The Looming Lost Decade

“A lost decade could be in the making for the global economy.”

This is the warning of the World Bank’s chief economist. More from whom:

Nearly all the economic forces that powered progress and prosperity over the last three decades are fading. As a result, between 2022 and 2030, average global potential GDP growth is expected to decline by roughly a third from the rate that prevailed in the first decade of this century — to 2.2% a year…

These declines would be much steeper in the event of a global financial crisis or a recession… It will take a herculean collective policy effort to restore growth in the next decade to the average of the previous one.

We believe there is justice here. We do not believe the present economy can push along much.

Like a pack mule loaded beyond all endurable limits… the present economy is debt-loaded beyond all endurable limits.

The legs are unequal to the burden upon the back. We hazard they are in for a good buckling.

Just Look at the U.S.

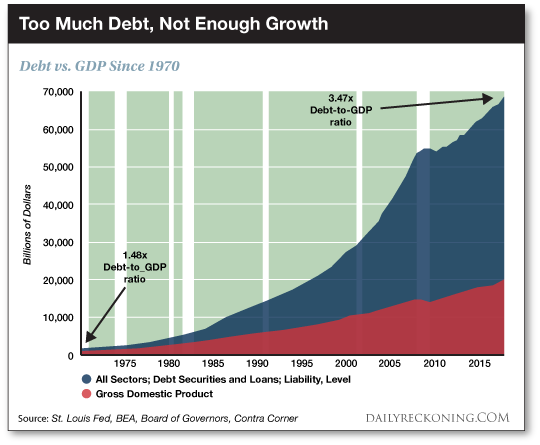

Consider the United States alone…

Its national debt presently runs to $31.6 trillion. Its altogether debt — debt both public and private — runs to a spine-busting and leg-collapsing $94.8 trillion.

Yet the raw and undigested numbers fail to draw the overall sketch. What they miss is… context.

A man stands six feet in height. Is he tall?

By the standards of the horse jockeying profession he is tall indeed. By the standards of the National Basketball Association he is not.

For context we must glance the nation’s debt-to-GDP ratio.

A Future of Gray and Twilight

The United States’ debt-to-GDP ratio rises presently to 125%. That is, the United States heaves up more debt than economic output.

Evidence indicates — evidence we deem credible — that any figure exceeding 90% represents a menace.

It indicates an economy overburdened with debt. This overburdened economy can merely gutter along.

In our estimation this economy presents a future not necessarily of collapse but of gray and twilight, of habitual malaise… of a dank and drizzly November… month upon month… year upon year.

Where’s the Emergency?

Not since 1946 has the United States’ debt-to-GDP ratio summited such impossible heights.

Scotching Messieurs Hitler and Tojo was not inexpensive business. And in that context, an extravagantly unbalanced debt-to-GDP ratio — 119% — was an understandable tolerability.

Yet where is today’s Hitler? Where is today’s Tojo?

If you attempt to inform us he resides in Moscow we will plug our ears. We will not listen.

United States government spending underwent considerable contraction in World War II’s wide wake.

Meantime, the 1950s represented a “golden age” of American economic might. What resulted?

By 1974 the debt-to-GDP ratio of the United States plunged to 23%. The mule could accommodate the load — and plenty, plenty more.

By the close of the Reagan years the ratio jumped to 50%. By the close of the Obama years the ratio leapt to 105%.

And now, after the debt deliriums and derangements of the pandemic years… the ratio goes at 125%.

In reminder: Credible evidence indicates any reading above 90% represents an unsustainable burden.

Thus the American mule whinnies and whinges under the load. It can scarcely advance.

Off Come the Golden Handcuffs

Compare — if you will – today’s debt-to-GDP with 1970’s.

In 1970 the United States government was still jailed in, partly at least, by the gold standard.

Old Nixon issued a pardon in 1971. Thereafter the United States government was free to go spreeing through the credit markets… and drive teams of wild horses through the Treasury.

This it has done:

Today, some 60 cents of each dollar Uncle Samuel spends, he borrows. The remaining 40 cents he collars in taxes.

Contrast these figures with the guns-and-butter 1960s — before Mr. Nixon banged the gold window shut.

You will find the mathematics very nearly inverted.

Seventy-five cents of each expended dollar the government hauled in through taxes. It borrowed the remaining 25 cents.

Productive Debt vs. Nonproductive Debt

We concede it at once: Debt is not what an academic man might term a malum in se. That is, debt is not necessarily an evil in itself.

That is because debt can be shoveled into productive pursuits. The proceeds from these productive pursuits can repay the loan by many multiples.

Yet has our doddering uncle borrowed to invest in a productive American future? No he has not.

He has borrowed largely to satisfy the consumptive needs of the moment. That money which enters through the front door goes instantly exiting through the back door.

Consider the abovesaid 1960s…

Merely 15 cents of each government-spent dollar went channeling toward “transfer payments” — that is, channeling from productive hands to nonproductive, consuming hands.

Today the figure approaches a productivity-sapping 50 cents of each dollar spent.

Some 50% of Americans haul aboard at least one federal benefit. Some 63 million receive Social Security payments. Sixty million receive Medicare. Medicaid, 75 million. Five million American households claim housing subsidies.

Some 40 million Americans take “supplemental nutritional assistance”. That is, food stamps.

Only during the locust years of the Great Depression — from 1931–36 — did government dolings out exceed taxes coming in… as they do now.

Is it any wonder then that the nation sags and groans under $31.6 trillion of debt? We hazard it is not any wonder at all.

Do we hector? Do we preach? Do we wag our finger?

No we do not. We approach the business with the detached air of the accountant. We merely count beans.

Look Yourself in the Mirror

Yet one question must be answered. We have raised it before and we raise it again today:

How did what was once the world’s greatest creditor nation sink so deeply into debt?

It is easy to blame the politicians. But if the theories of democracy have anything in them… We the People must be as guilty as the politicians we elect.

As we have also asked before:

Were the American people humbugged into so much debt? Or have we freely and knowingly put our names to the contract?

Two possibilities immediately suggest themselves…

1) The elected officials of the United States are colossal rogues who amassed today’s $31.6 trillion debt in full defiance of the thrifty American voter.

Or:

2) The $31.6 trillion debt reflects faithfully the desires of the American voter. He has gotten what he wants. At the very least, he accepts it in exchange for the perceived benefits it showers upon him.

As we have argued before: Option 1 mocks our cherished democratic theories. Option 2 stands in full indictment of them.

“Every nation gets the government it deserves,” said 18th-century French philosopher Joseph de Maistre.

Alas, we must conclude the United States has gotten the government it deserves.

Comments: