Oil Stocks and OPEC Lies

The Organization of Petroleum Exporting Countries (OPEC) announced at the end of November that it would leave oil production levels flat in the first quarter of 2026. That’s an unusual move for the cartel, which usually announces cuts in the face of falling oil prices. And that’s our current scenario:

However, even with a predicted glut in 2026, the cartel didn’t threaten to cut production. That’s interesting.

The power of OPEC is waning. The oil cartel once terrorized the west through its control of oil supply. Now, however, they depend on oil production to cover all their social services at home. Now the oil price controls them.

The news from OPEC is either production increases or cuts. When OPEC says they will increase production it’s the truth. But when OPEC says they will cut production, it’s rarely true.

The funny thing is that the market always seems to fall for it, bouncing the oil price up briefly.

OPEC members won’t tell the truth about production cuts. That’s because the countries rely on oil revenue to fund their government spending. We see it all the time in the U.S. Politicians campaign on tax cuts and reduced spending, but never actually do it.

In the case of OPEC nations, oil revenues generate the majority of the countries’ GDP:

As you can see, oil revenues are critical to the income of these countries. OPEC announces cuts with the idea of raising oil prices. Short-term pain from lower oil production at lower prices can be offset by higher prices in the future. However, few of these governments can afford short term pain.

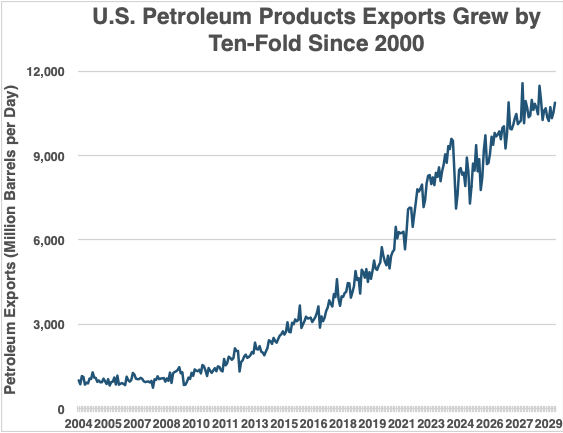

When OPEC controlled oil production, these proclamations had teeth. But since the shale revolution in mid-2000’s, they only work as marketing efforts. Since then, U.S. petroleum exports exploded. They grew 1,000% since 2000.

This change sped up over the past 17 years. As recently as 2008, OPEC’s market share was over 40% of oil sales in the world. The U.S. was just 5%. Today, OPEC’s market share shrunk to 35% and the U.S. market share grew to 17%.

This sector is on our watch list for 2026. At some point, oil companies’ shares will become attractive. However, commodity prices lead equities prices. So, we remain on the sidelines, waiting for the opportunity in oil.

I’ll be looking to scoop up shares of Schlumberger (NYSE: SLB), the giant oil service company, on the cheap. I think that opportunity will come sometime in early 2026. The company will be the first to move when oil prices rise. When prices fall, these companies defer maintenance to save money. When prices perk back up, they will get wells flowing again.

Schlumberger does all that work and helps drill new wells. It’s a great place to start investing in the oil industry. Oil is one of my favorite sectors, but when it comes to investing in energy stocks, timing is everything. We should get a better entry point next year. Stay tuned.

Comments: