Tech Dreams vs. Resource Reality

The modern world began with a hole in the ground.

Around 7,000 years ago, a few clever humans figured out how to work copper into crude, but useful tools and jewelry.

Innovation really picked up 5,000 years ago with the beginning of the Bronze Age. Bronze is an alloy of copper and tin, and it’s far stronger than either element alone.

Bronze was used to make superior weapons, armor, and tools. It was the most disruptive technology in the world for thousands of years. Empires rose and fell based on their ability to access bronze, and build with it.

The Bronze Age collapse of 1200 BC was triggered because all the easy tin deposits had been exploited. In a period of 50 years, almost every great empire collapsed.

But eventually, innovation found a way around this bottleneck. Iron was abundant, but much harder to work with. It had a far higher melting point.

But we figured out a way to wrought then smelt iron, too. That breakthrough would change everything.

Mining is the Foundation

Metals built the modern world. Without them, we’d still be living in wooden huts and teepees.

We wouldn’t have cars, skyscrapers, planes, bridges, or electronics. Metals are also what enable drilling for oil and gas. They are absolutely foundational.

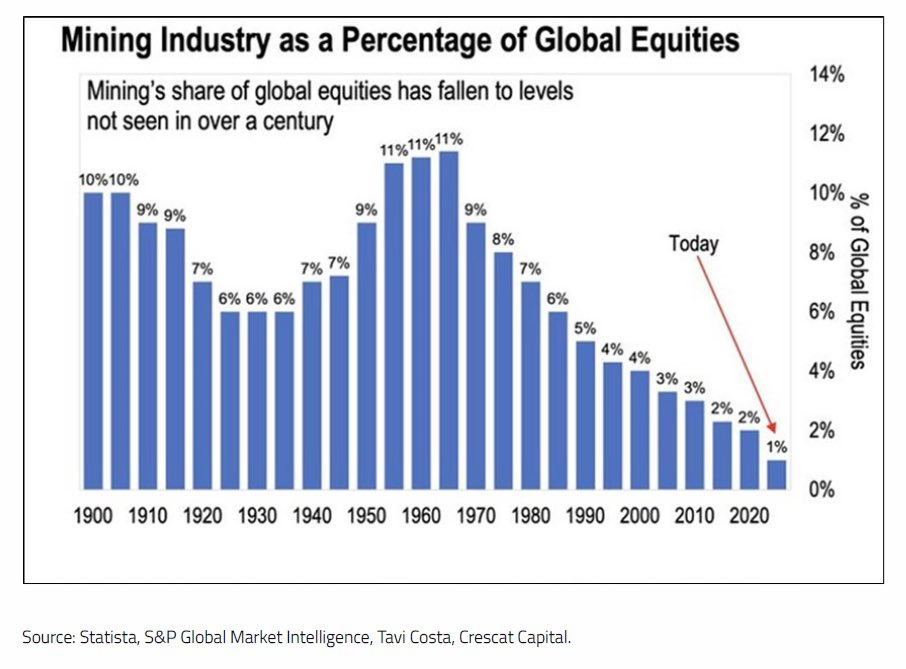

Yet today, mining stocks get little appreciation from investors. Take a look at the chart below, which shows the mining industry as a percentage of global equities (stocks).

Source: Tavi Costa

What a fascinating chart. The entire mining industry, including precious metals, iron, nickel, lithium, aluminum, etc only account for 1% of global equities.

And yet throughout the 20th century, mining made up an average of around 8% of the total stock market. In 1985, just 40 years ago, it was still 6%.

Let’s take a closer look at the chart and try to figure out what explains this shift. The current decline in the mining industry accelerated around 1970.

Now, what happened around that time which could explain a massive shift in the way markets work? Oh yeah, in 1971 Nixon ended America’s gold standard.

1971 was the beginning of a major shift in America. Our economy became increasingly financialized. Now that the dollar was no longer tied to gold, banks, wealth managers, and traders took over an increasingly large portion of the market. The rise of the petrodollar accelerated the change, as foreign money flooded into U.S. assets.

By the mid-2000s it got so crazy that financial sector profits made up 40% of all corporate profits in the U.S.

The global financial crisis in 2008 temporarily slowed down financial profits, but they still make up a huge portion of our economy. It’s not sustainable for a country to make so much money moving funds around forever.

Tech Temporarily Buries Natural Resources

The other factor that explains this curious chart is the rise of modern tech companies. Since the 1990s tech companies have made up an ever-increasing percentage of the overall economy.

To an extent, this is to be expected. As tech plays a bigger role in our lives, it’s natural that the sector eats up a larger piece of the portfolio allocation pie.

But it’s now gotten so extreme that the Magnificent 7 tech all-stars now make up around 34% of the S&P 500.

Just 7 companies making up more than a third of the top 500 American stocks is absolutely wild. We wrote more about this in Pure, Concentrated Risk.

With tech companies trading at unsustainably high prices, a rotation back into real assets is near.

The Inevitable Rotation Approaches

One final factor explains the decline of global mining stocks. America’s stock market dominates the global equity world, making up roughly 50% of global market cap with just 4% of world population.

And due to the rise of financials and tech, America has ignored its natural resources for far too long. We have come to rely on importing the vast majority of minerals and metals.

Besides, red tape smothered new domestic projects before they could get off the ground.

Today, this is finally changing. The trade war has woken Americans up to the idea that we need to become self-sufficient once again. We need our own metals and other critical minerals.

We can’t rely on countries like China for the materials which underpin our economy.

President Trump continues to make positive changes to regulations here in the States which will favor domestic natural resource projects.

This shift, in both attitude and regulation, will combine to bring America’s natural resource sector back to greatness.

We’re already doing well when it comes to oil and gas, but there’s always room for improvement. But mining is the area we truly need to focus on to get back on top of our game.

As our economy shifts back toward producing real things, rather than shuffling money around and selling tech hype, conditions for the average American will slowly improve.

We’ll start to value jobs like welding, mining, and engineering again. Our top minds will stop flooding into tech and banking, and instead head into the real economy.

And investors will finally start to appreciate the critical role that natural resources play in our modern economy.

For a long time, hard assets have been overlooked. This is finally starting to change, beginning with precious metals. But it will eventually spread to the broad natural resource sector.

Now is the time to position our portfolios for the shift.

I hope you all have a nice weekend.

Comments: