kramer, kingpin of Mott Capital Management.

The fellow’s research reveals ominous parallels between recent market action and past bear market cycles — in 1937, 2000 and 2008.

He concludes, peering out to September and beyond:

Fast-forward to 2022, and while the scenarios aren’t the same, they do have strong similarities. Today, the Fed is aggressively raising rates due to high inflation. In July, hopes that the Fed would slow rate hikes or even pause helped to push markets higher, aided by a better-than-feared earnings season. But the news on Aug. 26 that the Fed wouldn’t stop raising rates anytime soon and was likely to keep rates higher for an extended period has thus far turned the market lower.

While the ending in 2022 isn’t going to be the same, it seems likely given rising inflation, interest rates and the Fed’s determination to slow the economy. The idea that this 2022 bear market will turn on a dime, as many investors have grown accustomed to since 2010, seems highly unlikely. The Fed is not likely to waver anytime soon…

It leaves this bear market cycle far from over or until the Fed changes its policy path.

The Worst Month to Speculate in Stocks

Yet do we hazard a prediction of September doom?

No we do not. We have posted too many false advisories in times past.

That is, we have been forced to munch crow many times in the past — without salt, without butter, without beverages to help it down.

We maintain little appetite for another dose.

Yet if history is a reliable barometer… which we believe it is… September is perhaps the most dangerous month to speculate in stocks.

Along with, as the great scalawag Mark Twain noted…

July, January, April, November, May, March, October, June, December, August — and February.

Comments: