The Hype’s Demise… Farewell Meme Stocks

Last week, we set out on a search and rescue mission to find the missing Bitcoin bros.

My working theory is that crypto is slowly floating out into the sea of irrelevance. Well, mainstream irrelevance. While Bitcoin and some of the other major players won’t wash away forever, their status as wealth-building speculations will continue to deteriorate and fade from the financial media airwaves.

Once they’re relegated to the financial depths, Bitcoin and the other survivors can pick up the pieces and do their thing (whatever that might be), without having to endure the scrutiny of analysts and short-term traders looking to make a quick buck.

But there’s more to this story.

We’ll get to this idea in a minute…

But first, if we want to fully understand what’s happening with crypto right now, we must examine the quiet bursting of the Covid Bubble and how the pandemic mania of 2020-2021 could continue to affect markets for years to come.

The most important piece of information you must understand is that crypto is not a unique, untouchable asset class that somehow exists beyond the realm of normal market forces. In fact, one could argue that Bitcoin is even more attuned to the whims of the crowd than most stocks because it has no earnings, analyst ratings, or traditional valuation metrics. Therefore, the raw emotional power of speculators is more likely to drive prices than fundamental events.

We can support this theory by examining the Covid Bubble and immediate aftermath, comparing crypto’s performance with other speculative investments. It doesn’t take a technical wizard to see the relationship between crypto and the frothy tech trades that took the market by storm in 2020.

In fact, crypto and the tech-growth trade have remained on the same wavelength and have reacted similarly to various market conditions. Both broke out in the summer of 2020 as the lockdown trading phenomenon picked up steam. They each posted their biggest moves in the second half of 2020 leading into the Q1 2021 blow-off top. They even fell off a cliff together into the bottomless 2022 bear market, holding hands through every short-lived relief rally last year…

It wasn’t until this year when we finally saw crypto begin to diverge from the tech trade. Bitcoin, crypto-adjacent stocks, and the beaten-down tech names all rallied together off their lows in January. But many of these tech stocks continued to push higher throughout the summer months, well after the Bitcoin rally lost its mojo.

Meanwhile, crypto has looked a little shaky. Bitcoin has been essentially marking time since its March rally toward $30K — a level it has yet to convincingly clear this year despite a strong showing in June that ultimately failed. That leaves Bitcoin stuck in a wide range between $25K – $30K for the past six months.

No, we haven’t seen a major breakdown.

Not yet…

But the weakness in crypto is quietly spreading to another formerly frothy area of the market.

Goodnight, Meme Stocks

Has the sleepy action in crypto bored the post-pandemic speculators to death?

More importantly, is this malaise spreading into areas of the markets beyond the cryptosphere?

If you dig below the major outperformers in mega-cap tech, you’ll start to find some of these broken stocks.

But you have to dig deep…

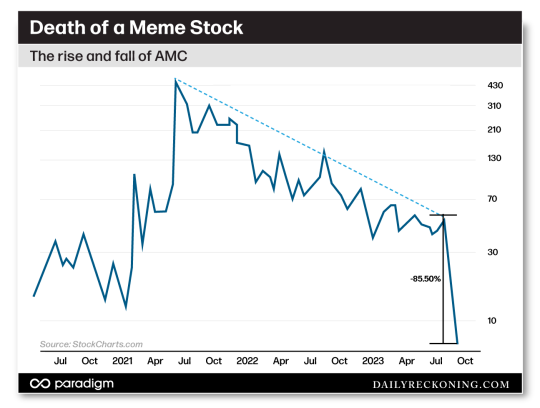

Once you arrive at the wreckage, you’ll find a heap of the formerly unstoppable meme stocks that captured the market’s imagination just a few short years ago. AMC Entertainment Holdings (AMC) resides at the bottom of the pile, down a cool 99% from its 2021 highs.

We don’t hear much anymore about the meme stock everyone couldn’t stop talking about in 2021.

You might be able to dig up some stray articles about flagging share prices as the company raised hundreds of millions of dollars issuing stock to the deluded masses of online stock gamblers over the past two and a half years. But this was a stock that was on the news every single day in early 2021. You couldn’t escape the financial media pumping these ridiculous meme stocks to gullible viewers who believed they were somehow sticking it to the man by temporarily bullying the shares of a failing movie theater.

Where Have the Speculators Gone?

The meme stock “revolution” hit the market with a bang. And it dies with a whimper. AMC has fallen more than 85% over the past six weeks. Few seem to notice (or care).

Of course, AMC isn’t the only garbage stock to parlay its pandemic fame into a couple more years of reverse splits and common stock offerings. It’s just the most egregious. There’s also GameStop (GME) and a now-bankrupt Bed Bath & Beyond. And let’s not forget the pandemic round-trippers. Zoom Video Communications (ZM), Peloton Interactive Inc. (PTON), and others experienced an insanely brief boom-bust cycle that now appears to be coming to its inevitable conclusion.

No one’s buying these stocks anymore. No one wants to talk about them. There was a time when these trades couldn’t lose. Now, we can’t seem to remember what all the fuss was about in the first place.

I believe this action says something bigger about the overall state of the markets.

Bitcoin is sputtering. Meme stocks are dying a slow, quiet death. The biggest, wildest speculations of the early part of this decade are no longer delivering the outrageous gains everyone has come to expect. So, the gamblers are cashing in what’s left of their chips and going home.

They won’t be back anytime soon.

Comments: