The Earthquake Starts Tomorrow

The BRICS Leaders’ Summit is scheduled to begin tomorrow, Aug. 22 in South Africa, which will run through the 24th.

As I’ve been warning, this meeting is the most significant development in international finance in the last 50 years.

It has the potential to displace the U.S. dollar as the leading payment currency and reserve currency from a standing start in just a few years.

This latest monetary change will be delivered by the BRICS, and the world is unprepared for this geopolitical shock to the global financial system. Of course, BRICS is an acronym for Brazil, Russia, India, China and South Africa.

Among the leaders attending the summit are President Xi Jinping of China, President Lula da Silva of Brazil and Prime Minister Modi of India. President Vladimir Putin of Russia cannot attend in person because there’s an outstanding warrant for his arrest on war crimes charges issued by the corrupt International Criminal Court (ICC) in The Hague.

South Africa is a member of the ICC and might have been required to arrest Putin on arrival. The in-person delegate for Russia will be Sergey Lavrov, Russia’s foreign minister.

Shrouded in Mystery

Even at this late date, the official agenda is shrouded in mystery. That’s not unusual considering that the members themselves, especially Russia and China, are accustomed to decision-making behind closed doors.

It’s also not an unusual feature where top leaders are involved. Negotiations tend to go down to the wire; indeed, key decisions will not even be made until the leaders actually get together in one room.

That said, we do know the top two issues that have been discussed by the leaders behind the scenes (often through so-called Sherpas, who are seasoned diplomats working in private to advance the agendas of their respective leaders and to obtain feedback from the other leaders about where points of agreement might actually lie).

What We Know

The first big issue involves new membership. The BRICS may be a five-member group, but over 67 countries have been invited to attend. Among those 67 countries, more than 20 have expressed interest in joining the BRICS, and seven have formally applied for membership.

If any new members are admitted, first on this list will be Saudi Arabia. As of now, both Russia and China favor Saudi Arabia for membership. China is the largest purchaser of Saudi Arabian oil, so a formal alliance including both countries makes sense, especially as they and others move forward on a common currency other than the U.S. dollar. (More about that in a second).

Also, Russia and Saudi Arabia are two of the three largest oil producers in the world (the other being the U.S.), so including both countries in the same group creates a forum that may be more powerful than OPEC when it comes to setting oil prices.

Brazil has been the BRICS member most opposed to admitting new members. That might be understandable in terms of not diluting Brazil’s power within the group. But Russia and China may simply force Brazil’s hand on the issue of Saudi Arabian membership.

We’ll see what happens. As of now, Saudi Arabian admission is a likely result at the summit, but it’s not a sure thing.

Here’s the Important Part

The other major issue is the launch of a new multilateral BRICS currency that might be used to settle trade balances in the short run and then evolve into a reserve currency over a longer period of time.

We know a lot about the potential shape of this new currency based on statements made over the past six months by BRICS leaders themselves as well as their foreign ministers or finance ministers.

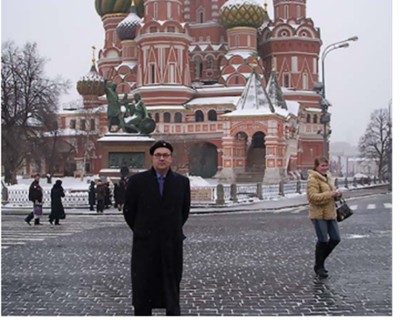

Your correspondent in front of St. Basil’s Cathedral in Red Square in Moscow. Russia is one of the original BRICS and has the largest gold hoard of any BRICS member. The new BRICS currency to be announced is likely to be gold-linked. This will position Russia to be one of the leading backers of the new currency and the de facto BRICS banker to the world.

The BRICS currency will not involve the yuan, ruble, rupee or other national currency of the members. Those currencies will continue to exist for domestic consumption and contracts, but they will gradually be replaced by the new BRICS currency for international settlements.

How It’ll Work

The value of each unit of BRICS currency will not be tied to another currency or basket. Instead, it will be tied either to a basket of commodities (oil, gold, copper, wheat, iron ore, etc.) or simply to gold.

The commodity basket idea is unwieldy (as John Maynard Keynes discovered when he explored a similar approach in 1944), so a non-currency valuation metric is likely to end up with gold (as Keynes also discovered).

However, this may be a two-step process as Brazil and South Africa both place some weight on the role as top commodity producers.

The other key element in the launch of the currency is the expansion of the BRICS membership beyond the current five. This is important not only for the geopolitical reasons noted above but because the larger the membership in a currency union, the more valuable the currency becomes.

The success of the euro is a good example; that currency union has expanded to 19 active members with several more on the waiting list.

When you receive a multilateral currency such as the new BRICS unit in payment for your own goods and services, it’s valuable to be able to spend it in 10 or 20 countries instead of just three or four.

This new currency would be issued by a multilateral central bank controlled by the BRICS members, possibly the New Development Bank created by the BRICS in 2014.

What We Don’t Know

While the outline of the new currency is clear, it’s not clear how much actual progress will be made at this meeting. Russia and China are clearly on board. Brazil is strongly in favor also because of its dislike for the United States and desire to get away from the U.S. dollar.

The reluctant member on this issue is India. This may be due to the fact that Russia has been selling oil to India for rupees and it suits India to be able to print its own currency to buy oil. That’s a privilege that heretofore has been reserved exclusively to the United States.

India’s mini exorbitant privilege may be ending as soon as it began. Russia has put India on notice that it will soon refuse to accept rupees for further oil shipments. This means India will either have to come up with dollars (or gold) or perhaps sign on to the new BRICS currency.

These are issues that will be hashed out behind closed doors over the next few days. It’s unclear what the outcome will be. My expectation is that some announcement will be made about progress toward the new BRICS currency, but it’s premature to announce the currency itself.

Such an announcement is no less momentous to investors than the actual issue of the currency.

The Fact That It’s Happening at All Is Important

Multilateral organizations with disparate views often take a piecemeal approach to agreements of this kind. What’s important is not that everything be done at once, but that something be done at all.

That sets the wheels in motion for the biggest change in the international monetary system since 1971.

We may get some leaks or comments over the next few days, but perhaps not. If there are any, I’ll alert my readers.

Other than any other leaks, the next big news development on the BRICS summit will be the Leaders’ Final Communiqué that will be issued late Thursday. These communiqués are typically 10 pages or so, listing all the matters agreed upon and the next steps.

This formidable grouping of not just the BRICS, but a united Global South is challenging the Western rules-based order and the U.S. dollar.

It will be a busy and critical week. Stay tuned.

Comments: