The Next Wave(s) of Inflation

Have you ever been caught in a set of gnarly waves at the ocean? The kind where you get smashed by a breaker, come up for air and there’s another big one waiting for you at the surface?

This is a solid metaphor for inflationary periods. They don’t happen like a single big tsunami.

They are typically processes that play out in stages over a decade or more. Policymakers try various fixes, and most fail or only provide temporary relief.

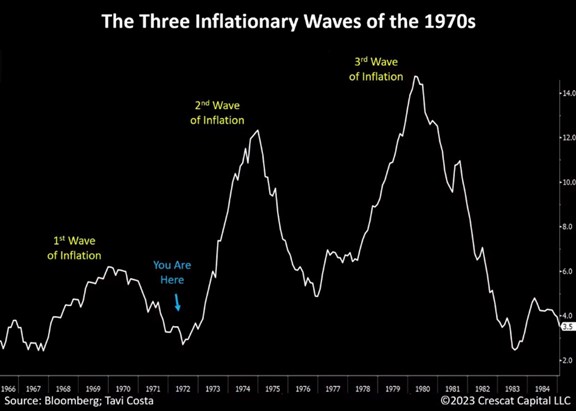

Let’s take a look at the three waves of America’s 1970s inflation…

Source: Crescat Capital

I believe we are currently floating in the trough after the first wave of inflation, catching our breath.

Things seem to be trending in the right direction, despite prices remaining permanently higher.

But the fundamental problems haven’t been addressed, and more breakers loom on the horizon.

Commonplace Problems, Fewer Options

Like most inflationary periods, the ‘70s woes trace back to bad monetary policy and too much government spending.

In 1971, President Nixon ended the dollar’s convertibility into gold after France, Germany and others began to swap their rapidly inflating dollars for bullion.

This set the stage for a decade of stagflation (high unemployment, sluggish growth, and sustained inflation).

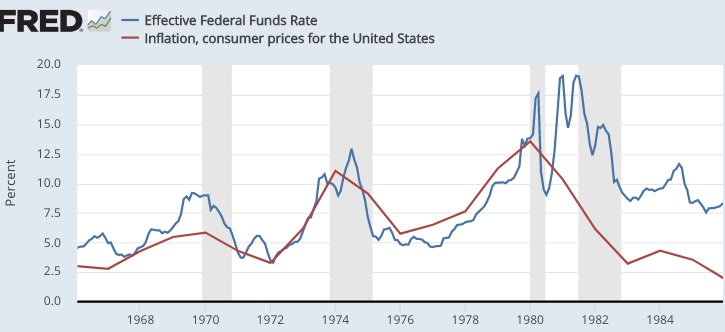

Throughout the 1970s, the Fed hiked interest rates to match CPI, yet inflation persisted.

Source: Econlib

Higher interest rates, price controls, but nothing really worked until the dollar found equilibrium after being severed from gold.

(Eventually, the petrodollar system would help restore demand for dollars, but we’ll save that for a separate article.)

We can learn much by studying the 1970s stagflation. I believe we will also see multiple waves of devaluation and disruption, interrupted by brief respites.

But we also need to acknowledge key differences.

In the 1970s, America’s debt load was not nearly as bad as it is today.

Throughout the 1970s, U.S. federal debt/GDP never got above 35% or so. Today it’s over 120%. At such levels, our country can’t even handle 3% interest rates for much longer.

Interest costs on U.S. debt are soaring and should approach 6% of GDP by the end of this year. At the current pace, we risk a severe debt spiral within the next few years.

This means that if and when inflation returns, hiking interest rates to compensate may not be an option. So this period will almost certainly look different from the ‘70s because the Fed has fewer options to choose from.

Unfortunately, more waves of inflation seem certain. Our financial situation practically guarantees it.

The Federal Reserve, and Americans, may have to simply grin and bear these next waves of debasement. The value of fiat savings will dwindle as yields can’t come close to matching CPI.

Gold: Crucial in the 70s and Today

Precious metals investors thrived in the 1970s. Purchasing power for gold and silver owners was preserved and even grew.

Jim Rogers and George Soros built the foundations of their fortunes by investing in precious metal assets through their Quantum fund.

Here’s a chart showing the performance of gold vs. inflation. Note how gold follows CPI closely during the 70s…

Source: Suisse Gold

The primary difference I see today is the magnitude of the problem we face. It’s far more severe, and the Fed has fewer options.

If anything, gold may be even more important today than it was in the 70s.

There’s only so much Jay Powell can do. Eventually the Fed will have to get “creative.” And when central banks get creative, that’s when money printing tends to get out of control.

Physical bullion is the most obvious way to protect your assets. And makes an excellent addition to any portfolio.

Comments: