Saudi and Russia: Best Buddies

Some of the best friendships start that way.

A knockdown, dragout brawl kicks things off. A brutal beating was taken on both sides. A moment of clarity ensues. The look that says, “What did we start fighting over to begin with?”

A shoulder shrug, indicating no one can remember what the catalyst was. A smile. A handshake. And a drunken night out with raucous backslapping and man hugs to consummate the new, fast friendship.

It seems the Saudi-Russian bromance knows no bounds.

Since their kerfuffle in the oil market crash of 2020, MBS and Pooty Pooty have been fast friends. And if the news is to be believed, the Saudis went above and beyond the call of duty to their relatively new friends.

According to Bloomberg, Saudi Arabia whispered to its buddies earlier this year it would sell its European debt holdings if the G7 seized $300 billion in Russia’s frozen assets. “Whispered,” in this context, means “quietly threatened.”

Let’s get into this newfound friendship and why it’s such a big story on the political stage.

The Russia/Saudi relationship experienced significant shifts after the oil crisis of 2020. Here’s a detailed look at how their relationship evolved.

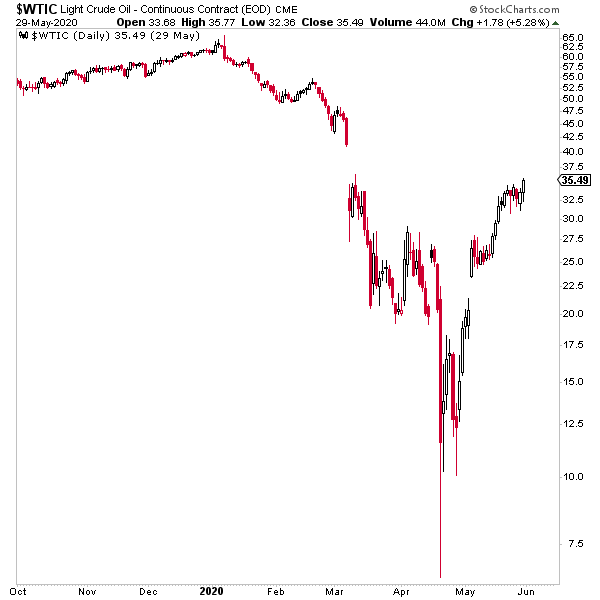

The Oil Crisis of 2020

In March 2020, a “disagreement”— their word, not mine — between Russia and Saudi Arabia over oil production cuts led to a price war. This was in the period of collapsing global demand thanks to the government-mandated private sector shutdown known as the COVID-19 pandemic.

Initially, both countries increased production, flooding the market with oil and driving prices to historic lows, even into negative territory for a brief period.

Changes Post-2020 Oil Crisis

After the initial price war, both countries recognized the mutual harm of continued low oil prices. In April 2020, they and other OPEC+ members agreed to historic production cuts to stabilize the market. This marked a significant reconciliation and deepened their cooperation within the OPEC+ framework.

Post-crisis, Saudi Arabia and Russia managed oil production and supply together. They coordinated subsequent agreements to adjust production levels in response to market conditions, demonstrating a more unified approach to oil market management.

The crisis underscored the importance of collaboration between the two major oil producers. Both countries expressed a commitment to long-term cooperation to avoid future market destabilization. This strategic partnership started to extend beyond oil, involving discussions on broader economic and political cooperation.

And that’s where it started getting interesting.

Their relationship saw an increase in joint investments and economic initiatives. Both countries explored opportunities in energy projects, infrastructure, and other sectors to diversify their financial ties.

The oil crisis acted as a catalyst for closer diplomatic relations. Both countries recognized the importance of maintaining a stable and cooperative relationship to increase their benefits internationally.

They took a more proactive role in stabilizing oil prices and engaged in continuous dialogue and regular meetings to assess market conditions and adjust production levels.

Saudi Arabia and Russia also developed better crisis management mechanisms to prevent future disagreements from escalating into price wars. These included more transparent communication and a willingness to compromise on production decisions.

To be fair, it was much easier to develop this relationship because the U.S. experienced its shale oil revolution, and the Europeans caved into their Green parties, getting scammed into less efficient alternative forms of energy like wind and solar.

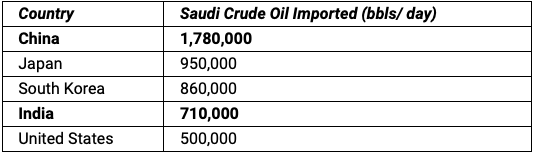

This and the crisis highlighted the delicate balance of power and influence in the global oil market. Saudi Arabia and Russia, through their collaboration, aimed to counterbalance the influence of other major players, particularly the United States, in the global energy landscape.

Saudi Has Russia’s Back

Therefore, the Saudis’ threat to dump European bonds if the G7 confiscated $300 billion in Russian assets is a strategic move analyzed through several lenses, reflecting geopolitical, economic, and strategic considerations.

Saudi Arabia and Russia have a significant partnership, especially in the energy sector. We know they’ve worked closely within the framework of OPEC+ to manage oil production and prices. The Saudis view confiscating Russian assets as a destabilizing move that could harm their ally and, by extension, their interests in maintaining stable oil markets and prices.

Europe is a major trading partner for Saudi Arabia, and the Kingdom holds substantial investments in European assets, including bonds. Threatening to dump these bonds is a way for Saudi Arabia to leverage its economic power to influence G7 decisions, signaling that punitive actions against Russia will have broader repercussions for the global financial system and will not be tolerated.

By threatening to dump Europe’s government bonds, Saudi Arabia is warning of potential financial instability that will arise from such a large-scale daylight robbery. The sale of a “chunk” of European bonds will significantly impact yields and borrowing costs for European countries, potentially triggering a broader financial crisis.

Saudi Arabia’s threat is also a defensive move. If the G7 sets a precedent by confiscating Russian assets, other countries with significant holdings in the West, including Saudi Arabia, fear similar actions in the future. In this light, the threat can be seen as a determined move to protect their financial interests.

The threat should also be interpreted as diplomatic signaling, indicating Saudi Arabia is willing to take drastic measures to support its geopolitical and economic partners. It reminds us that actions taken by major powers like the G7 have unintended, far-reaching consequences.

Wrap Up

The Saudis’ threat to dump European bonds in response to the potential confiscation of Russian assets by the G7 is a complex interplay of geopolitical strategy, economic interests, and financial stability concerns. It reflects the intricate web of relationships and dependencies that characterize global politics and finance. Saudi can’t be counted on anymore to do the U.S.’s bidding, those days died with Kissinger.

Comments: