Own Gold, but Avoid the Golden Haircut

Today, we’ll discuss why you should own gold. But first…

Let’s say that you walk into a bank. You hand the teller a $10-bill and ask for a roll of quarters, worth $10. Seems easy, right? It’s no big deal. Perhaps you want some quarters in case you must feed a parking meter or use the washer-dryer machines at a laundromat.

A basic roll of quarters, $10-worth… plus tax.

So, the teller hands you a roll of quarters, smiles, and says, “Here you go. Oh, and there’s $0.60 tax, too. It’s the new, 6% sales tax on transactions.”

And you say, “Huh? I’m just exchanging paper currency for metal coins. And there’s tax?”

“Yup,” says the teller. “The state government just passed an act saying that this kind of exchange is a ‘transaction’ under commercial law, subject to sales tax. And we’re required to collect it.”

You stand there, totally perplexed as in… You. Must. Be. Kidding.

Well, yes and no. I’m sort of kidding, but I’m not really kidding because… Hey, welcome to Maryland.

“We’re From the Government, and We Want Your Money!”

Okay, don’t panic (not yet). Because right now there’s no Maryland sales tax if you go to the bank and exchange paper currency for every-day, widely used coins like quarters.

But there is a new 6% Maryland tax if you exchange dollars for gold. Call it the new, golden haircut.

The tax applies even to gold coins issued by the U.S. Mint, the same federal entity that produces those (so far) untaxed quarters. But quarters are not made from gold, which for some bizarre reason Maryland thinks is alright to tax.

It used to be that Maryland taxed sales of gold under $1,000, but not over that number. The idea was that anything over $1,000 was an investment, not subject to sales tax. As a matter of course, Maryland gold dealers typically explained to customers why they should buy at least a little bit over $1,000 of gold at a time. Say, $1,005 or $1,010. Avoid the sales tax.

But as of July 1, 2025, buying all forms of gold in Maryland is subject to sales tax. For example, $1,000 of gold will cost you $1,060. Or $10,000 of yellow metal will set you back $10,600. Etcetera… Do the math. The government’s take is 6%.

This is all part of a new tax bill from the collective geniuses who make laws from their political power perch in the state capital of Annapolis. This past spring, the legislature of the Terrapin State passed a so-called “Blueprint for Maryland’s Future,” loaded with all manner of new spending – upwards of $3 billion – on schools, teacher training, education-related grift, and innumerable other stuff.

But there was a problem with the new spending bill; it’s that the state treasury lacks funds to pay for all these high and lofty ambitions. So the new bill also increased taxes on a long list of items, notably applying state sales taxes to gold bullion over that former $1,000 level. The state anticipates a haul of about $3 million per year (yes, million with an “m.”)

In the runup to passing this new spend-and-tax bill, a coalition of Maryland businesses that sell gold coins and bullion lobbied against the idea. They noted the likely miniscule government take from the new tax, versus the hassle to businesses. Truly, it’s a small drop in a big bucket.

This business group also made the obvious point that customers can easily drive across state lines and buy gold in jurisdictions without sales tax on the metal: Pennsylvania, West Virginia, Virginia and Delaware come to mind, as well as most of the rest of the country.

Maryland gold buyers can always go elsewhere.

When you consider that buying even a single, one-ounce U.S. gold Eagle coin involves handing over $3,500 or more, depending on dealer markup, it’s a stretch to believe that anyone will pay an extra 6% to conduct their gold business in Maryland. As even a casual glance at a map will show, geographically the state is perfectly shaped for its gold-buying citizens to drive up or down the proverbial road to somewhere else.

And the Marylnd business coalition pointed out that the tax increase would likely wreck the in-state gold-selling aspect of many businesses by reducing volume, perhaps killing the gold-side entirely. And these businesses would possibly show less overall profitability, which means lower business taxes; that, and job losses, depending on how things work out.

But no, the legislature didn’t absorb these arguments. Maryland raised the sales tax level for gold, and the future will unfold in its own way. Wait and see.

In Maryland the government wants your money, and will do what it can to get your money. Yes, sure; that’s the case most everywhere, but very few other states tax gold sales. And even if the tax receipts don’t roll into Annapolis because the original scheme was kind of dumb to begin with, the collective political entity doesn’t particularly care.

American Government Doesn’t Understand Its Own Money

Perhaps you think that this news item doesn’t matter much because you don’t live in Maryland, nor buy gold there. And even if you live in Maryland, you’re more than willing to drive across the line to another state to buy your gold with no sales tax. Yes, fair enough…

Then again, it’s no stretch to think that we may already be in the early innings of a dangerous political idea; namely, that governments everywhere – not just Maryland – are desperate for revenue, and they’re moving to tax gold sales, if not gold holdings. Because, to borrow a line from the old bank robber Willie Sutton, “That’s where the money is.”

Clearly, in recent years the price of gold has moved up sharply. Just think back not-too-many years, to a time of gold at $1,250 per ounce, or $1,750 per ounce, or $2,250 per ounce. Indeed, for that last price, think back just a little over a year.

By comparison, the current price of gold is north of $3,300 and rising. There’s little downside, and big blue sky above. Here at Paradigm Press, our own Jim Rickards believes that gold prices will climb up and over $4,000 per ounce by the end of the year, meaning within the next six months.

Plus, until quite recently and at the retail level (at least in the U.S.), only quirky gold bugs bought gold. Owning a stash was more of a curiosity than a financial norm. But now, and for many reasons, more people are literally buying gold; even Costco sells it, and the giant, consumer-facing, mass-retail chain can’t keep it in stock.

Any way you look at it, these cumulative gold sales involve growing numbers of people and represent a lot of money, which tends to attract politicians and tax collectors.

Of course, there’s more to the gold story than coin shops and/or Costco. And for all the media coverage of gold, it appears that most American politicians really don’t get the monetary angle. They lack sufficient education and perspective on money even to process what’s happening with dollars and by extension with gold.

That is, at numerous levels America’s government doesn’t understand its own money.

Gold Is Money, All Else Is Credit

In previous articles I’ve discussed how the price of gold is NOT moving higher because armies of retail buyers are mobbing the coin shops of America.

No, gold has moved higher in price because central banks across the world (well, central banks outside of America) are buying metal by the tonne. Think of Russia, China, India, and dozens of other nations; first, they are de-dollarizing, and second, seek the security of gold in the vaults versus the risk of U.S. Treasuries subject to the whims of American politics and politicians.

Slowly but surely, the global monetary system is headed for a reset. It may not be next week or next month, but something is coming. Meanwhile the U.S. government, via out-of-control spending and expansive monetary policy, is ruining its own currency.

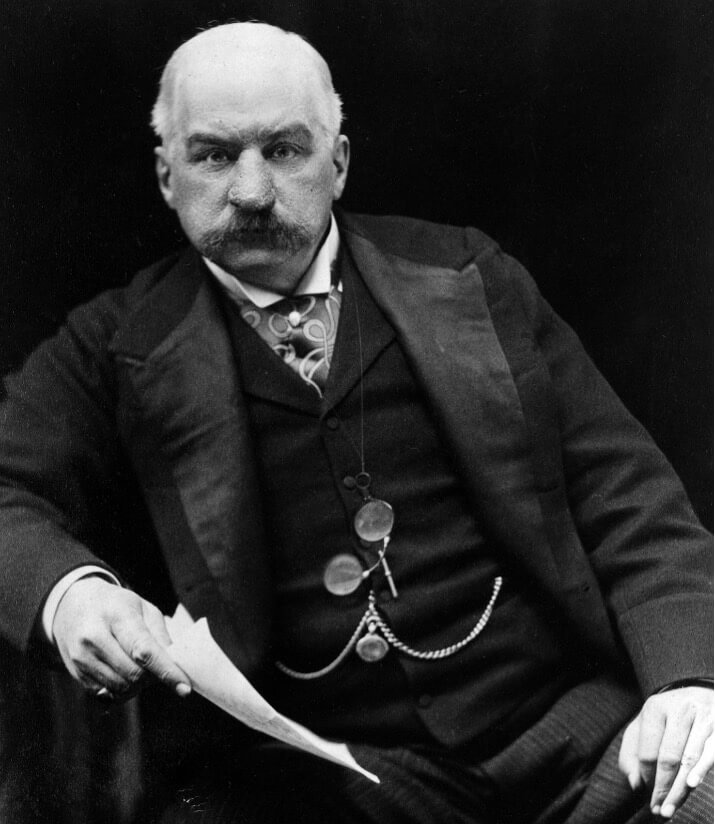

And this brings us back to an old, sturdy piece of wisdom, that “Gold is money,” according to banker J.P, Morgan, who made the remark over 115 years ago. “Everything else is credit,” he added.

J.P. Morgan, American banker. Wiki Commons.

Indeed, Morgan was testifying before Congress about how he bailed out the U.S. government from a financial Panic in 1907-08, and at the time all American politicians understood what he meant. In that era, America and the world were on a gold standard, and it was a given that gold was the foundation of wealth.

Today, we’re five generations post-Morgan. Very few people have an inherent understanding of the gold standard. Very few colleges or universities teach much of anything about gold, outside the geology department. And in the West in general, and the U.S. in particular, studying gold as money is an arcane idea, kind of like a branch of economic archaeology.

Modern American culture has become fully dollarized and financialized, courtesy of the Federal Reserve and its notes, which are basically just entries in a ledger book or electronic equivalent. The term commonly used is “money creation” from the Fed, as if wealth can be generated by willing it into existence versus delivering some article or service of value.

Ideally, the Fed should create dollars only in enough quantity to reflect the true growth in productivity and material wealth of the internal American economy, plus the value of imports. But in practice, the Fed has created far more dollars than America (or the world) has created wealth over the past century, which is why a current dollar is worth about 2-cents from, say, 1914.

In these respects, it’s fair to say that the American governing class has little to no understanding of the meaning of money itself; the politicians are just counting the Niagara of dollars that flow through the economy, in so far as that can even be correctly measured. And they’re grabbing for dollars in any tax scheme they can conjure up.

I’ll wrap up by returning to the story of Maryland and its new tax on gold. The state wants to collect sales tax when people exchange fiat-money dollars for real-money gold. In essence, it’s a penalty on foresighted people who see problems ahead and want to exit the dollar system for the hard-money comfort and security of gold.

Yes, sure; Maryland needs the money to fund the dreams of its silly politicians. But no, this doesn’t mean that you must play the game. Get your gold, put it away somewhere safe, don’t discuss it, and preserve your wealth until our cultural craziness plays out.

That’s all for now. Thank you for subscribing and reading.

Comments: