The Big Bipolar Breakout

It feels like a lifetime ago…

Trump had just won the election. Bullish momentum thrusts were popping up left and right. Small-caps and the major averages were breaking out. Everywhere you looked, stocks were posting new highs.

The small-cap Russell 2000 ETF gapped to fresh multi-year highs, letting loose a barrage of speculative breakouts to post its largest single-day return in more than two years. The Nasdaq Composite and S&P 500 leaped to all-time highs. Also-ran artificial intelligence stocks and quantum computing caught a big, and would eventually bubble up to become the best-performing names on the market.

It was an investing paradise. Everywhere you looked, the universe would reveal a fresh bullish setup for you to consider.

Fast forward just a few months, and we’re trapped in an ugly mess. About a fifth of the S&P 500’s components are left above their respective 50-day moving averages. Most of the frothier trades are completely resetting. And now, we’re watching many Magnificent Seven stocks take a beating as spooked speculators sell everything in sight.

Last week, we discussed the failed Santa Claus Rally and what conditions might develop in the markets during the first quarter. I also showed you a few key areas to watch to help get a feel for which direction this market might break: Bitcoin, semiconductors, and tech-growth stocks.

Spoiler alert: All these themes are lower early this week as the market stumbles out of the gate.

Just how bad is it? For starters, Bitcoin briefly fell below $90K early Monday morning. The VanEck Semiconductor ETF (SMH) has completely forgotten about its breakout last week and has closed in the red every single day since last Monday.

The bulls are clearly nervous here. The big question during pullbacks like this is whether the decline has gone far enough to wash out the exuberance and reset sentiment. Everywhere we look, we see stocks and sectors at do-or-die levels. If they catch and bounce, we’ll get more relief.

If not, more pain. Simple as that.

One of the most difficult mental hurdles during corrective action like this involves turning off your emotions. We have to try our best to remain objective so we don’t get caught buying at the very top, only to get frustrated and sell out just as the market begins to bottom.

Stepping Back from a Messy Market

It’s a mess out there right now. I know it feels like market conditions are changing almost every day. One hour, speculators are attempting to buy the dip in quantum computing stocks. By the next morning, they’re selling their mega-cap tech names.

Decision making is especially difficult during these market shocks.

The first instinct of many investors is to do something.

News is breaking! Markets are in flux! It’s time to make a big move…

Unfortunately, these knee-jerk reactions often lead to trouble. A corrective, choppy market is like quicksand. If you thrash around too much, you’re going to be up to your neck in poorly-judged trades.

During these wilder moves, it’s usually best to take a step back. Yes, you should always honor stop losses on your open positions (I’m not advocating for taking your hands off the wheel). But firing off round after round of directional plays coming off yet another tough week for the averages isn’t a winning formula.

Another valuable market exercise during drawdowns is to turn back the clock to just before stocks turned south.

What were the key market levels before the trouble started? What trends were already changing?

The market’s still chopping along as I type. The averages are attempting to fight off their lows, but they have some more work to do.

Here’s what you should keep an eye on as the week continues…

Mapping Out a Potential Pullback

It’s possible the market is setting up for a decent relief rally following yesterday’s performance. Many stocks were able to fight off their lows. Despite gapping lower to start the new trading week, the Dow and S&P both closed in the green, while the Nasdaq finished lower by less than 0.4%.

Every bounce has to start somewhere. Perhaps the S&P can build on its modest gains and push higher now that it has closed its post-election gap. While this move is entirely in the realm of possibilities, it’s important to keep an open mind while the market is in flux. Too often, traders pounce on every little tick higher that could maybe, just maybe turn into a bigger rally.

That’s why I like to map out alternate scenarios. Instead of getting bulled up every time we see a green candle on the five minute charts, what would the market look like if it kept going down?

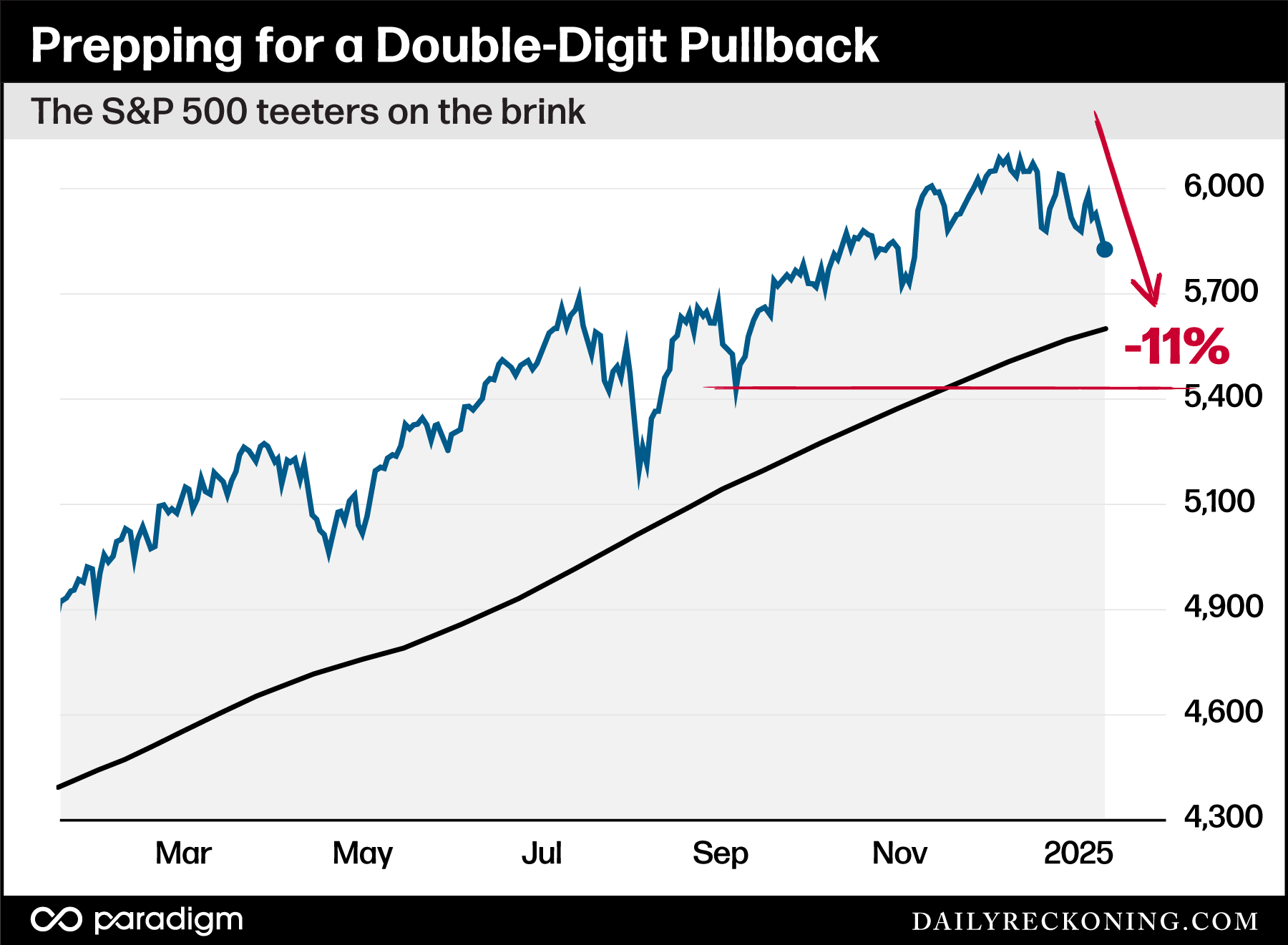

Let’s check out a quick chart:

The S&P 500 is a little less than 5% off its all-time highs and is currently stuck below that gap-up move that occurred the day after the election.

I’ve been on the lookout for the start of a pullback of at least 10% to happen sometime during the first half of this year. While the S&P got close to a 10% drop back in August during the Yen panic, it missed the mark. It has not retreated 10% from its highs since late 2023.

So, why not now?

Remember, 10% pullbacks are an important (and necessary!) feature of all bull markets. If we map out a double-digit drop from all-time highs, the S&P would bounce somewhere near the September lows. This would be a drop of approximately 11% that would also undercut the 200-day moving average – and probably cause a fair bit of anxiety amongst investors.

That’s exactly the type of “reset” move this market could use to stabilize and offer fresh buying opportunities for patient investors.

It doesn’t have to happen this way. But planning for these scenarios ahead of time will help keep your emotions from triggering poor trading decisions.

Stay objective and keep an open mind. If you can execute a plan while everyone else is panicked, you’ll come out ahead every time.

Comments: