Silver Miners are Printing Money

Precious metal miners have done very well over the past year.

But today I’m going to show why silver miners in particular have much further to run based on current metal prices (hint: it involves a 10x increase in profits).

In 2025, gold rose about 70%. Silver jumped an impressive 130%.

People unfamiliar with mining may think the industry’s profits jumped in line with these price increases.

But that’s not how it works. Profitability is increasing by multiples of the underlying metals. Especially for silver.

Let’s look at a real world example and run the math.

Pan American Silver (PAAS) is a large silver and gold miner (disclosure: I own it, along with most other big silver producers).

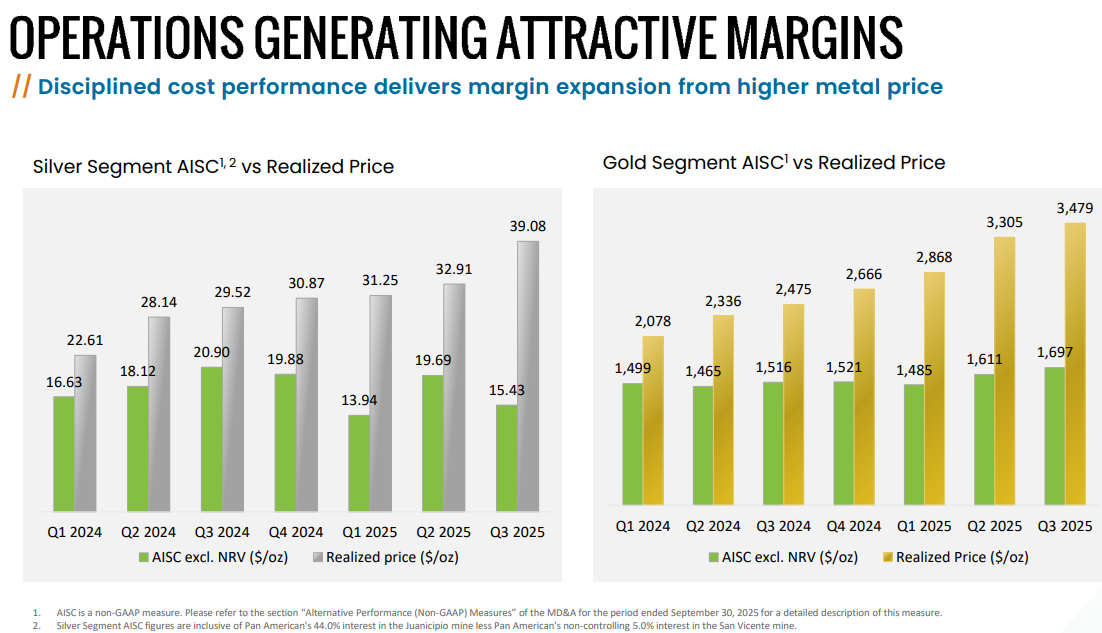

In the company’s most recent investor presentation, they show how much it costs them to mine each ounce of gold and silver. This is known as the all-in sustaining cost (AISC).

Source: Pan American Silver

As we can see, in Q1 of 2024, Pan American was mining silver at a cost of around $16.68 per ounce. They sold silver during that quarter at an average price of $22.61 per ounce.

So in Q1 2024, they made a profit margin of roughly $6 per ounce.

By Q3 of 2025, the price of silver rose to an average of around $39/oz. Pan American’s AISC decreased slightly, so their profit per ounce rose to $23. An almost 4x increase from Q1 2024.

When the company reports Q4 earnings, that profit per ounce will rise more.

And if silver stays around the current $80 level, and their costs stay around $16/oz, the profit/oz will rise to a crazy $64/oz.

So from Q1 2024 to Q1 2026, many silver miners’ profitability per ounce has increased by a ridiculous 10x.

In Q3 2025, PAAS produced around 5.5 million ounces of silver. If they maintain that production in this current quarter, and sell at an average price of $80/oz, the company could earn about $352 million in 3 months, from silver alone.

And like most silver miners, Pan American also produces a lot of gold and other metals. In Q3 2025, PAAS produced around 153,000 ounces of gold at an AISC of $1,697.

That is a very long way of saying that silver (and gold) miners are absolutely printing money in this environment. And to be clear, Pan American is not unique in this regard. Most big producers are making similar profit margins.

Hopefully this explains why I’m still holding onto all my miners, despite the impressive gains last year. If silver stays above $70 through 2026, miners should do incredibly well. But if it rises to $125/oz? They should go wild.

One important note: AISC (all-in sustaining cost) does not actually include everything. It’s a non-GAAP measure, but is widely followed in the industry and is an easy way to get a gauge on a miner’s profitability.

A Fantastic Environment for Producers

Running any kind of mine requires vast quantities of gasoline and diesel. Giant bulldozers, diggers, loaders, and haul trucks are necessities.

So fuel can account for up to 15% of a miner’s costs.

The fact that oil is currently trading under $60/barrel is fantastic for the industry.

I would argue this is one of the all-time great environments for miners. For example, the 1970s, which was a spectacular precious metals bull market, had much higher (relative) fuel costs. Miners still did incredibly well.

In some ways, this environment is even better. Especially for big producers with existing mines, which is where most of my portfolio is allocated.

I want to primarily invest in the companies making a killing today. Not ones that have a long road of capital raises and permitting ahead of them.

Starting a new mine today is still a nightmare of red tape. While President Trump is attempting to make it easier here in the U.S., the vast majority of precious metals are mined abroad. And it’s still a multi-decade process from discovery to production. This makes operating long-life mines all the more valuable.

In my view, our situation today heavily favors large producers. I have a few explorers and developers in my portfolio, but about 85% of my miners are producers (for more on this, read The 3 Stages of Gold Miners).

Spending the Money

So miners are printing cash, and should be making even more soon.

What will they spend it on? A few things.

First of all, many smart mining companies are reducing or eliminating their debt. This is always a solid use of funds.

Secondly, we’re likely to see a continued wave of mergers and acquisitions. A good mine will last a decade or three, but companies need to always be thinking about the future. If they can snap up great assets at a fair price, this is also an excellent use of capital.

Third, they’re boosting dividends. Yields on gold and silver miners aren’t huge, but they’re growing fast. And these payments add up over time. I always reinvest my dividends using a DRIP program, which helps to compound returns faster.

Fourth, and this is what we don’t want to see, some companies will undoubtedly boost executive compensation. Sure, if a company is well run, the leaders deserve to be rewarded for it. But most of this pay should be in the form of stock options, not cash. And they should be reasonable. This is something to watch for, because once a miner’s culture becomes self-enriching, it is a difficult thing to reverse. We’ll keep an eye out for misbehaving miners.

To be clear, I don’t think excessive pay is a big problem in miners today. From 2012 to 2022, the industry went through a rough patch and was forced to get lean and mean. The cultural discipline developed over those years should hold for a while.

Hopefully this piece helps explain why despite huge gains over the past year, I haven’t sold a single silver miner. And have no plans to anytime soon.

Comments: