Tech Bros vs. Gold Bugs

For the past few years, the world has been infected with a common strain of tech stock fever.

Symptoms include buying stocks at 50x revenue, chasing a handful of big names to ridiculous prices, and believing the bull market can last forever.

This particular strain of tech mania has been around for centuries:

- Railway mania, England 1840s, U.S. 1860 – 1870s

- Electricity and telephone boom, U.S. 1880 – 1900

- Internet boom and bubble, U.S. 1990 – 2000

Technological innovations change, but human behavior never does. It starts out with real tech breakthroughs, and evolves into a raging out-of-control mania. Only the strongest companies survive, and even those almost always crash hard towards the end of the bull market.

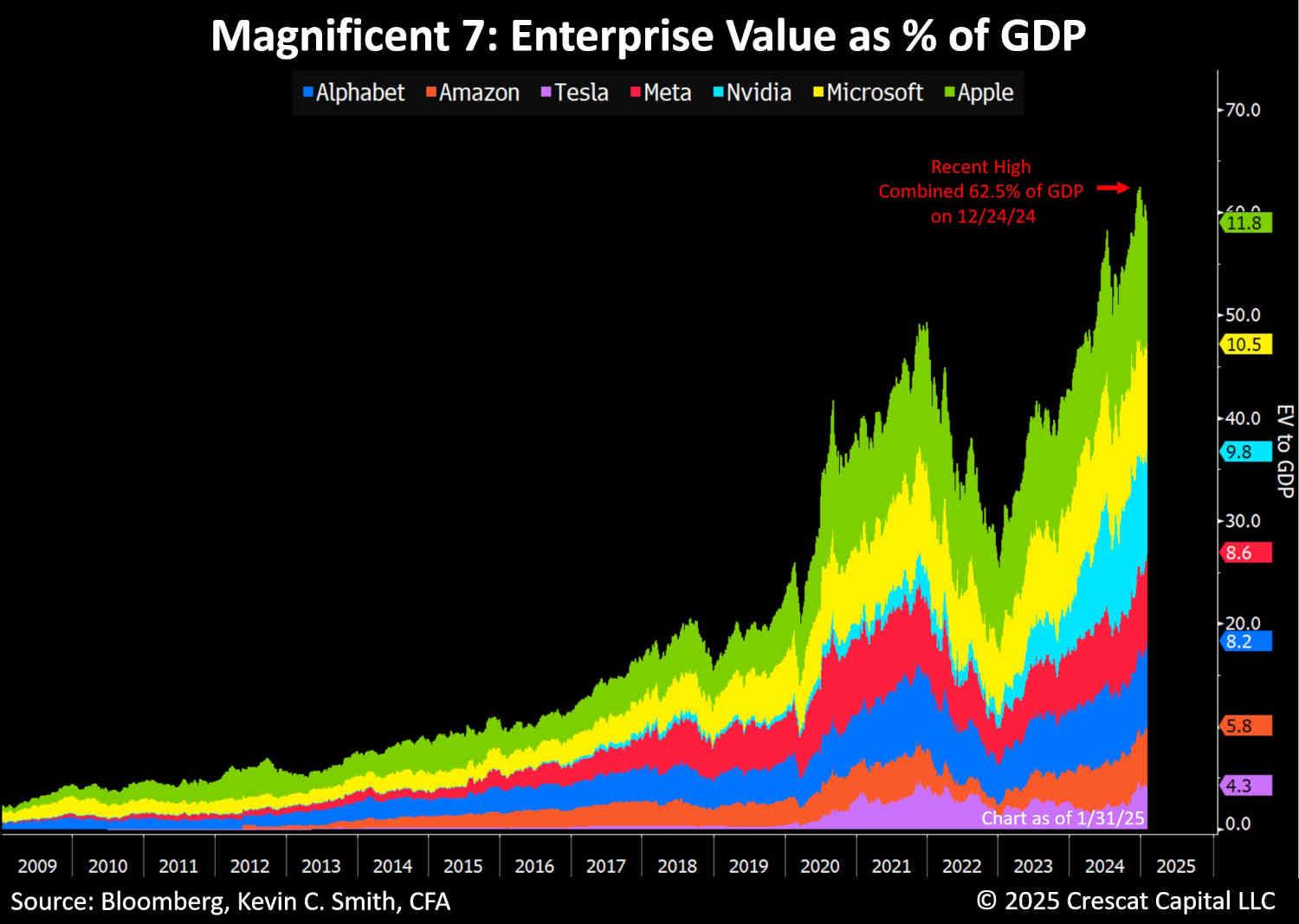

The current bubble in tech stock prices has gotten so extreme, that the so-called Magnificent 7 (Apple, Nvidia, Alphabet, Meta, Tesla, Microsoft, and Amazon) were, near the peak, worth a remarkable 62% of U.S. GDP.

Source: Kevin C. Smith

Sorry, tech bros. It’s almost certain that we’ve already witnessed the peak in tech for this cycle.

For those savvy enough to take profits in tech, where will they shift their capital to now?

A New Fever for Gold

The world is changing. What has worked best over the past 15 years (tech) is unlikely to repeat over the next decade-plus.

A debt crisis nears. Here in the U.S., President Trump and Elon Musk seem to be hitting a wall when it comes to cutting spending. They are making a valiant effort, but Washington D.C. swamp creatures have remarkably robust defenses.

Additionally, President Trump has backed off his idea of cutting military spending by 50%, and now plans to boost it even further.

Even if the U.S. balanced its budget this year (which it won’t), we’d still have more than $36 trillion in debt which costs more than $1 trillion of annual interest expense. These costs will compound higher rapidly from here.

A recession is a near-certainty at this point, and this will strain government budgets even further. Stimulus checks, tax cuts, and QE (money printing) are all in the cards.

And let’s not forget off-balance-sheet liabilities, which is what America has promised beneficiaries in Social Security, Medicare, Medicaid, and other programs. Estimates for these “unfunded liabilities” range from $70-150 trillion over the next 50 years. This is an unfathomably large amount of money. And the bill is coming due.

As a result of this mess, a rotation towards precious metals has begun. Gold is flying higher, and miners are finally starting to catch up.

Just Getting Started

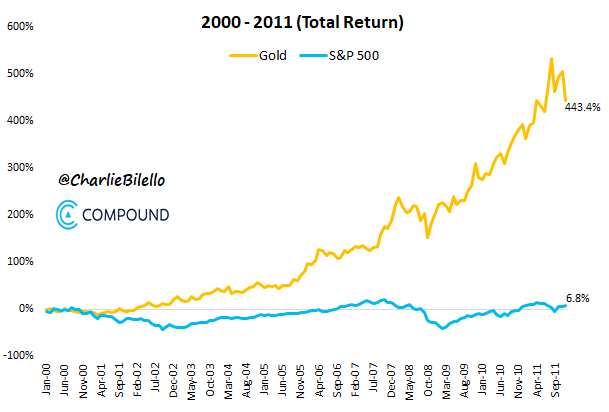

In October of last year, in our article The Gold Bull Cycle Has Just Begun, we featured this fascinating chart, which shows how gold performed vs the S&P 500, from 2000 – 2011.

Source: Charlie Bilello

While gold returned an impressive 443% during this period, gold mining stocks did even better, notching around 700% gains.

Over the past 5 years, the largest gold miner ETF (GDX) has done well, but it’s still only up about 68%. There is still massive room to run.

Additionally, we must consider that from 2000-2011, the U.S. was in great financial shape compared to what we face today.

So the outlook for precious metals is far better than it was back then. I continue to allocate an increasingly large percentage of my portfolio to gold, silver, and mining stocks.

A major rotation out of tech and bonds, and into precious metals is underway. But, and I cannot emphasize this enough, we are still early. It may seem like the move in gold is “toppy”, but history tells a different story.

Sure, there will be precious metal pullbacks, but these should be treated as buying opportunities.

America faces a major financial and economic crisis over the coming years. President Trump and his team are working to address the fundamental issues, but these problems will take decades to address, not months or years.

In the meantime, precious metals remain the safest place to invest. The upside is outstanding (especially in miners and silver), and there is no other sector that will benefit as much from the inevitable chaos over the next decade.

Comments: