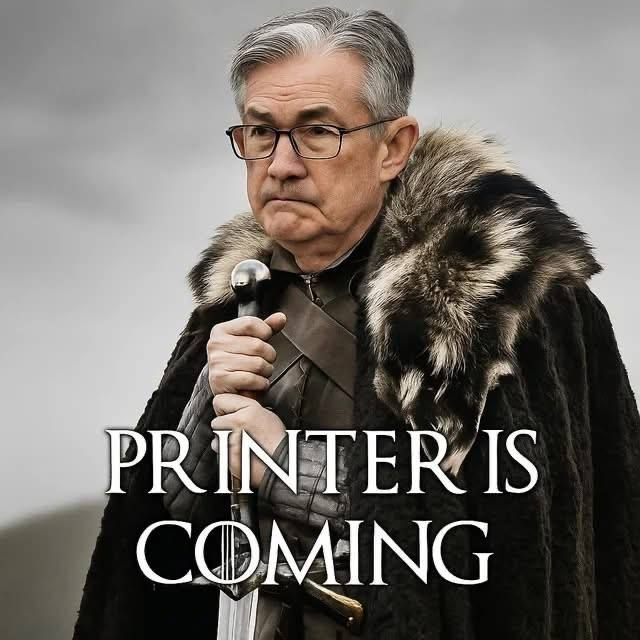

Printer is Coming

After the stellar year we’ve had in precious metals, a correction was inevitable. Necessary, in fact.

And last month, it finally happened.

Gold fell about 10% from a high of around $4,400 to $3968.

The GDX gold miner ETF slipped from a high of $85 to $68. Almost exactly -20%.

Silver fell from around $54 to $47 (-13%), while the SILJ junior silver miner ETF dropped from $27 to $20, a substantial 26% drop from peak to trough.

It’s interesting to see that miners fell about 2x as much as the underlying metals. That’s leverage for you, and on the upside it can be absolutely beautiful.

Over the past week, precious metals and miners are bouncing back nicely. Silver is back above $50, gold’s sitting around $4113, and miners are jumping again.

It looks like the drawdown may be over.

As I explained in last month’s Keep Calm and Hold Gold and Silver Miners, I’m sitting tight. I want to hold these positions for at least the next 3-5 years, and have no plans to sell anytime soon.

In my view this bull market in precious metals and miners still has plenty of gas in the tank. Today we’ll explore why.

FISCALLY FUBAR

When President Trump was elected in November of last year, gold fell 3% the following day. Hopes were high that he and Elon Musk would be successful with their DOGE initiatives. Scott Bessent was viewed as a deficit hawk who would help clean up the mess in D.C.

But despite this administration’s efforts, spending reductions haven’t materialized. It turns out that draining the swamp is, for now, impossible. This realization has played a significant role in the impressive performance of precious metals this year.

Federal spending is still spinning out of control, with U.S. annual deficits running around 7% of GDP. And if debt is growing that fast in the middle of a bubble, imagine how it’ll look during the next recession.

The Federal Reserve has begun an interest rate cutting cycle, and any major economic hiccups will accelerate it.

Central banks around the world continue to accumulate gold at a rapid pace. The dollar is out of favor, and gold is in. This is a sea-change in central bank policy, and I don’t see it changing anytime in the next decade or two.

As we have covered extensively, private investors have only just begun to dip their toes into precious metals. Exposure to gold and silver remain extremely low.

The chart below shows just how low gold and miners are as a percentage of total global assets compared to previous cycles.

Source; Tavi Costa

So yes, this environment is still a bullish one for precious metals. And we haven’t even gotten to the most disturbing stuff yet…

Social Security, Medicare, and Unfunded Liabilities, Oh My…

As a young man, I remember reading about how Social Security would be bankrupt well before I ever received any return on my contributions.

So those deductions on my paycheck are mentally written off as money flushed down the toilet.

Well, Social Security’s day of reckoning is indeed approaching. Via CNBC:

Social Security payments for retirees will still be available after 2033, but they’ll only receive 77% of their full benefits.

The fund used to pay disability benefits is anticipated to become insolvent in 2034, at which time it will be able to pay 81% of benefits.

So by 2033, retirees are on track to only receive 77% of their benefits. That’s assuming inflation doesn’t get worse, which would cause the system to go bust sooner due to cost-of-living increases.

Let’s also remember that government estimates have a tendency to be far too optimistic.

So what happens when Social Security and disability payments start coming up short? Will the government tell citizens to grin and bear it? Or will they print money to pay the difference?

My guess is we’ll print money to pay the difference. Social security is a sacred cow. Millions of people were forced to pay into it, and I don’t see the feds telling people to pound sand when it comes time to collect.

Instead, what’s more likely is that inflation will slowly eat away the value of those payments. Sure, they’ll raise payments in line with official CPI, but as we know, the books are cooked when it comes to government inflation measures.

Medicare will also soon face funding difficulties. The Medicare trustees recently said the key Hospital Insurance trust fund will be depleted in 2033, moved up from its previous estimate of 2036.

Hopefully these looming deadlines will create some urgency. There is a lot of fraud and waste that can be cut from these programs, but at this point we’ve waited too long to address the fundamental problems.

Printer is Coming

Our friend Sean Ring recently posted this in the Paradigm company chat:

Indeed, the Fed will soon have no choice but to lower interest rates to near zero, and fire up the money printing.

Once the next round of quantitative easing (QE) gets rolling, people are going to be shocked by the scale of it.

Somebody has to absorb all the debt America is set to unleash over the coming years. It’s no longer being gobbled up by foreign investors. The Fed will have to buy an increasingly large share of the Treasury’s bonds and notes.

Social programs are practically impossible to cut, so the Fed will need to pick up the tab there too, probably.

And then there’s our soaring costs to pay the interest on our nation’s debt. That’s another reason rate cuts need to be drastic. The Fed’s going to have to buy a lot of treasuries to keep rates near zero this time around.

Nothing has changed about the fundamental case for gold, silver, and miners. If anything, it continues to strengthen.

Some people assume that since gold and silver have doubled in a few years, it’s time to take profits. This is the wrong way to look at it.

We’re in the middle of an unprecedented debt bubble. The global monetary order is rearranging itself. Central banks are about to embark on a money printing spree that could last another decade.

So no, a 20% correction shouldn’t shake us out of our positions. I’m holding strong, and if you have a medium or long-term time horizon, I suggest you do the same.

There’s no guarantee the correction is over, but I feel much better now that a correction has finally taken place. Parabolic moves aren’t sustainable, so it’s good we’ve moved past that phase.

It wouldn’t hurt to have a consolidation phase here where things leveled off for a while. But the market may have other ideas for us.

Let’s watch…

Comments: