The Perils of Abusing Leverage

In 2004, I imploded my first trading account.

I was 24 years old and thought I was hot stuff. You see, I had just gotten my stockbroker and financial advisor licenses.

I was young, naive, and ready to take on the world.

My journey began trading hot stocks like Research in Motion (RIMM).

On my second trade, I made $1,400. Wow, this is easy!

That win was the worst thing that could have happened. I ramped it up and started using absurd amounts of leverage. Every trade was at least 30% of the account, and occasionally more than 100%.

Swing trading, daytrading, momentum, I tried it all. And eventually my trading account balance ticked down to zero.

That was my first and only account wipeout. It was a painful – but important – lesson. Fortunately I was young and didn’t have much to lose.

I haven’t used margin since. I learned from the experience, and began holding the vast majority of my portfolio in long-term positions.

Eventually I learned to use options properly, and those are now the only way I employ leverage. When buying options, potential losses are limited to your initial investment. And the possible upside is just as lucrative as margin.

For most of us, however, options should make up a limited portion of our portfolios. Yes, the profit potential is high, but so can be the losses. Keep things balanced.

An NVIDIA Heartbreaker

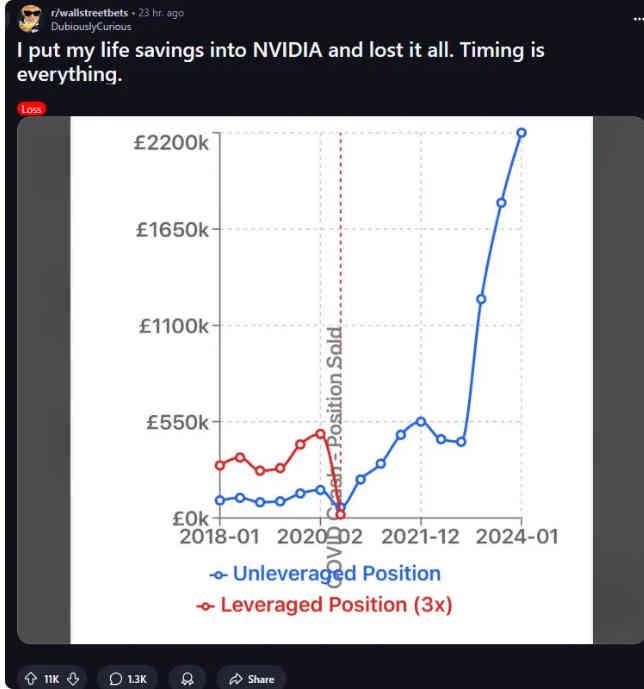

I recently found a painful margin story on Reddit’s infamous WallStreetBets forum.

Back in 2018, a user going by the handle “DubiouslyCurious” correctly predicted the rise of NVIDIA (NVDA). He saw that the company was moving beyond video game hardware and into the nascent AI space.

So DubiouslyCurious went all-in on NVIDIA with his net worth of approximately £100,000 (British pounds). He used margin to leverage his position up 3x.

For a while, everything was going according to plan. NVIDIA shares rose, and his position was in profit. DubiouslyCurious wrote that, “For the first time in my life, I saw a path to financial security.”

And then 2020 happened. The COVID pandemic was a classic black swan event, and the crash wiped out his position.

The chart below, posted by DubiouslyCurious himself, tells the story. The red line is his leveraged position, and the blue line shows how his investment would have performed without 3x leverage.

Source: Yahoo Finance

The story was hard to read. I felt that pain. He had correctly assessed NVIDIA’s prospects, but due to his aggressive use of leverage (combined with Dr. Fauci’s aggressive use of gain-of-function research on coronaviruses), he lost it all.

“I sold when I had to take out the pittance remaining just to buy food. Ironically, of course, as soon as I sell it jumped back up. But by that point the damage had been done.”

If he had simply bought NVIDIA shares without leverage, his position today would be worth over £2 million.

Leverage is not something to be played with or taken lightly. With 3x margin, it only takes a 33% correction to wipe out a position. On top of that, you’re paying interest to borrow the funds.

Learning and Moving On

Many investors have a story like mine or DubiouslyCurious’. It’s practically an initiation ritual for traders. Most of us take a major loss at some point in our experience.

The important thing is that we learn from our mistakes, and incorporate real change into our investing strategies going forward.

The earlier an investor learns this lesson, the better. So in the near future I’m going to let my kids trade with $100 each.

If the plan works, they’ll lose most of it. And by learning this lesson so early in life, they’ll be ahead of the game once they begin their real investing journey. Then I’ll teach them about the virtues of a long-term, balanced approach.

Comments: