Silver, the A-Bomb, and Russia

During a critical stage of the Manhattan Project in 1942, its organizers ran into a problem while attempting to build those first atomic bombs.

They had figured out a way to enrich uranium using electromagnets, but it was a highly resource-intensive process.

Thousands of tons of copper were needed to create electromagnetic coils, but the metal was in short supply due to its use in weapons production. Copper was needed for shell casings, coatings, wiring and other applications.

Thus the leaders of the Manhattan Project decided to secretly borrow 300 million ounces of 0.999% silver from the Treasury Department.

As the most conductive metal in the world, silver was the ideal material for the job. It made highly efficient wire coils, which created the powerful magnetic fields needed to separate and enrich uranium.

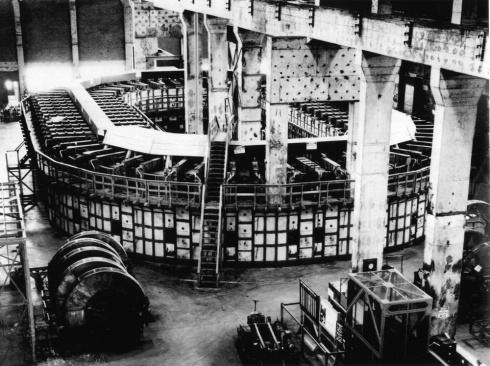

In all, 14,700 tons of US silver was melted down and forged into the massive electromagnetic coils used to build the nation’s initial nuclear arsenal. Nearly 1% of the entire nation’s electric capacity was directed toward these efforts, and the silver coils ensured an efficient use of it.

Source: Phys.org

Needless to say, the project was successful and by 1970 the silver was returned to the Treasury Department.

So in a strange way, America’s silver reserves played a role in ending World War II, which set the stage for America’s ascent to premier global superpower. Without it, the war effort would have been delayed, either by a lack of ammunition, or later development of the A-bomb.

Silver Breaks Out as Russia Buys

Silver coinage in the US ended in 1965. And by the late 1970s, America had sold off almost all of its silver reserves.

Today, nations no longer hold silver as a monetary or strategic asset.

Until now, that is. The Russian government recently announced it would begin adding silver to its precious metal reserves. Allow me to explain why this is a fascinating development.

Russia certainly is isolated from the West. But within the BRICS+ and Global South, its influence has never been greater. Russia is playing a leading role in building the BRICS’ alternative to the dollar-based monetary system. It has no choice, as it has been cut off from the legacy system.

There’s a good chance that other countries will follow Russia’s example and begin building their own strategic silver stashes.

It makes sense for nations to build reserves of silver bullion. As we saw during the Manhattan Project, silver can come in handy in a pinch. Most nations have a strategic oil reserve. Every serious central bank has gold reserves. Why not silver too?

In today’s technological world, silver is more important than ever. It’s critical for building advanced electronics, batteries, solar panels, medical supplies, and more. Additionally, modern weapons require silver to operate at the highest level. When precision and efficiency truly matter, silver is the clear choice.

Following this news out of Russia, it’s probably not a coincidence that silver has broken out to 12-year highs.

Source: Kitco

As you can see, silver broke through resistance around the $32.50 level with gusto.

In Silver: So Much Bigger Than 2011, I explained how the fundamentals for silver demand already looked excellent before Russia’s announcement.

Now we have the possibility of national buyers jumping on board. This could create massive demand, as we have seen with gold’s recent run, which is almost entirely driven by central banks (see Metal Mania Starts Soon for more on that).

In contrast, silver’s bull run so far has been driven primarily by industrial demand for solar panels, electronics, and medical uses. But as I argued in my last article on silver, I believe investment demand will grow rapidly from here.

In the US, inflation expectations are soaring. The Fed is back in easy money mode, and investors are finally beginning to sense something significant happening in precious metals.

Silver is a tiny market compared to gold. A small amount of additional investment demand may upset the balance and send prices far higher. If we see nations buying silver, along with additional investor demand, the result could be explosive.

If we get a significant economic recession, silver could fall temporarily due to lower industrial demand. But in my view, that should be offset by the increase in investment demand as central banks are forced to respond to the slowdown with quantitative easing (QE) and other inflationary policies.

Silver looks fantastic as a long-term investment and hedge here. Personally, I don’t plan on selling any before it’s in the triple digits.

Comments: