PACO vs. TACO

First things first. Let’s define these acronyms.

PACO = Powell Always Chickens Out. A new twist on TACO.

TACO = Trump Always Chickens Out. A tired line from mainstream media.

The big question is, who will bend first? President Trump, or Fed chief Powell?

At this point, their battle has been raging for Trump’s entire second term.

Last year, President Trump gave Federal Reserve head Jerome Powell a Native American-style nickname. “Too late”.

As in “too late” on slashing interest rates. He threatened to fire Powell and even sue him for “gross incompetence”.

Now a criminal investigation into Fed chief Jerome Powell has been opened. It involves the Fed’s wildly expensive $2.5 billion headquarters renovation, and Powell’s testimony to Congress about it.

Trump denied involvement, telling NBC News he knew nothing about the investigation, “I wouldn’t even think of doing it that way. What should pressure him is the fact that rates are far too high. That’s the only pressure he’s got.”

A grand jury investigation and subpoena of the Fed boss has never happened before.

According to CNBC, analysts at JPMorgan now expect the Fed to stand firm and keep rates at current levels, despite Trump’s pressure campaign. “We now expect the Fed to stay on hold throughout 2026.”

Chair Powell responded to the investigation on Sunday, an extremely unusual move. The Fed published a video statement via their X/Twitter account.

Powell looked like he hadn’t slept in a week. But he argued that this investigation is about Trump’s desire to gain control over the Fed:

“This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions, or whether instead monetary policy will be directed by political pressure or intimidation.”

Root Causes

In fiscal year 2025, the federal government spent $7 trillion. Tax receipts were $5.2 trillion, leaving a $1.8 trillion deficit which needed to be financed with new debt.

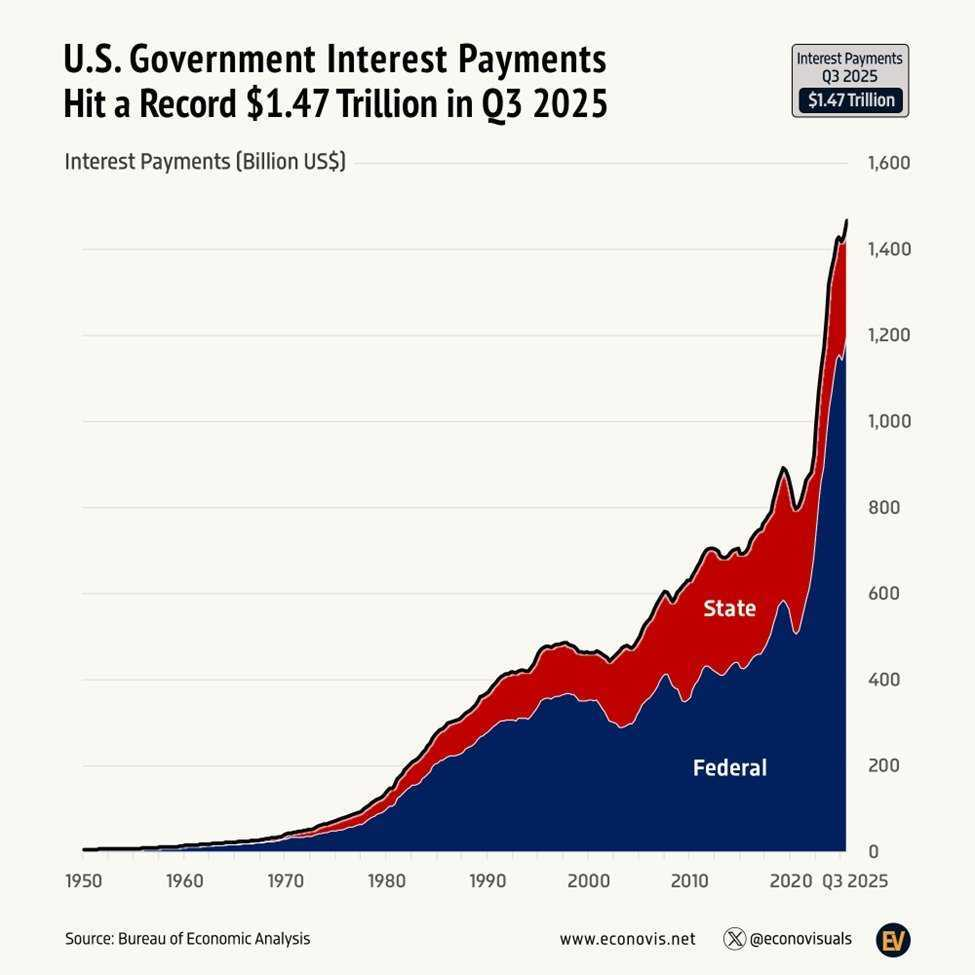

$1.2 trillion of the federal deficit came from paying the interest on our debt alone. See the chart below.

Source: Econovis.net

Look at that hockey-stick spike over recent years. It was caused by pandemic spending, and much higher interest rates.

We’ve now reached the point where paying the interest on our debt is a major drag on the economy.

The only way to lower interest costs is for the Federal Reserve to slash interest rates. The alternative is paying off the debt, which is never going to happen.

Now the President can’t come out and say “Hey Jerome, we need you to lower rates so that we don’t enter a debt spiral during my second term.”

Instead, Trump argues that lower rates will support the economy, stock market, and homebuyers. Which may be true over the short run, but long-term there are no good solutions to a debt crisis.

I believe the real urgency around lowering rates is to slash interest costs. Otherwise our debt and deficit will snowball even faster.

We’ve reached the stage where debt is so high, and interest costs so expensive, that interest rates need to come down on that basis alone. President Trump and Treasury Secretary Scott Bessent surely realize this.

Financial Repression Approaches

We are entering a period of financial repression. High deficits and debt. Artificially low interest rates. Money printing. Welfare and stimulus. And ultimately, inflation.

People who save in cash and bonds will likely take the brunt of the pain. The best escape is hard assets.

This debt crisis has been building since the 1980s, but we are now reaching the terminal stages.

There’s no easy way out of it. The only paths are:

- Inflationary – Print money, lower rates, try to inflate away the debt

- Deflationary – An economic and stock market collapse

Throughout history, governments almost always choose the inflationary/money-printing path. It’s just a lot easier, and allows the status quo to remain relatively intact, for a while at least.

Essentially, the inflationary path is kicking the can down the road. And governments will always choose that given the option.

Who Breaks First?

So, who will bend first – Trump or Powell? Powell is my guess.

But it doesn’t really matter.

Powell is also fully aware of the interest cost problem. But he wants to maintain the appearance of a responsible and independent Fed.

So he’s waiting until something really bad happens, like a stock market crash, to slash rates to near zero and ramp up QE.

But no matter what, the future is full of money printing. It’s already begun, with $40 billion of Fed Treasury-buying beginning just last month.

And President Trump is kicking off a QE-like campaign of his own, instructing Fannie and Freddie (government-backed mortgage giants) to buy $200 billion worth of mortgage bonds in an effort to lower rates.

So whether Trump is forced to replace Powell or not, the Fed will be churning out money in the near future. It’s just a matter of power and keeping up appearances.

Powell just wants to protect the Fed’s image, and pretend to be a responsible steward of our currency. Of course, nothing could be further from the truth.

Comments: