The Market Survived The Holidays. Now What?

We waited (and waited) for stocks to find a bottom and recover during the December slide.

Then, we crossed our fingers for a low-volume melt up in that magical window between Christmas and New Year’s Day.

But nothing happened.

Santa was a no-show over our little holiday break. We were instead hit with wave after wave of selling as speculators ditched their broken trades and pouted about the lumps of coal filling the pages of their brokerage accounts.

Perhaps I suffer from a fair amount of stock market PTSD, because the failed December rally prompted flashbacks of late 2021. If you have a short memory, this was exactly when the market started to show serious signs of cracking lower, which it promptly did as the final stalwart stocks broke through support in January 2022, dragging investors into a grinding bear market that lasted almost the entire calendar year.

Fortunately for the bulls, the market stabilized when the calendar flipped to January. So it’s a bit premature to begin leaning on any bearish calls. Not yet, anyway.

Today, we’ll dig into what’s ailing this market. I’ll explain what I think is going on since the melt-up stalled in early December, where stocks might be headed in 2025, and the tickers you need to watch to keep up with the snapback moves that are brewing this week.

First up: let’s talk about the Santa Rally phenomenon.

Technically, the Santa Claus Rally is a period of unusual market strength falling on the final five trading days of the year, and finishing up on the second trading day of the new year. No, stock’s don’t have to go up during this low-volume period. But they tend to do just that as investors and traders “get ahead” of the best plays of the next calendar year.

Here’s the thing…

When it comes to these little seasonal quirks, we tend to gain more information when they fail to materialize.

Everyone was watching and waiting for choice holiday trading conditions. When the big man didn’t show (and stocks continued to drop), speculators started to get worried.

Did Santa Doom the Market?

Is the market completely broken after Santa failed to show?

Not quite!

Here’s my best guess to explain what’s going on:

First, Trump’s victory emboldened the bulls and pulled much of what would have been the December melt-up gains ahead by about a month. November featured a massive crypto breakout and a stock market run that featured some bubbly groups extending higher.

I think it’s fair to say that the market became way too frothy by the time December rolled around. That’s when market breadth began to deteriorate. Fewer and fewer stocks were moving higher, and we once again found ourselves in a market propped up by the mega-caps as

crypto pulled back, many of the snapback tech-growth names cooled, and investors started to get more defensive.

Yes, there’s still plenty of froth out there.

But the market’s sluggish holiday performance caused some ugly numbers to creep into the picture.

For starters, the percentage of stocks outperforming the S&P hit an all-time low over the holiday break, according to Bank of America Merrill Lynch. This adds even more fuel to the arguments about a few big stocks propping up the rest of the market…

Next, we witnessed a handful of failed breakouts – small-caps, biotechs, and many of the popular growth stocks are the most prominent names that ripped above resistance, only to get yanked right back down once the market softened.

Then there are some not-so-bullish seasonality patterns emerging. Now that it’s January, we’re entering a bit of a soft spot for the market. One of the worst quarters during the four-year Presidential Cycle starts now, Carson Research’s Ryan Detrick reminds us. In year one of the presidential cycle, Q1 is the weakest. The Stock Trader’s Almanac also says that a failed Santa rally can precede bear markets, or at the very least time where stocks can be found at lower prices later in the year.

Speculators Save the Day

While I don’t think the sky is falling, I do believe we should do our best to keep our heads on straight as we dive deeper into the first quarter.

Trading conditions could get more difficult by February. Perhaps we see new highs in the averages, followed by some chop and then the beginning of that elusive 10% pullback that the market has managed to avoid (the last one ended in Oct. 2023).

Are conditions about to get a lot more difficult over the next three months?

This question continues to run through my mind as stocks continue to recover this week.

For now, we’ll see if some of these fresh 2025 bounces stick. If the market continues to recover from here, we might enjoy a little pre-earnings season rally for a couple of weeks. While I’m staying tactically long here, I’m still on alert for any evidence that supports a weakening market. If I do start to see these cracks widen, it will be time to look for some downside plays.

Here’s what you should be watching this week to help cut through the noise:

Semiconductors: The VanEck Semiconductor ETF (SMH) is beginning to break out of a six-month consolidation this week. It’s hard to be bearish if the chip stocks are back on top, and NVIDIA Inc. (NVDA) is back to teasing all-time highs following Monday’s 3.4% rally.

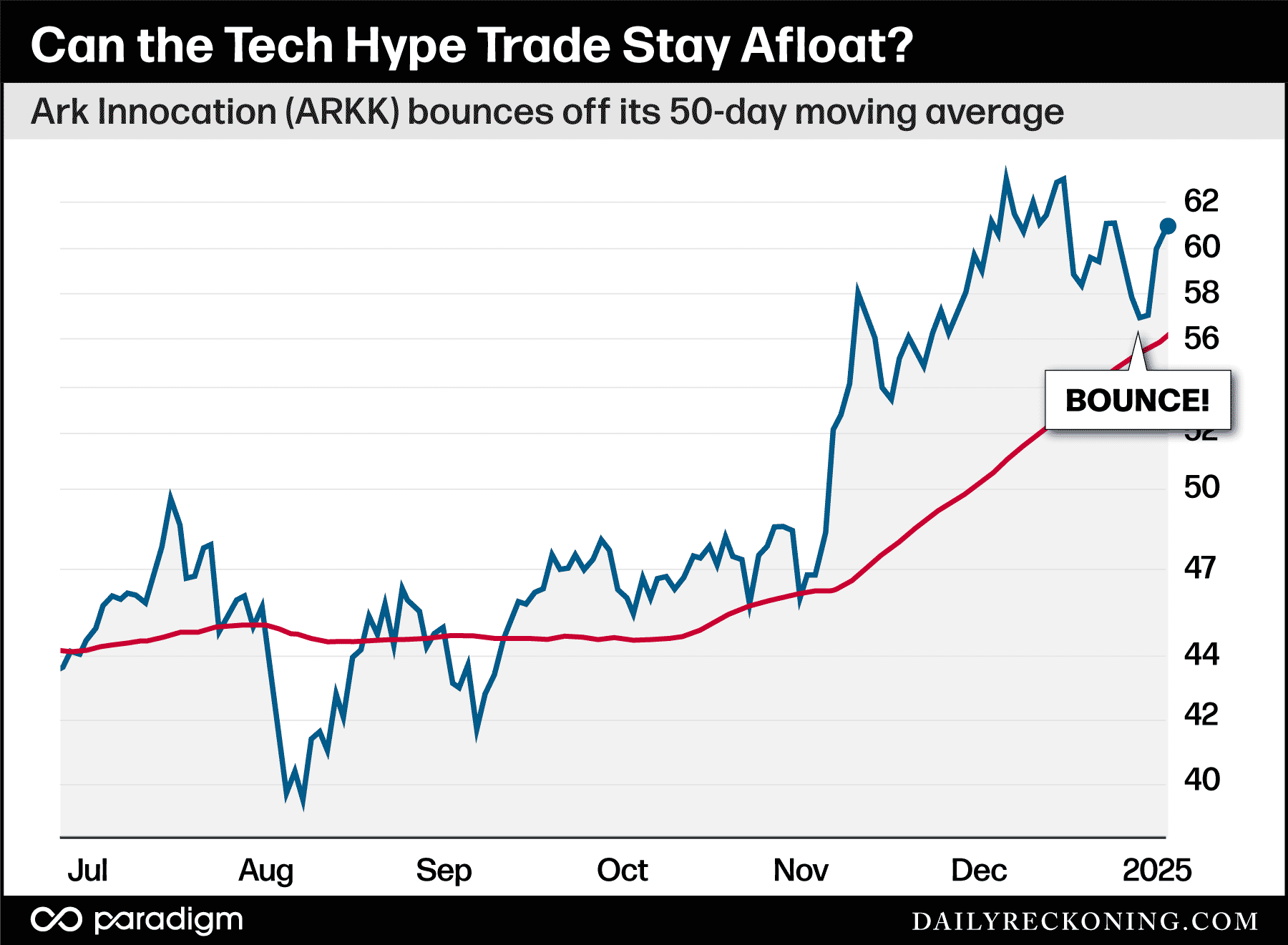

Tech-growth: Many of the tech snapback trades fell flat over the holidays. But our tech-hype proxy ARK Innovation (ARKK) is working to get back on track after just barely kissing its 50-day moving average.

If these “growthier” tech names can make another run, the market’s likely repairing our late December breadth worries…

Crypto: The air came out of Bitcoin just before the holidays as the flagship crypto fell from a high of $108K all the way down into the low 90K range, revisiting support from late November. But crypto started perking up again late last week, and Bitcoin was able to sneak back above the magical $100K level to kick off the trading week.

Bitcoin (and the rest of the crypto space) did exactly what the bulls needed. It established a floor without eating too much into its early November rally. It’s safe to assume that with crypto moving higher to kick off 2025, there’s still plenty of speculative firepower left out there.

Bottom line: If these charts continue to look healthy, there’s no need to get too bearish over shorter time frames.

But if we do see market conditions deteriorate, we’ll discuss ways to prepare (and profit!) in the days and weeks ahead.

Comments: