The Rotation is REAL!

We’ve talked about it for months…

Heck, we might have willed it into existence.

For whatever reason, the illusive bull market rotation we’ve patiently waited on is finally materializing.

Today, we’ll discuss what a bull market rotation entails, how it works, and, most importantly, how we can profit from the inevitable rallies that could power the market higher in the weeks and months ahead.

First, some quick background…

Unless you’ve completely detached from the financial noise machine, you already know Big Tech and the stalwart semiconductors have grabbed this market by the ear way back in January and dragged it to new highs.

Yet while names like NVIDIA Corp. (NVDA), Super Micro Computer Inc. (SMCI), Microsoft Corp. (MSFT), and Alphabet Inc. (GOOG) dominated the tape, many other stocks and sectors started to fall behind. Even more impressive has been the mega-caps ability to shrug off extreme overbought conditions, completely ignoring some obvious signs of exhaustion while continuing to push to new record highs week after week.

It’s truly a sight to behold.

To be clear, I’m not the only one yapping about this top-heavy market. Nearly every major analyst has mentioned the dominant mega-caps going back to early 2023. But as we discussed earlier this year, the stock market doesn’t care what we think!

Over-saturated? Overvalued? Overbought? All three might be true – but it hasn’t stopped these stocks from screaming higher.

It’s also worth noting that despite these newfound rotations, the semiconductors haven’t stalled out just yet. In fact, the VanEck Semiconductor ETF (SMH) is still sporting a year-to-date gain of nearly 60% (as of yesterday afternoon, the ETF is less than 4% from its all-time highs). The NYSE FANG+ Index also remains a force to be reckoned with as it sits on a year-to-date gains of almost 40%. For comparison, the S&P 500 is sitting right near its all-time highs and is up “only” 19% so far this year. The biggest of the big remain firmly in control of this market.

But something new has happened over the past week. While the leaders are still clinging to their gains, traders are beginning to rotate to other less-loved corners of the market. This has led to some fast and furious rallies that are hinting at a potential midsummer leadership change…

The Next “Hot Money” Trade

So, how do these market rotations typically play out?

During these rotation events, the market’s strongest stocks consolidate or retreat as other stocks and sectors begin to outperform and take on new leadership roles. If you learn how to spot and take advantage of these rotations, you’ll find that you can grab onto emerging trends and ride them to fresh highs as they begin to dominate the market.

Let’s get back to the big question we asked earlier this year:

When the streaking semis finally get doused with a bucket of cold water, which stocks could pick up the baton and start running?

Well, we’re finally seeing key breakouts emerge in some forgotten corners of the market.

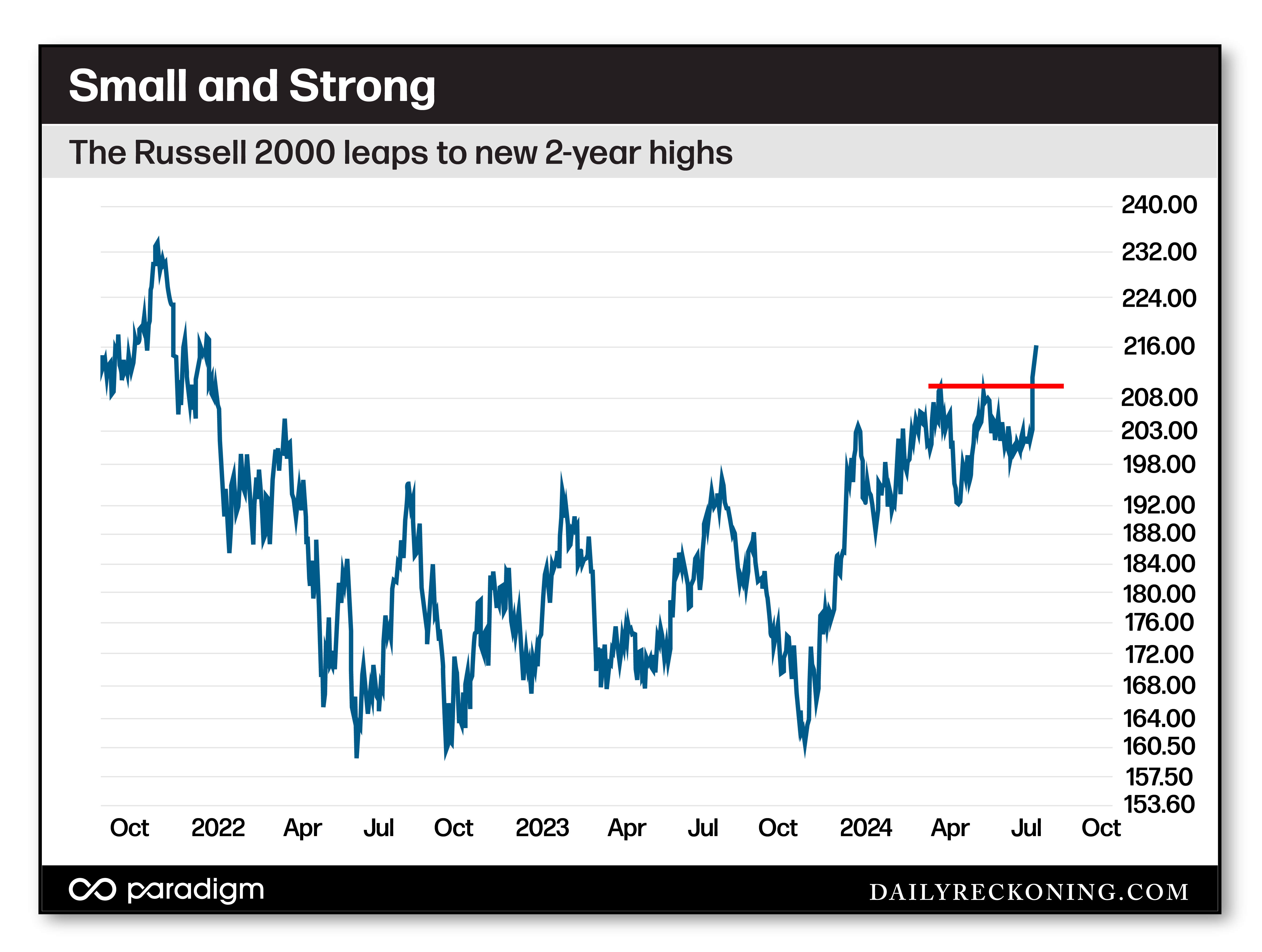

My favorite (and strongest!) move unfolding right now is the monster breakout in the small-cap Russell 2000.

We’ve been watching and waiting for a small-cap resurgence since the melt-up rally began late last year. The Russell 2000 initially snapped out of its stupor and broke above its December highs following a rocky start to 2024.

But it wasn’t able to harness this momentum and extend higher during the first quarter. Instead, small-caps sank back into a choppy range while the mega-cap leaders dominated the tape.

Frankly, small-caps have been a mess for months. We’ve witnessed not one but two false breakouts so far this year as the Russell 2000 badly lagged the major averages.

That all changed late last week…

A midweek surge shot the iShares Russell 2000 ETF (IWM) back above 200… and it hasn’t looked back yet. Following yet another gap higher at today’s open, and the Russell 2000 is now up more than 8% since Thursday morning. That’s an incredible move for these stubborn, formerly range-bound small-caps!

Remember, the Russell 2000 has grossly underperformed the major averages for nearly two years. The Russell was hit hard by the regional banking crisis in early 2023. It also failed to rally with the major averages into the summer months, leading to a hard reset that lasted from August through October.

Most mega-caps were stable during this period while smaller names took a beating, acting as a safe haven for investors worried about the potential for a bigger drawdown heading into the fourth quarter. When the big move lower failed to materialize and the melt-up rally ignited, the Russell flipped its switch and posted a 20% move off its lows.

It’s consolidated in a wide, frustrating range ever since.

Now, we’re finally seeing a powerful breakout that could take these small stocks much higher.

Are these our new market leaders as the third quarter begins in earnest?

It’s possible.

Now that IWM has stabilized and is approaching its 2021 highs, more traders and investors will feel comfortable buying back in. If the rotation theme continues to play out, we could see the smaller stocks outpace the big boys – even if the major averages decide to take a break.

The move has been dramatic. After all, no one was really expecting it. Despite the fact that some of these stocks are short-term overextended, we think they’ll soon consolidate and offer alert traders solid entry points.

This move isn’t finished yet!

Comments: